Article Text

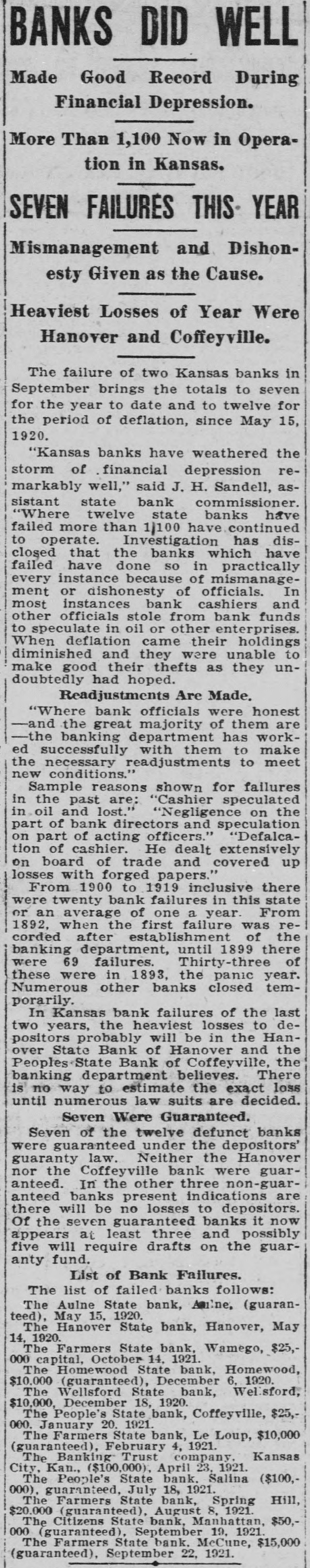

BANKS DID WELL Made Good Record During Financial Depression. More Than 1,100 Now in Operation in Kansas. SEVEN FAILURES THIS YEAR Mismanagement and Dishonesty Given as the Cause. Heaviest Losses of Year Were Hanover and Coffeyville. The failure of two Kansas banks in September brings the totals to seven for the year to date and to twelve for the period of deflation, since May 15, 1920. "Kansas banks have weathered the storm of financial depression remarkably well," said J. H. Sandell, assistant state bank commissioner. "Where twelve state banks have failed more than 1)100 have continued to operate. Investigation has disclosed that the banks which have failed have done so in practically every instance because of mismanagement or dishonesty of officials. In most instances bank cashiers and other officials stole from bank funds to speculate in oil or other enterprises. When deflation came their holdings diminished and they were unable to make good their thefts as they undoubtedly had hoped. Readjustments Are Made. "Where bank officials were honest and the great majority of them are -the banking department has worked successfully with them to make the necessary readjustments to meet new conditions." Sample reasons shown for failures in the past are: "Cashier speculated in oil and lost." "Negligence on the part of bank directors and speculation on part of acting officers." "Defalcation of cashier. He dealt extensively on board of trade and covered up losses with forged papers." From 1900 to 1919 inclusive there were twenty bank failures in this state or an average of one a year. From 1892, when the first failure was recorded after establishment of the banking department, until 1899 there were 69 failures. Thirty-three of these were in 1893, the panic year. Numerous other banks closed temporarily. In Kansas bank failures of the last two years, the heaviest losses to depositors probably will be in the Hanover State Bank of Hanover and the Peoples State Bank of Coffeyville, the banking department believes. There is no way to estimate the exact loss until numerous law suits are decided. Seven Were Guaranteed. Seven of the twelve defunct banks were guaranteed under the depositors' guaranty law. Neither the Hanover nor the Coffeyville bank were guaranteed. In the other three non-guaranteed banks present indications are there will be no losses to depositors. Of the seven guaranteed banks it now appears at least three and possibly five will require drafts on the guaranty fund. List of Bank Failures. The list of failed banks follows: The Aulne State bank, Amine, (guaranteed), May 15. 1920. The Hanover State bank, Hanover, May 14, 1920. The Farmers State bank. Wamego, $25,000 capital, October 14. 1921. The Homewood State bank. Homewood, $10,000 (guaranteed), December 6. 1920. The Wellsford State bank, Wellsford, $10,000, December 18, 1920. The People's State bank, Coffeyville, $25,000. January 20. 1921. The Farmers State bank, Le Loup, $10,000 (guaranteed), February 4, 1921. Kansas The Banking Trust company. City, Kan., ($100,000), April 23. 1921. The People's State bank. Salina ($100,000). guaranteed, July 18, 1921. The Farmers State bank, Spring Hill, $20,000 (guaranteed), August 8. 1921. The Citizens State bank, Manhattan, $50,000 (guaranteed), September 19. 1921. The Farmers State bank. McCune, $15,000 (guaranteed), September 22, 1921.