Click image to open full size in new tab

Article Text

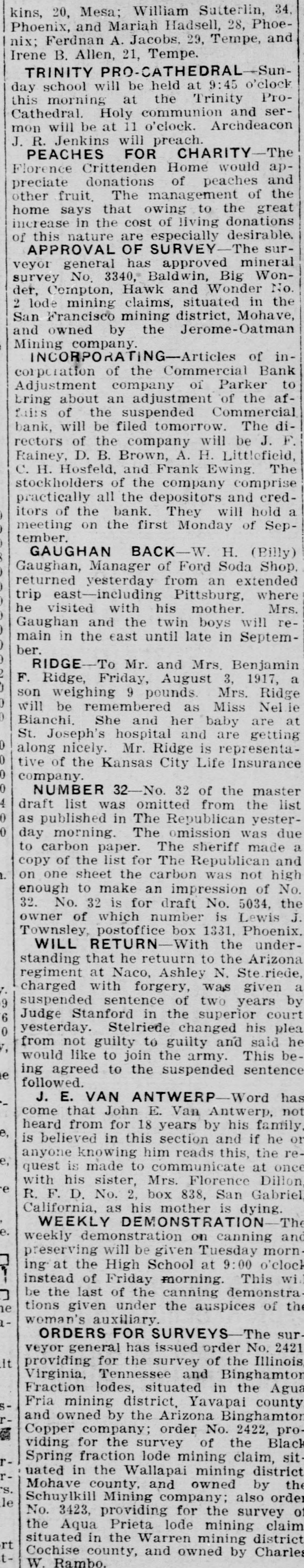

20, Mesa; William Sutterlin, 28, Phoe- 34, kins, and Mariah Hadsell, and nix; Phoenix, Ferdnan A. Jacobs, 29, Tempe, Irene B. Allen, 21, Tempe. PRO-CATHEDRAL-Sun o'clock TRINITY will be held at 9:45 Proday at the Trinity serthis Holy communion be at 11 o'clock. J. Jenkins will mon Cathedral. school morning will preach. Archdeacon and PEACHES R. FOR CHARITY-The would apCrittenden Home and Florence donations of peaches of the preciate fruit. The management the great other that owing to home the cost of living nature are especially OF has approved increase of APPROVAL this says general in SURVEY-The sur- donations desirable. mineral Wonveyor No. 3340, Baldwin, Big No. survey Compton, Hawk and Wonder in the der, mining claims, situated Mohave, 2 lode Francisco mining district, and San owned by the Jerome-Oatman MINCORPORATING-Article company. of Bank incorporation of the Commercial Parker to Adjustment company of the afabout an adjustment Commercial of bring of the suspended difairs will be filed tomorrow. The F. rectors bank, of the company will be J. Rainey, D. B. Brown, A. H. Litt!cfield, The H. Hosfeld, and Frank Ewing. stockholders C. of the company comprise practically all the depositors and hold cred- a of the bank. They will itors meeting on the first Monday of September. GAUGHAN BACK-W. H. (Billy) Gaughan, Manager of Ford Soda Shop. returned yesterday from an extended trip east-including Pittsburg, where Mrs. he visited with his mother. Gaughan and the twin boys will remain in the east until late in September. RIDGE-TO Mr. and Mrs. Benjamin Ridge, Friday, August 3, 1917, a F. son weighing 9 pounds. Mrs. Ridge remembered as She and her will Bianchi. be baby Miss getting are Nel at 0 St. Joseph's hospital and are 0 along nicely. Mr. Ridge is representaO tive of the Kansas City Life Insurance 0 4 company. NUMBER 32-No. 32 of the master was omitted from the list 0 as in The 0 draft published list Republican yester- due day morning. The omission was to carbon paper. The sheriff made a 1. copy of the list for The Republican high and one sheet the carbon was not on to make an impression of No. 32 is for draft enough 32. No. No. Lewis 5034, the owner of which number is J. Townsley, postoffice box 1331, Phoenix. WILL RETURN-With the underthat he retuurn to at Naco, Ashley N. standing regiment the Ste given Arizona riede, charged with forgery, was a 9 suspended sentence of two years by 6 Judge Stanford in the superior court Stelriede 0 y, yesterday. guilty changed and his said plea from not to guilty he would like to join the army. This bele ing agreed to the suspended sentence followed. J. E. VAN ANTWERP-W has come that John E. Van Antwerp, not e, heard from for 18 years by his family is believed in this section and if he or e, anyone knowing him reads this, the re quest is made to communicate at once e with his sister, Mrs. Florence Dillon R. F. D. No. 2, box 838, San Gabriel California, as his mother is dying. e. WEEKLY DEMONSTRATION-The demonstration on canning and will be given weekly preserving Tuesday 9:00 o'clock morn1 ing at the High School at wi instead of Friday morning. This ] be the last of the canning demonstra e tions given under the auspices of the 1woman's auxiliary. ORDERS FOR SURVEYS-The sur has issued it for the survey of providing veyor general order the No. Illinois 2421 Virginia, Tennessee and Binghamton Fraction lodes, situated in the Agua sFria mining district, Yavapai county rand owned by the Arizona Binghamton order No. 2422, proto for the survey of Copper viding company; the Black sit rSpring fraction lode mining claim, ruated in the Wallapai mining district S. Mohave county, and owned by the le Schuylkill Mining company; also order No. 3423, providing for the survey o the Aqua Prieta lode mining claim the Warren rt situated in mining by district Charles Cochise county, and owned tW. Rambo.