Article Text

# EXPLANATION OF CHARGES

time for the amount of $5,000, the bank receiving no money for it; but which was counted as a cash item by the cashier, and included in the amount of cash till the morning the bank was examined, when it was credited to that account, and taken from the amount of the cash. The bank was not cheated or detrauded out of the value of anything by this transaction; neither was there any intention upon my part, or any one else, so far as I know, that it should be.

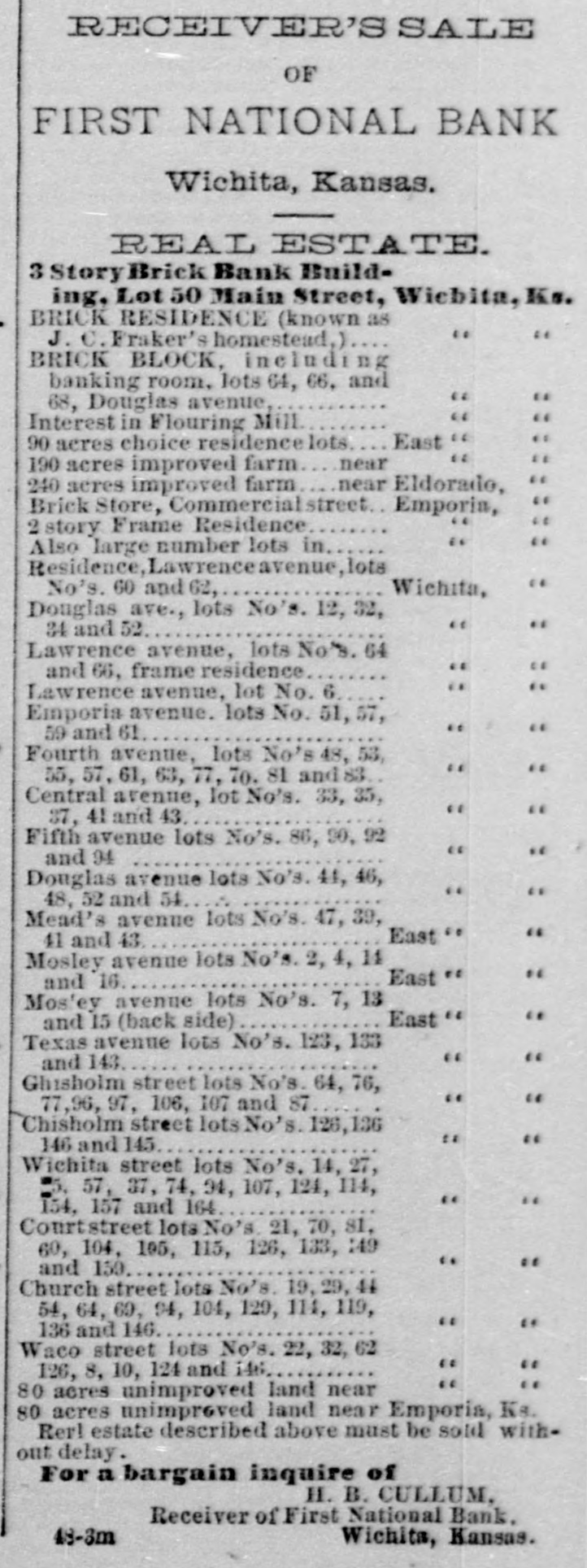

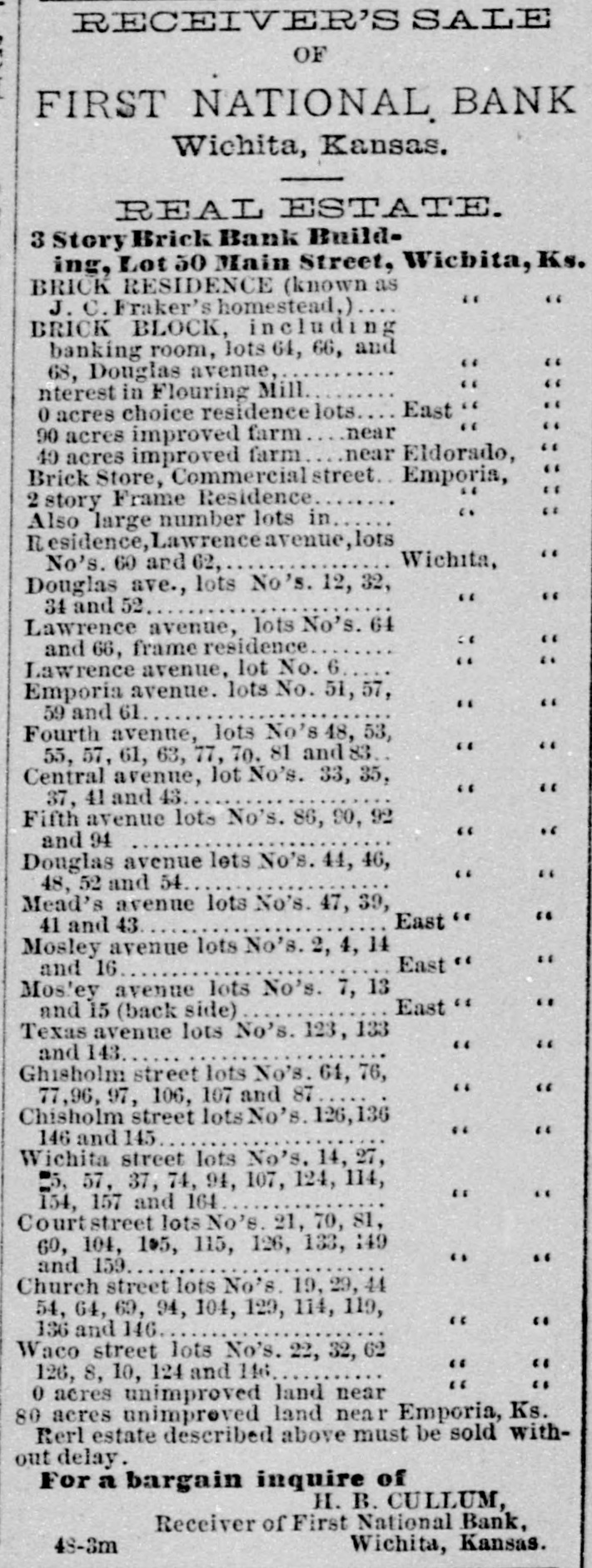

The amount charged to the "surplus fund" account on the 12th day of July, 1876, the day the bank examiner was there, was $7,941.76, not one cent of which was taken by me. But this amount so charged, was the aggregate of sundry past due and worthless notes, which were charged to that account and credited to "bills receivable." In the evening of the day of examination, I gave the bank examiner, in the presence of the Vice President of the bank, an itmeized list, which I found in the cashier's drawer, giving the number and amount of each note, and which the examiner atter looking it over requested to take with him to be embodied in his report to the department, to which I readily assented without copying it. Had I necess to the bill register and cash journal, I could show this court the names of the makers and the amount of each of these notes. The amount $7.858.86, that I am charged with taking from the bank on the 11th of July, 1876, was the amount drawn on a check against a just and correct balance due Lewis Öge, and by him and in his own hand writing. He is a responsible citizen of Texas, living hear San Antonio. This amount was drawn after banking hours that day In exchange on our Kansas City, Chicago and New York correspondents payable to his order, and collected by him. I had no interest in this account, and was not benefitted by it. The amount of the other two items, one for $4,058.24 charged "surplus fund," and the other for $1,067.36, charged "profit and loss" aggregating $5,125.60, on the 30th of August, 1876, on the day the bank suspended, is the amount of this "cash check," which I have already explained, which, when, it was returned to Mr. Woodcock's account on the balance book, was carried as a cash item till the bank suspended, when it was charged to these two accounts, as they appear on the books of the bank. The former account not being large enough to cover the entire amount, it was divided, and the balance charged to the latter account. I solemnly affirm that I did not have any knowledge of its existence prior to, or on the day it was created. Nor for a balf a month afterwards, and I have never received to the value of one cent on that account, now, sir, these four items, the "certificate of deposit" for $5,000, the amount of notes charged "surplus funds" of $7,94176, the amount of Louis Oge check of $7,858.86, and the amount of this cash cheek of $5,125.60, aggregating an amount of $25,02, was fully explained to the bank examiner, to whom the books, papers and assets of the bank were turned over by sworn statements of the officers of the bank, for the purpose, as it was alleged, to guide the receiver in settling up its affairs, and to prevent needless litigation! The present receiver made out those statements, who was at that time acting as clerk for the examiner, and who, I suppose, has them in his po-session. Sir, it is passing strange, that with these full explanations made to the bank examiner and the receiver of the bank, how they could have been charged to me, in this court, and published to the world, as funds that I had embezzled and stolen from the bank, unless it was to trump up false charges, to prejudice the court, and its officers, and the public mind against me, in advance of trial; as I see that the complaining witnesses before the grand jury, at the time that these indictments were found against me, were these very parties. It seems to me, that they must have known that there is no evidence to show that I got any money whatever, on any of these counts I have named. The parties who are pursuing me, well know that the public mind, just at this time, is sensitive to the slightest touch of suspicion against any one who fails, and more especially, against a bank and its officers. It seems to be a matter of special gratification, with some of these parties, that so many large banks in St. Louis, Chicago, and elsewhere, have so recently failed, thereby adding to this wide-spread prejudice of the people at the time of these trials, under these circumstances, a false report would travel around the world, while the truth is getting on its eboots to follow.

Now, as to the last and remaining charge of embezzlement. From the amount of it, it is intended to cover my indebetedness to the bank, as evidenced by sundry notes held by the bank on an overdraft charged to my account, and which was turned over to the bank examiner, and which my sworn statement shows is justly due from me to the bank. The overdraft on the book against me was made a few days before the bank suspended, when I was absent from the bank, and at Emporia, by the charging of a note I owed to an outside party, to my account, which, with added interest, amounted to $629, and which the bank paid for me, my account not being good for the full amount of it, made an overdraft on the bank against me. The vice president, on my return home, told me that the note was presented for payment on that day, was due, and if not paid, would have been protested, and as he supposed it would be a favor to me, he directed it to be paid.

The cashier and myself are charged with making a false entry on the 30th of August, 1876, in the account of the St. Louis National bank, of $5.000. This item was a note of mine, which was discounted by the St. Louis bank, and when due, was charged to the account of our bank. It would be unfair to the cashier if I did not explain the circumstances of this note, to show that it was a proper credit to have been made. This note was first made about the middle of March, 1875, to be discounted at the St. Louis National bank, and the proceeds placed to the credit of the First National bank of Wichita, for the purpose of taking up a note of mine, due in that bank, for about that amount. This note was endorsed by the cashier and the vice president and the bank, and also by two friends of mine at Emporis. When this note came due it was renewed, the same parties endorsing it. When it came due the last time, it was charged to the account of our bank, and it was not credited at that time. On the 30th of August, 1876, I gave my notes to the bank, for this amount, with added interest, and the St. Louis National bank was credited.

The reason I became involved in so