Click image to open full size in new tab

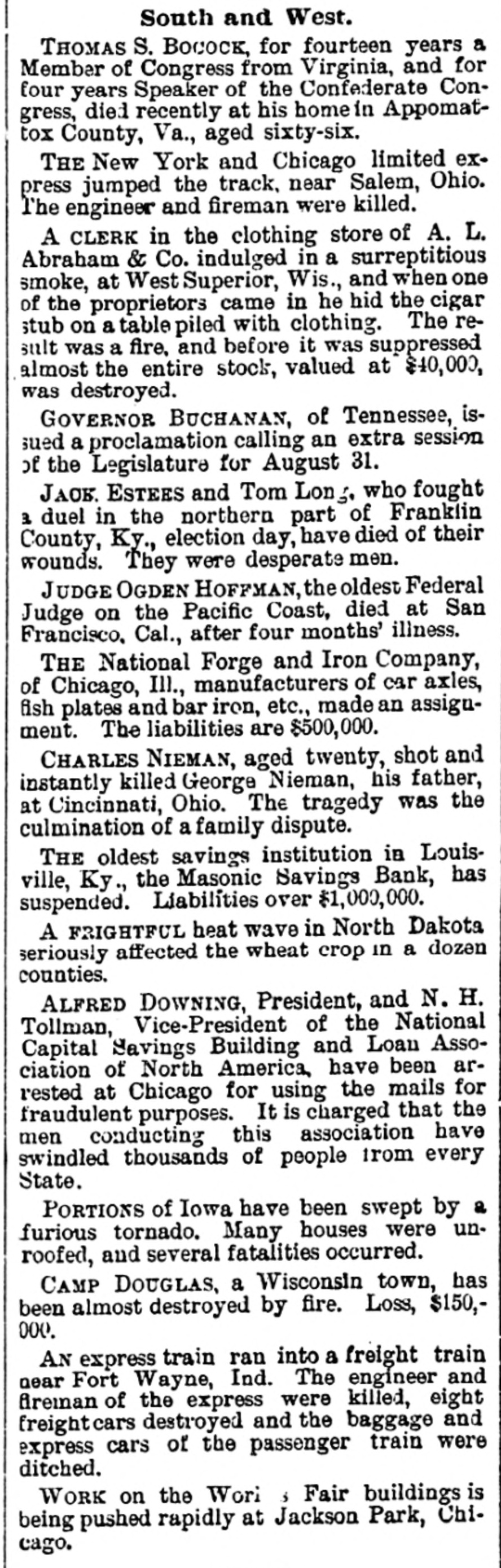

Article Text

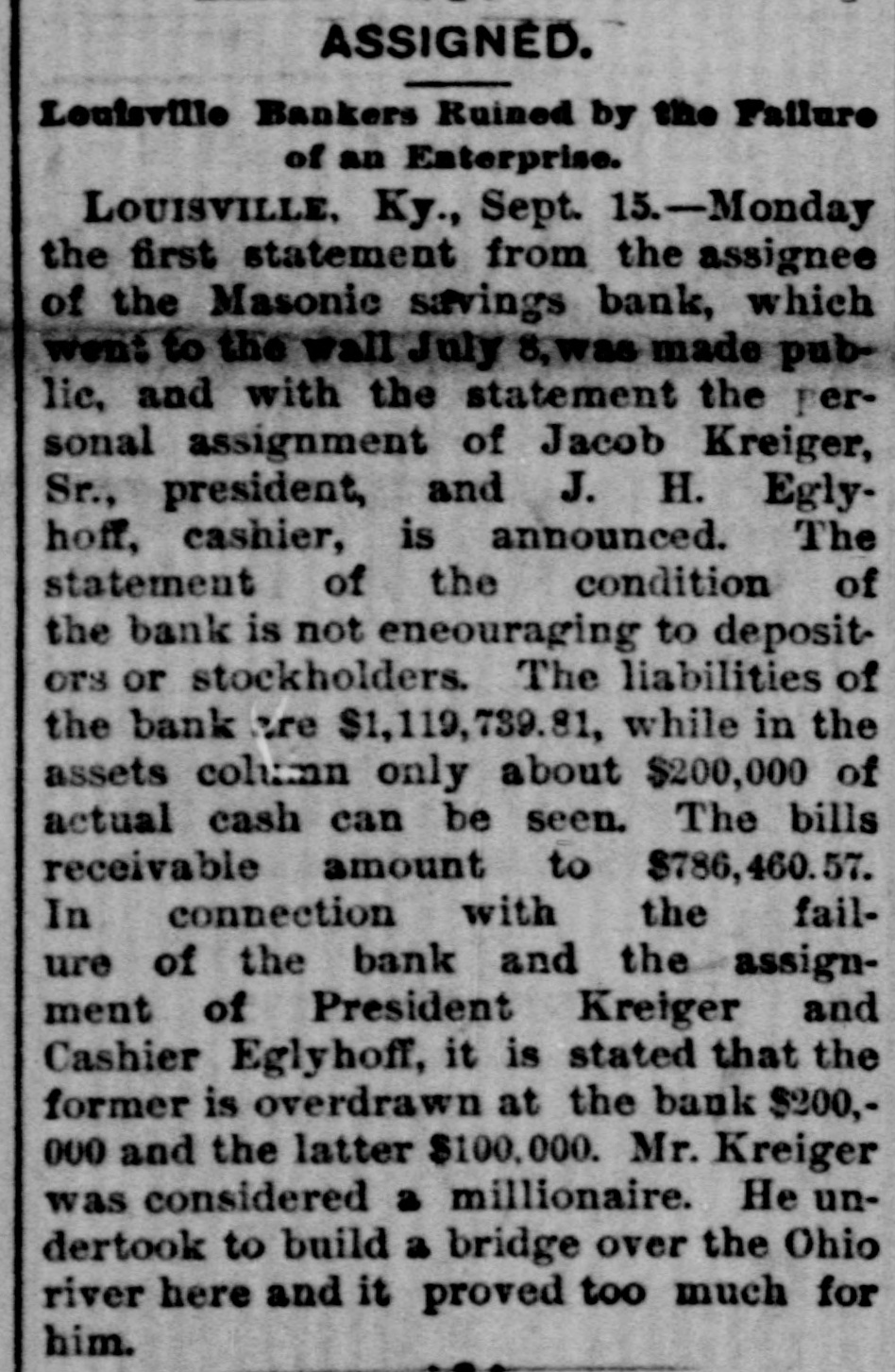

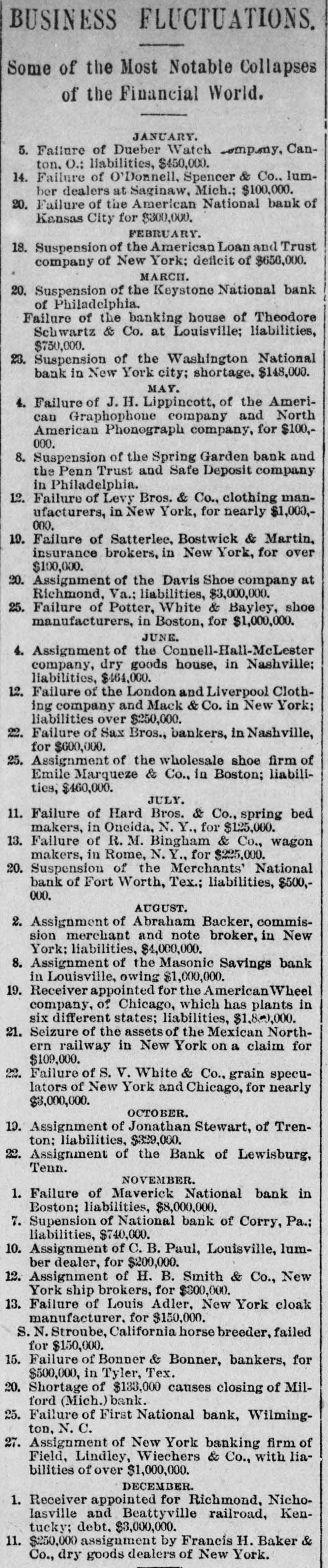

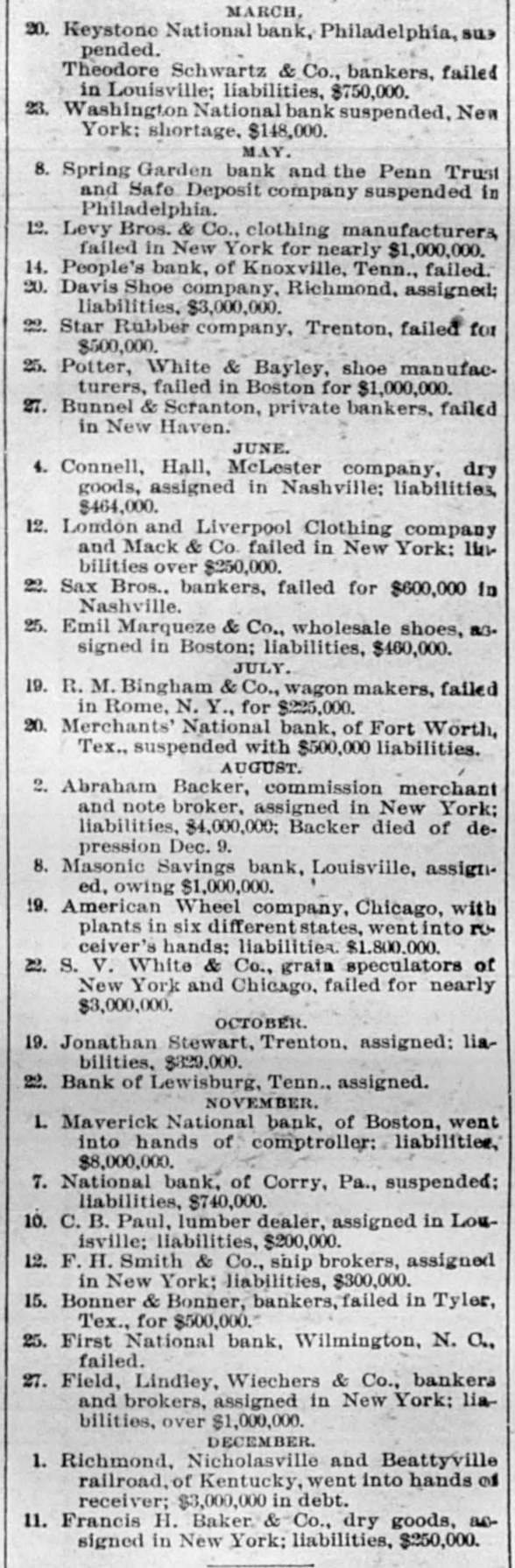

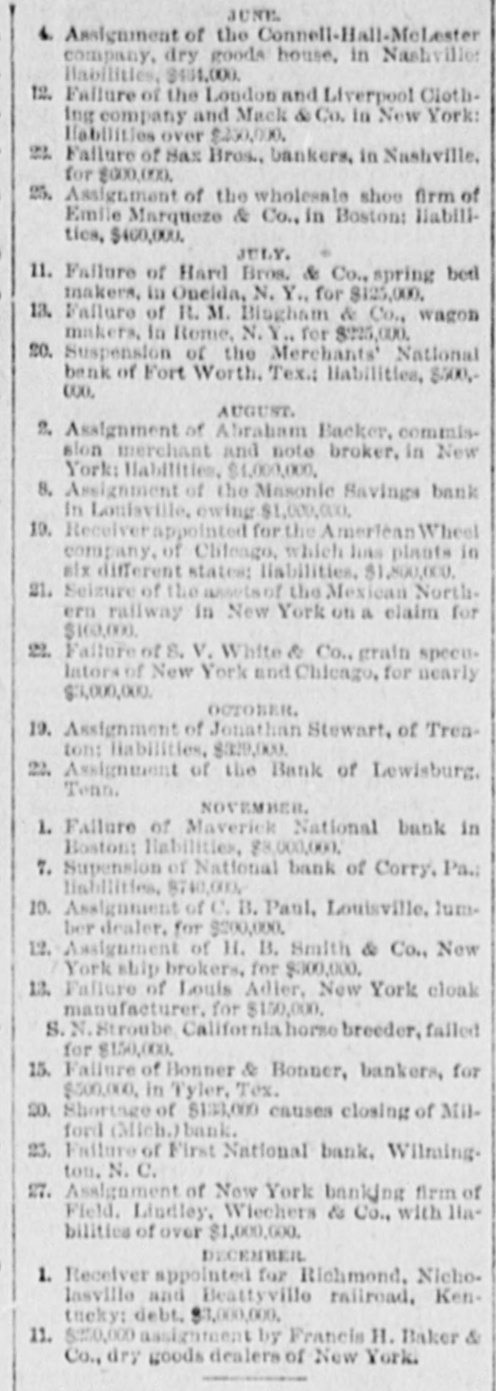

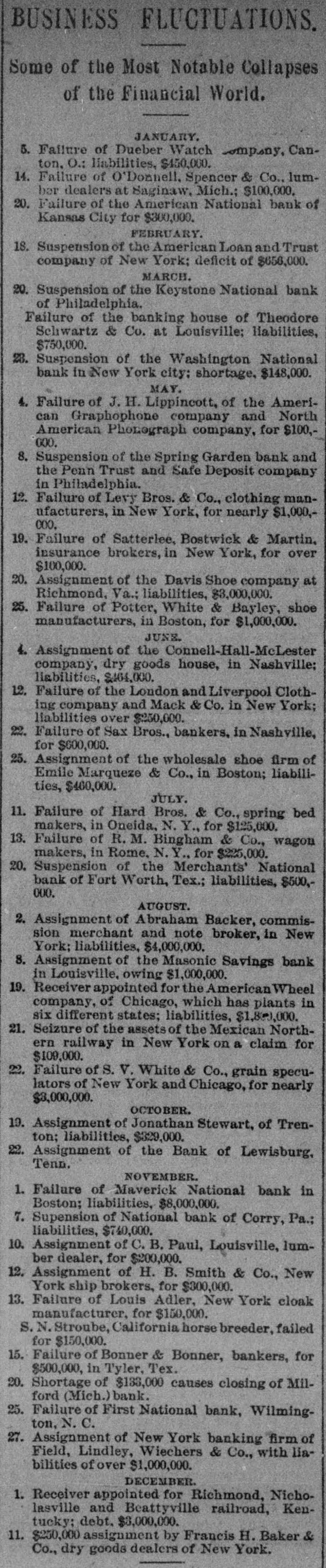

BUSINESS FLUCTUATIONS. Some of the Most Notable Collapses of the Financial World. JANUARY. 5. Failure of Dueber Watch supeny, Canton. O.: liabilities, $450,000. 14. Failure of O'Donnell, Spencer & Co., lumber dealers at Saginaw, Mich.; $100,000. 20. Failure of the American National bank of Kansas City for $300,000. FEBRUARY. 18. Suspension of the American Loan and Trust company of New York; deficit of $656,000. MARCH. 20. Suspension of the Keystone National bank of Philadelphia. Failure of the banking house of Theodore Schwartz & Co. at Louisville; liabilities, $750,000. 23. Suspension of the Washington National bank in New York city: shortage, $148,000. MAY. 4. Failure of J. H. Lippincott, of the American Graphophone company and North American Phonograph company, for $100,000. 8. Suspension of the Spring Garden bank and the Penn Trust and Safe Deposit company in Philadelphia. 12. Failure of Levy Bros. & Co., clothing manufacturers, in New York, for nearly $1,000,000. 19. Failure of Satterlee, Bostwick & Martin, insurance brokers, in New York, for over $100,000. 20. Assignment of the Davis Shoe company at Richmond, Va.; liabilities, $3,000,000. 25. Failure of Potter, White & Bayley, shoe manufacturers, in Boston, for $1,000,000. JUNE. 4. Assignment of the Connell-Hall-McLester company, dry goods house, in Nashville: liabilities, $464,000. 12. Failure of the London and Liverpool Clothing company and Mack & Co. in New York; liabilities over $250,000. 22. Failure of Sax Bros., bankers, in Nashville, for $600,000. 25. Assignment of the wholesale shoe firm of Emile Marqueze & Co., in Boston; liabilities, $460,000. JULY. 11. Failure of Hard Bros. & Co., spring bed makers, in Oneida, N. Y., for $125,000. 13. Failure of R. M. Bingham & Co., wagon makers, in Rome. N.Y., for $225,000. 20. Suspension of the Merchants' National bank of Fort Worth, Tex.; liabilities, $500,000. AUGUST. 2. Assignment of Abraham Backer, commission merchant and note broker, in New York; liabilities, $4,000,000. 8. Assignment of the Masonic Savings bank in Louisville, owing $1,000,000. 19. Receiver appointed for the American Wheel company, of Chicago, which has plants in six different states; liabilities, $1,800,000. 21. Seizure of the assets of the Mexican Northern railway in New York on a claim for $109,000. 22. Failure of S. V. White & Co., grain speculators of New York and Chicago, for nearly $3,000,000. OCTOBER. 10. Assignment of Jonathan Stewart, of Trenton; liabilities, $329,000. 22. Assignment of the Bank of Lewisburg, Tenn. NOVEMBER. 1. Failure of Maverick National bank in Boston; liabilities, $8,000,000. 7. Supension of National bank of Corry, Pa.: liabilities, $740,000. 10. Assignment of C. B. Paul, Louisville, lumber dealer, for $200,000. 12. Assignment of H. B. Smith & Co., New York ship brokers, for $300,000. 13. Failure of Louis Adler, New York cloak manufacturer, for $150,000. S. N. Stroube, California horse breeder, failed for $150,000. 15. Failure of Bonner & Bonner, bankers, for $500,000, in Tyler, Tex. 20. Shortage of $133,000 causes closing of Milford (Mich.) bank. 25. Failure of First National bank, Wilmington, N. C. 27. Assignment of New York banking firm of Field, Lindley, Wiechers & Co., with liabilities of over $1,000,000. DECEMBER. 1. Receiver appointed for Richmond, Nicholasville and Beattyville railroad, Kentucky; debt. $3,000,000. 11. $250,000 assignment by Francis H. Baker & Co., dry goods dealers of New York.