Click image to open full size in new tab

Article Text

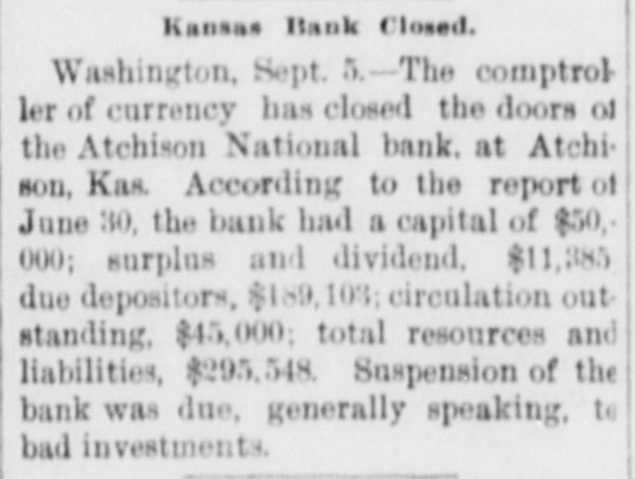

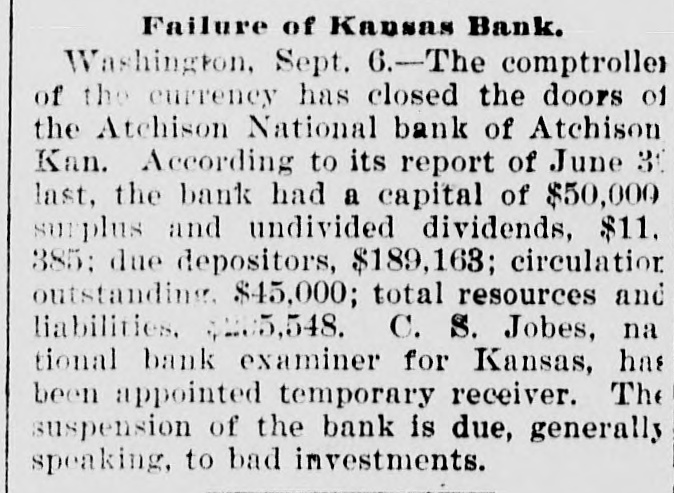

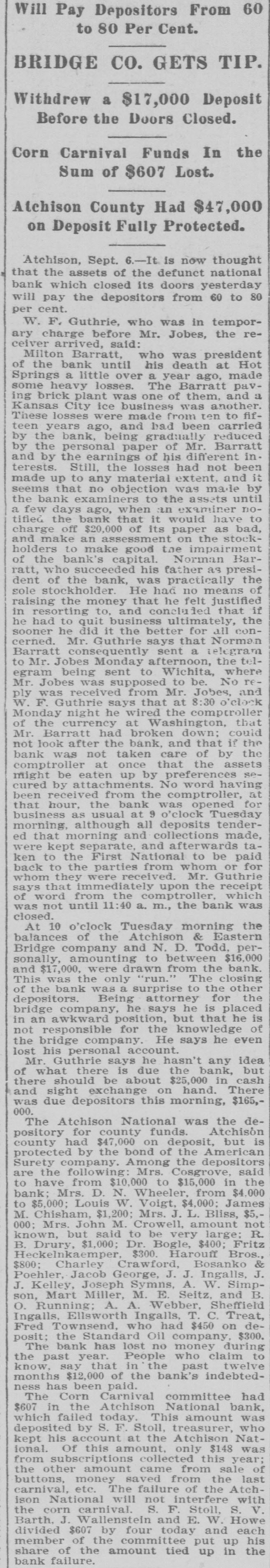

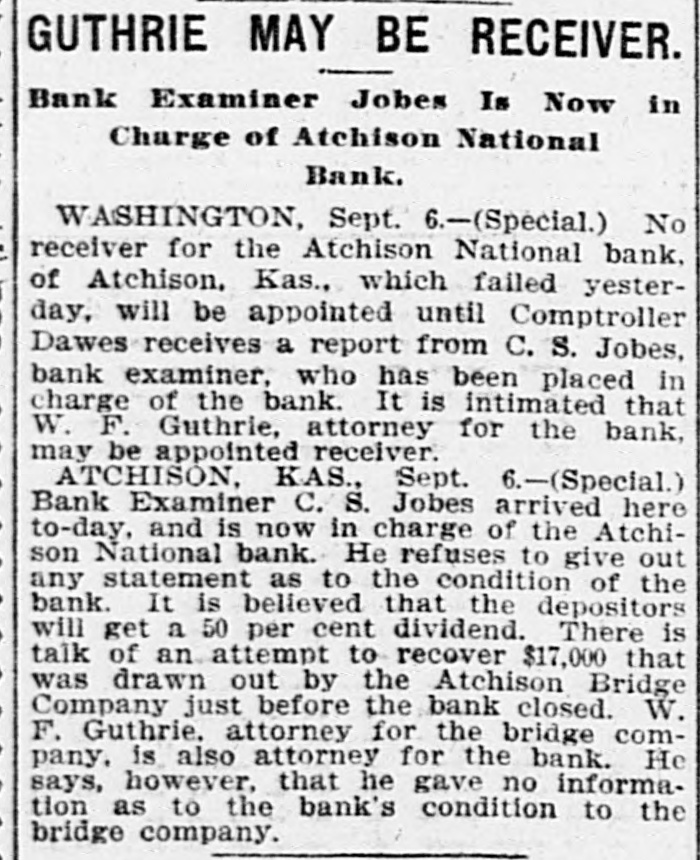

Will Pay Depositors From 60 to 80 Per Cent. BRIDGE CO. GETS TIP. Withdrew a $17,000 Deposit Before the Doors Closed. Corn Carnival Funds In the Sum of $607 Lost. Atchison County Had $47,000 on Deposit Fully Protected. Atchison, Sept. 6.-It is now thought that the assets of the defunct national bank which closed its doors yesterday will pay the depositors from 60 to 80 per cent. W. F. Guthrie, who was in temporary charge before Mr. Jobes, the receiver arrived, said: Milton Barratt, who was president of the bank until his death at Hot Springs a little over a year ago, made some heavy losses. The Barratt paving brick plant was one of them, and a Kansas City ice business was another. These losses were made from ten to fifteen years ago, and bad been carried by the bank, being gradually reduced by the personal paper of Mr. Barratt and by the earnings of his different in. terests. Still, the losses had not been made up to any material extent. and it seems that no objection was made by the bank examiners to the assets until a few days ago, when an examiner notifled the bank that it would have to charge off $20,000 of its paper as bad, and make an assessment on the stockholders to make good the impairment of the bank's capital. Norman Barratt, who succeeded his father as president of the bank, was practically the sole stockholder. He had no means of raising the money that he felt justified in resorting to, and concluded that if he had to quit business ultimately, the sooner he did it the better for all concerned. Mr. Guthrie says that Norman Barratt consequently sent a telegram to Mr. Jobes Monday afternoon, the telegram being sent to Wichita, where Mr. Jobes was supposed to be. No reply was received from Mr. Jobes, and W. F. Guthrie says that at 8:30 o'clock Monday night he wired the comptroller of the currency at Washington, that Mr. Barratt had broken down; could not look after the bank, and that if the bank was not taken care of by the comptroller at once that the assets might be eaten up by preferences secured by attachments. No word having been received from the comptroller, at that hour, the bank was opened for business as usual at 9 o'clock Tuesday morning, although all deposits tendered that morning and collections made, were kept separate, and afterwards taken to the First National to be paid back to the parties from whom or for whom they were received. Mr. Guthrie says that immediately upon the receipt of word from the comptroller, which was not until 11:40 a. m., the bank was closed. At 10 o'clock Tuesday morning the balances of the Atchison & Eastern Bridge company and N. D. Todd, personally, amounting to between $16,000 and $17,000, were drawn from the bank. This was the only "run." The closing of the bank was a surprise to the other depositors. Being attorney for the bridge company, he says he is placed in an awkward position, but that he is not responsible for the knowledge of the bridge company. He says he even lost his personal account. Mr. Guthrie says he hasn't any idea of what there is due the bank, but there should be about $25,000 in cash and sight exchange on hand. There was due depositors this morning, $165,000. The Atchison National was the depository for county funds. Atchison county had $47,000 on deposit, but is protected by the bond of the American Surety company. Among the depositors are the following: Mrs. Cosgrove, said to have from $10,000 to $15,000 in the bank; Mrs. D. N. Wheeler, from $4,000 to $5,000; Louis W. Voigt, $4,000: James M. Chisham, $1,200; Mrs. J. L. Bliss, $5,000; Mrs. John M. Crowell, amount not known, but said to be very large; R. B. Drury, $1,000; Dr. Bogle, $400; Fritz Heckelnkaemper, $300. Harouff Bros., $800: Charley Crawford, Bosanko & Poehler, Jacob George, J. J. Ingalls, J. J. Kelley, Joseph Symns, A. W. Simpson, Mart Miller, M. E. Seitz, and B. O. Running; A. A. Webber, Sheffield Ingalls, Ellsworth Ingalls, T. C. Treat, Fred Townsend, who had $450 on deposit; the Standard Oil company, $300. The bank has lost no money during the past year. People who claim to know, say that in the past twelve months $12,000 of the bank's indebtedness has been paid. The Corn Carnival committee had