Article Text

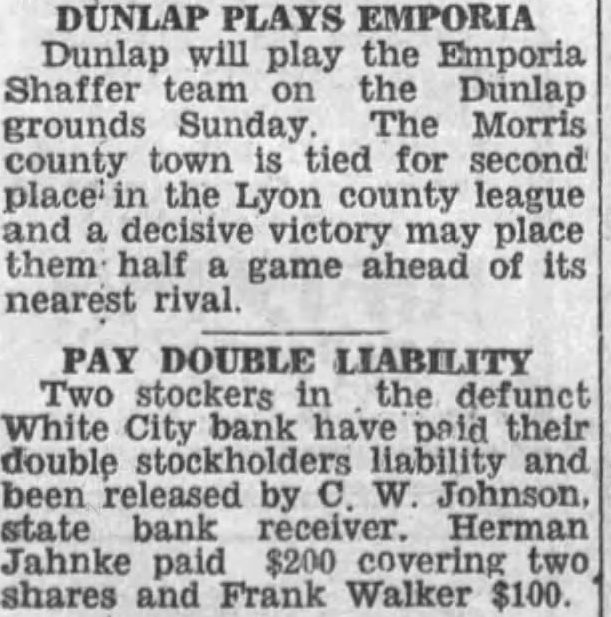

PLAYS EMPORIA Dunlap will play the Emporia Shaffer team on the Dunlap grounds Sunday. The Morris county town is tied for second the Lyon county league and decisive victory may place them half game ahead of its nearest rival. PAY DOUBLE LIABILITY Two stockers the defunct White City bank have their double and been released Johnson, state bank receiver. Herman Jahnke paid $200 covering two shares and Frank Walker $100.