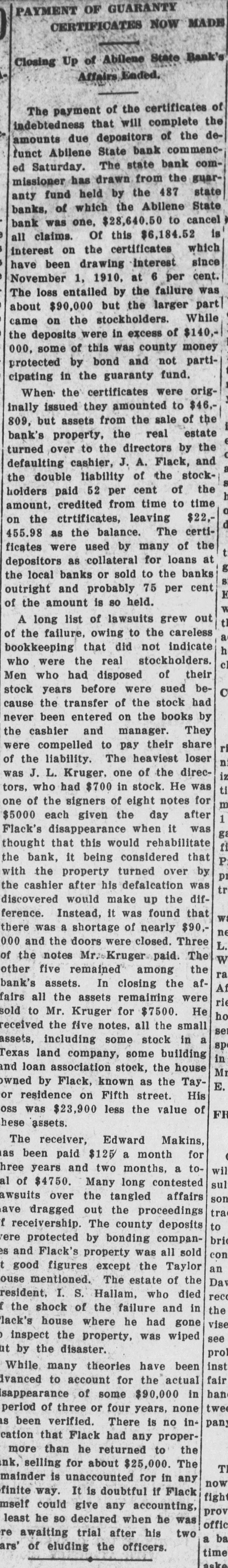

Article Text

Flack's Shortage to Be - Finally Paid Topeka, Nov. 4.-Depositors in be in the neighborhood of $30,000, which will have to be made up from the Abilene State bank, which closthe guaranty fund. There is $112,ed its doors three years ago as the 000 in the fund at present." result of the operations of Cashier John A. Flack, will be the first to How the Law Works. benefit from the bank depositors' Under the operation of the law guaranty fund of the state of Kanevery bank that takes advantage of sas. A warrant for about $30,000 the depositors' guaranty fund prothe exact amount has not been revision deposits one-fifth of one per ported by the receiver-will be cent of its average deposits for the drawn this month on the state treasyear in the guaranty fund. Then if urer by Charles M. Sawyer, bank a bank fails, its available cash is commissioner, to take up certifidistributed pro rata among the cates issued when the bank failed. depositors. For the balance of his When the affairs of the bank were deposit each depositor is given a turned over to Edward Makins, recertificate against the guaranty fund ceiver, there was a deficit of $90,bearing six per cent interest. Then 000 after the available cash had when the bank's affairs finally are been returned to the depositors. Rewound up, whatever cash the assets ceiver Makins has just finished windof the bank have realized is used to ing up the affairs of the Flack bank, take up these certificates; the baland his report to the bank commisance of the certificates are taken up sioner is expected this week. The from the guaranty fund. This is statement, it is understood, will the system by which Kansas proshow a deficit of $30,000. This sum tects her bank depositors. will be taken from the depositors' No bank has to take advantage guaranty fund. of the guaranty fund law, but as a No Depositors Suffer. matter of fact practically every This guaranty fund has been acstate bank in Kansas has come uncumulating for four years, and now der its provisions, with the result totals $112,000; no inroads have that no depositor, in the long run, been made upon it since the law has lost out from back failure since went into effect. But for this law the law was put on the statute book. the $30,000 deficit of the Abilene