Article Text

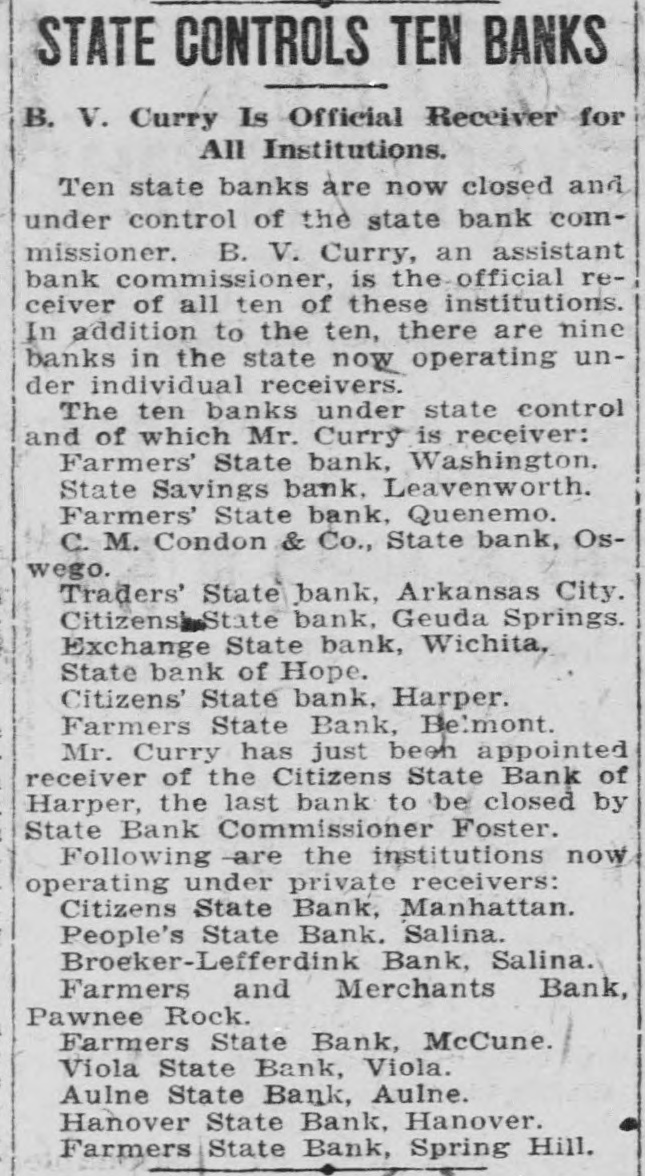

STATE CONTROLS TEN BANKS B. V. Curry Is Official Receiver for All Institutions. Ten state banks are now closed and under control of the state bank commissioner. B. V. Curry, an assistant bank commissioner, is the official receiver of all ten of these institutions. In addition to the ten, there are nine banks in the state now operating under individual receivers. The ten banks under state control and of which Mr. Curry is receiver: Farmers' State bank, Washington. State Savings bank, Leavenworth. Farmers' State bank, Quenemo. C. M. Condon & Co., State bank, Oswego. Traders' State bank, Arkansas City. Citizens State bank, Geuda Springs. Exchange State bank, Wichita, State bank of Hope. Citizens' State bank, Harper. Farmers State Bank, Belmont. Mr. Curry has just been appointed receiver of the Citizens State Bank of Harper, the last bank to be closed by State Bank Commissioner Foster. Following -are the institutions now operating under private receivers: Citizens State Bank, Manhattan. People's State Bank. Salina. Broeker-Lefferdink Bank, Salina. Farmers and Merchants Bank, Pawnee Rock. Farmers State Bank, McCune. Viola State Bank, Viola. Aulne State Bank, Aulne. Hanover State Bank, Hanover. Farmers State Bank, Spring Hill.