Click image to open full size in new tab

Article Text

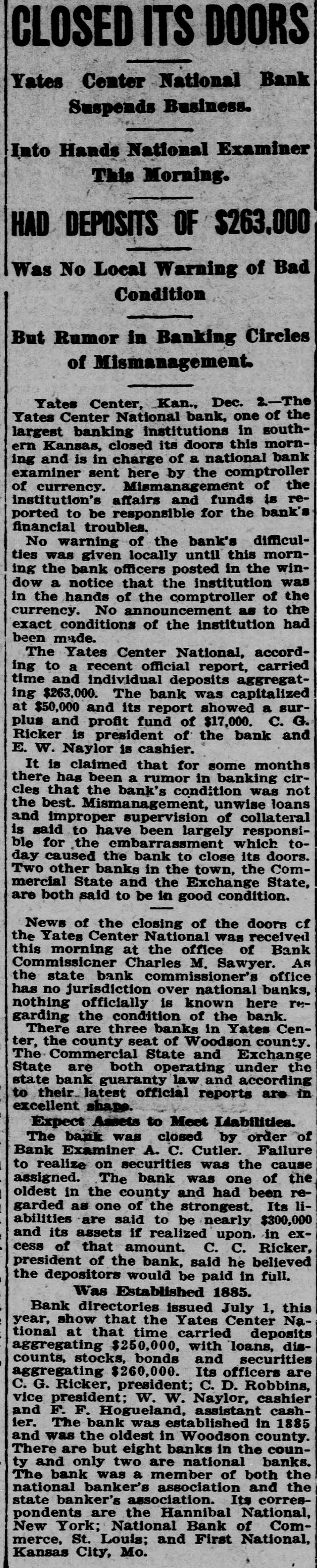

IS PASSED RICKER CASE Senate Approves Conference Echoes of Yates Center Bank Case Are Sad. Report on Currency Measure. It Now Goes to the President Widow Who Lost Her Allfor Signature. Ricker's Wife Destitute. FINAL VOTE STOOD 43 TO BELONGED TO CHURCH Three Republicans and One Had a Good Record Up to Bull Moose Join Majority. This Time. It Was Passed by the House His Son Is Loyal and Still Be298 to 60. lieves Father Will Pay. Washington, Dec. 3.-The conference New stories of the affairs of the report on the administration currency Yates Center National bank indicate bill was approved by the senate today that the condition of the institution is by a vote of 43 to 25. As the house even worse than at first reported and already had approved it there remain no one pretends to know the extent of ed only the signature of the vice presPresident Ricker's shortages and deident and the speaker to complete the falcations, although the total has been to measure for the president's signature. conservatively placed at $175,000 Three Republicans and Senator Poin$200,000. dexter, Progressive, joined the DemoAs the gossip of the affairs of the crats, voting for the bill in its final form. bank is told and retoid on the streets The Republicans were Senators Jones, of Yates Center, some new sensation is Norris and Weeks. The passage of the daily added to make conditions even report was greeted with little demonstration. worse than first reports indicated. R. Bristow Attacks the Bill. H. Trueblood, a director and stockWhen the senate debate began unholder in the bank, admits that the in- 25 stitution will not pay more than der the agreement to vote by 2:30 this afternoon, Senator Bristow, one of the per cent to the depositors. Other perRepublicans on the banking commitsons in touch with the affairs of the tee who had been denied admittance bank are inclined to believe that Trueblood's figures are too high. to the deliberation of the Democrat conferees, led off with an attack, say Nearly a quarter of a million dollars ing he proposed to express his opinof Woodson county farmers and merions where they would get into the cants' money is tied up in the bank permanent record. and its alleged assets. Ricker is gone The agreement placing the secreand the government is locking for him tary of the treasury, secretary of agwith a warrent charging him with falriculture and comptroller of the cursifying records and reports In their rency on the committee to organize home in Yates Center, Mrs. Ricker is a the new system, he declared, was alone and almost destitute, it is claimmove to bring the whole system uned. No one knows when the affairs der political control. (Continued on Page Six.) Arrangements for debate provided that Senators Bristow, Nelson and other Republicans who opposed the conference agreement would have IT MAY BE BLACK about three hours to talk. Senator Bristow declared he believed Senator Owen had excluded him from the conRumored That Rock Island Is ference for fear he would join some of the Democrats against Owen's "pet After Santa Fe Official. measures. "It was done because he knew he could not control my vote," cried Mr. Ripley Road May Lose Another Bristow, "as he could not control the votes of some of his Democratic colMan to Competitor. leagues, in the interests of certain great banking interests, that have had a hand throughout in framing this Following the announcement from bill. The senator from Oklahoma has Chicago to the effect that John Sebasaccepted the meet offensive provisions tian, the dean of railway passenger of the Aldrich bill and has covered had resigned as third vice presithem with a mask to deceive the people. men, dent of the Rock Island Lines, it is rumored persistently in Topeka today traffic Dose of Their Own Medicine. that W. J. Black. passenger asked Senator John Sharp Williams, declarmanager of the Santa Fe, will be affairs the passenger ing the Republicans were crying Rock the Island. to take charge of In view of the fact against the same sort of procedure they had always exercised, when in power, on that the Rock Island has taken over illustrated his point with a story of several Santa Fe department heads in a negro woman who had decried autothe last few years, it is considered very mobiles until she got a ride in one, and likely by Topeka railway men that the then admonished the driver: move may be followed out. 'Jedge, jes run right over dat man, instance look at the Rock Island he ain't got no business out in front staff For of Santa Fe trained men as it of our car. stands today: H. U. Mudge, president. "That's the way I feel about you Republicans. said he. J. E. Gorman, first vice president. Senator Townsend, Republican, atA.E. Sweet, general manager. C.A. Morse, chief engineer. tacked the bill. declaring it would reF. J. Easley, assistant general mansult in inflation. The measure shows the effect of the views of that Democratic leader who is now the ager. Any number of division superintendents and other minor officials are Santa distinguished secretary of state," he Fe trained men They were taken over said, "and those views, if carried to the Rock Island owing to the at conclusion, would inflate both curtractive by salaries offered by the road rency and credit to the breaking point. The policy of the Santa Fe in setting Senator Lewis, Democrat, defended certain limit on the salaries paid its officers a and the energy of the Rock Secretary Bryan and declared the ReIsland in taking advantage of this publican party had been forced to write into law many of the policies he policy by flattering offers, has given had advocated the latter road a trained set of offiSenator Shafroth, Democrat, decials with which to compete with its rival across the country between Chifended the procedure of the Democratic conferees. cago and the coast. House Passes It. It is believed by many railroad men that the Rock Island will not fill the Washington, Dec. 23. The house vacancy caused by the retirement of passed the conference report on the Sebastian. It is thought that the exadministration currency bill at 10:46 ecutive heads of the passenger and o'clock last night by a vote of 298 to freight departments will be placed un60, and sent the report to the senate, der the supervision of one office-that which had waited in session to receive of Vice President Gorman. The econoit before adjournment for the night. my plan of the Rock Island has inProlonged and uproarious cheers cluded the assistant general managerfrom the Democrats greeted the anship of the third district. nouncement of the vote by Speaker W. J. Black is well known in Topeka Clark and members of the house hastand in railway circles of the west. He ened over to the senate to see the rethe in Earlier there. received port was general passenger agent of the road here from 1897 until 1905. Then evening the senate had agreed to vote he went to Chicago as passenger trafnot later than 2:30 o'clock today and fic manager He has been right up the leaders regarded it as certain that through the ranks of the passenger the completed bill would be in the department beginning railroad work as hands of President Wilson for his signature before tonight. rate clerk on the Missouri Pacific in 1884. On the final vote, 37 Republicans, 12 Progressives, including Victor Murdock, and one independent, Kent (Cal.), voted with the majority for PESSIMISM IS GONE. the report, and two Democrats, Calloway (Tex.) and Witherspoon (Miss.), joined the opposition. Wall Street Smiles Once More Since The vote followed a debate of nearCurrency Bill Passed. ly three hou.s, during which the galleries remained crowded with spectaNew York, Dec. 23 -The note of pestors, including many prominent fig. simism in the holiday sentiment in Wall ures in official life. The house adjourned until 2:30 p. m. today, when street, which was in evidence a week ago, has disappeared and now it is the leaders hope to put through a said that the usual bonuses to emjoint resolution for a recess until Jan. 12. ployees will be paid by brokers and How They Voted. bankers generally. Saturday's sudden reversal in the course of prices as a Republicans who voted for the report are: result of the passage of the currency bill through the senate and the peaceBarton, Burk (S. D.), Cooper, ful solution of the American Telephone Cramton, Curry, Davis, Dillon, Esch, and Telegraph case with its promise of Farr. Frear, Haugen, Helgeson, Kelly an old-fashioned bull movement ban(Mich.), Keiss, Kinkaid (Neb.), Le. ished the pessimism. Follette, Lenroot, Lindquist, Miller, There was more happiness to the Moss (W. Va.), Nelson, Nolan, Norton, Sinott, Sloan, J. M. C. Smith (Mich.) square inch on the New York Stock ExSmith Smith (Mich.), Samuel change in one minute Monday, as one of its members expressed it, than there (Minn.), Stafford, Stevens (Minn.), Sutherland, Treadway, Young (N.D.), had been to the whole securities marMinahan, Mapes, Stephens (Cal.), ket in any one month earlier in the Woodruff-37. year. Paying of Christmas bonuses by Progressives who voted for the rethe big banks has already begun. One bank with many branches throughout port: Bell (Cal.). Bryan (Wash.). Chan the city started the ball rolling by disdler, Falconer, Hulings, Kelly (Pa.), bursing $38.000 among its employees. Lafferty, Murdock, Temple, MacDonaid. Thompson (IH.). RupleyWeather Forecast for Kansas. After the announceme of the Cloudy and unsettled tonight and by vote, a joint resolution proposed Wednesday; not much change in temperature (Continued on Page Eight.)