Click image to open full size in new tab

Article Text

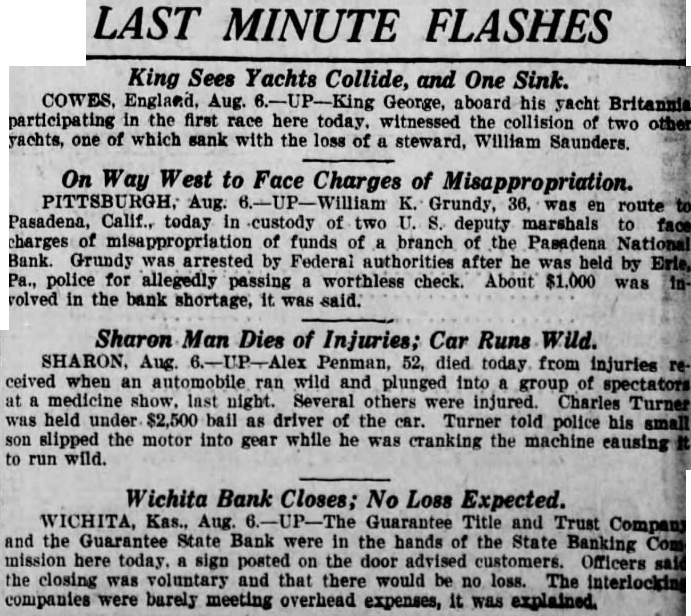

PAYMENT OF SCHOOL CHILDREN'S DEPOSITS STARTS HERE TODAY

Child Depositors Whose Last Names Run From A to E Will Receive Money

PAY OTHERS THIS WEEK

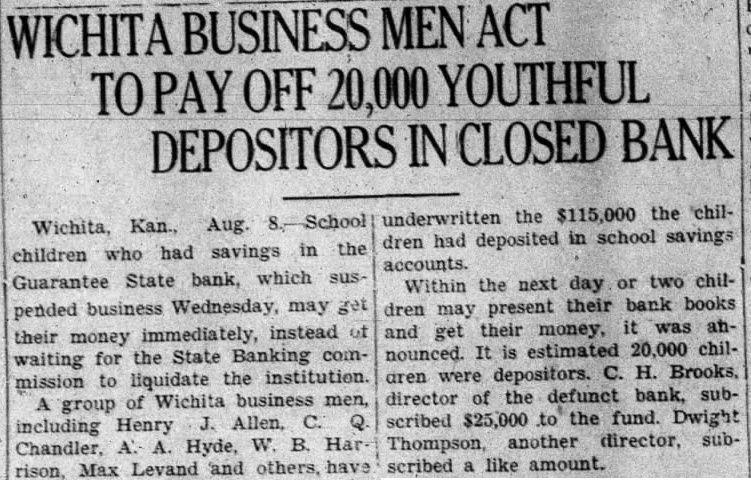

Payment of school children's deposits in the Guarantee State bank. which suspended business last week for the purpose of going into voluntary liquidation, will start today, it was announced yesterday by the committee in charge of that work. Funds gor the payment of the accounts, most of which amount individually to but comparatively few dollars, were provided by subscriptions made by group of Wichita business men and bankers, who will take their chances on being reimbursed in full when the final liquidation of the Guarantee State bank and Guarantee Title & Trust company is completed. Today child depositors whose last names begin with either A, C. or may receive their money at any Wichita bank by presenting their school passbook and signing receipt therefor. Children must be accompaned by parent or guardian, who will the claim to the underwriters at the time payment is made. Settlement of the claims is in charge of composed of Sylvester A. Long, of the Chamber of C. Chandler of the First National bank and R. Clevenger of the Fourth NaThe following statement was issued by the committee yesterday "Children who wish to secure their money must be by parents or guardians and must have their school savings pass books. They may secure the money at any of the following banks: "Fourth National, First National. Merchants State. National, State Reserve, Union National. Citizens State. Farmers State, Union Stockyards National, First Trust company, Industrial State, Wheeler Kelly Hagny Trust company. staff of trained workers has been working since last Thursday, balancing the accounts and compiling the list of the depositors. The list from to has been completed and will be in the hands of the banks Wednesday morning, August 13, so that children whose last names begin with the initials A, C, and E can their money on that day. "The list covering the last names with G, H. J, and L will be completed by Thursday morning and payment to children whose last names begin with these initials will begin Thursday August 14. "The list covering the last names commencing with the letters M. N, O. P, Q. and R will be completed by Friday and payment to children whose names begin with these initials will begin Friday, August 15. "The list covering the last names commencing with the letters S. V. W. and z. will be completed by Saturday morning, and payment to children whose names begin with these initials will begin Saturday, August 16. committee explains that while these accounts will payable on any banking day within 12 months, payments for the remainder this week will be on the above schedule. In view of the fact that there are than 20,000 accounts to handled, the banks request that the above schedule observed this week, and that any child who cannot conveniently make his withdrawal on the day scheduled above, should wait until later. The committee is that it be that it is necessary that the money be withdrawn set out in the above schedule, and that the money may be withdrawn any banking day during the next 12 withdrawing the funds, each child must be accompanied by his or her parent guardian, must present his or her school savings pass book. during regular banking hours. "The work of preparing these counts so that they could be handled in convenient manner through the various banks listed above has been tremendous task, and the committee expresses its appreciation of the special assistance and given by H. Koeneke, state bank commissioner; the Wichita Mapping & Engineering which reproduced the lists of the accounts, and the Fidelity Title which for the clerical work, and also, the Armstrong Press, which did all of the necessary printing free of charge; the Wichita Clearing house, and the banks listed above which co-operated to make possible convenient method of gavment, and those whose subscriptions made possible the immediate payment of these saving accounts in full. Contributors to the fund are: H. Brooks. Dwight Thompson. Q. Chandler. Henry Allen. Fourth National bank. Wheeler Kelly Hagny Trust comJackman. Hyde. company. Allen Hinkel. A. Rorabaugh. Innes Goods company. Wichita Gas company. Kansas Gas & Electric company. Lon H. Powell. Harry Fox. Southwest National bank. Bridgeport Machine company. A. A. Buschow. Derby associates. Harrison. B. Gardiner. State bank. Monarch Investment company. Farmers & Bankers Life Insurance company. Roger Hurd. Citizens State Powell. Masterman. Farmers State bank. Union Stockyards National bank. Music company. Industrial State bank. First Trust company.