Article Text

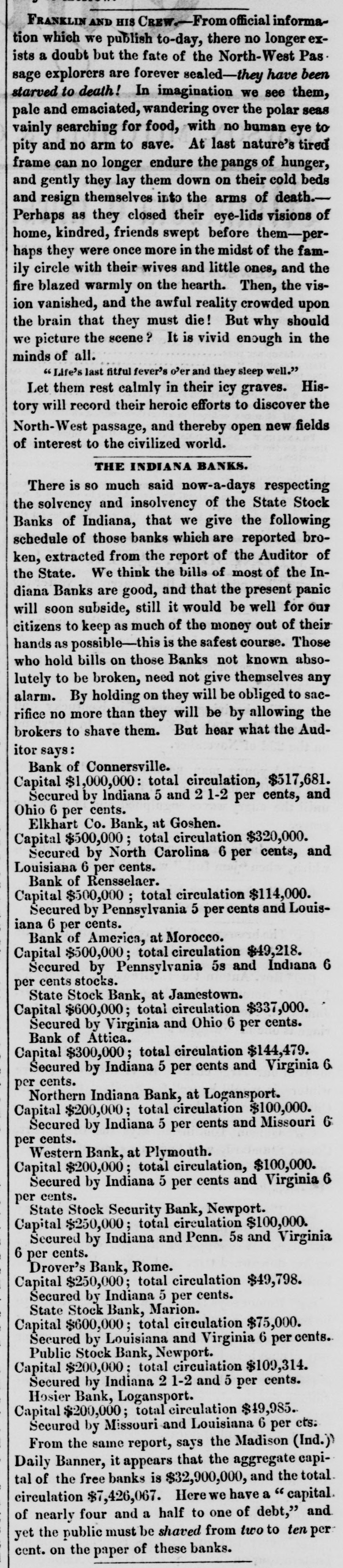

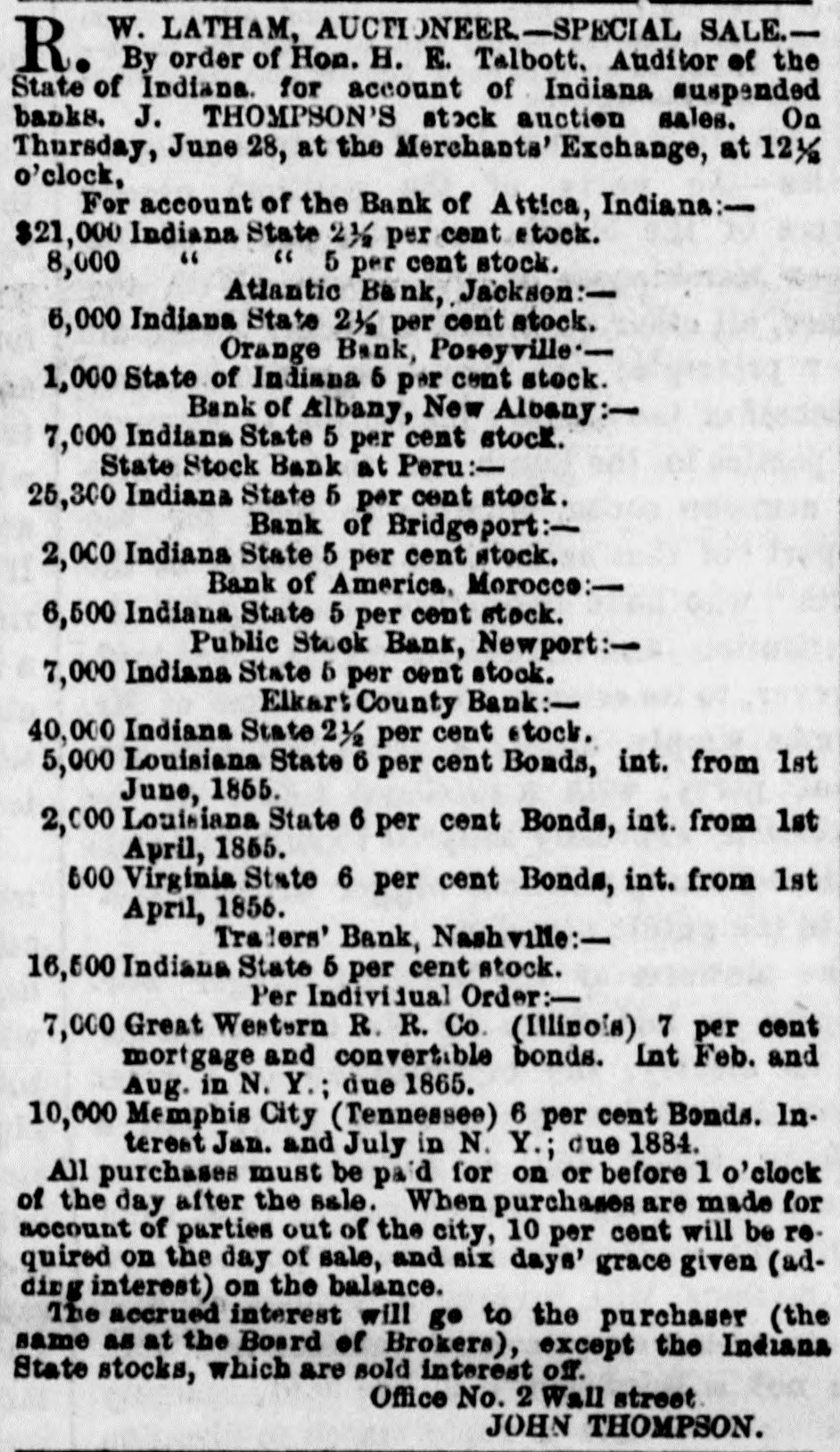

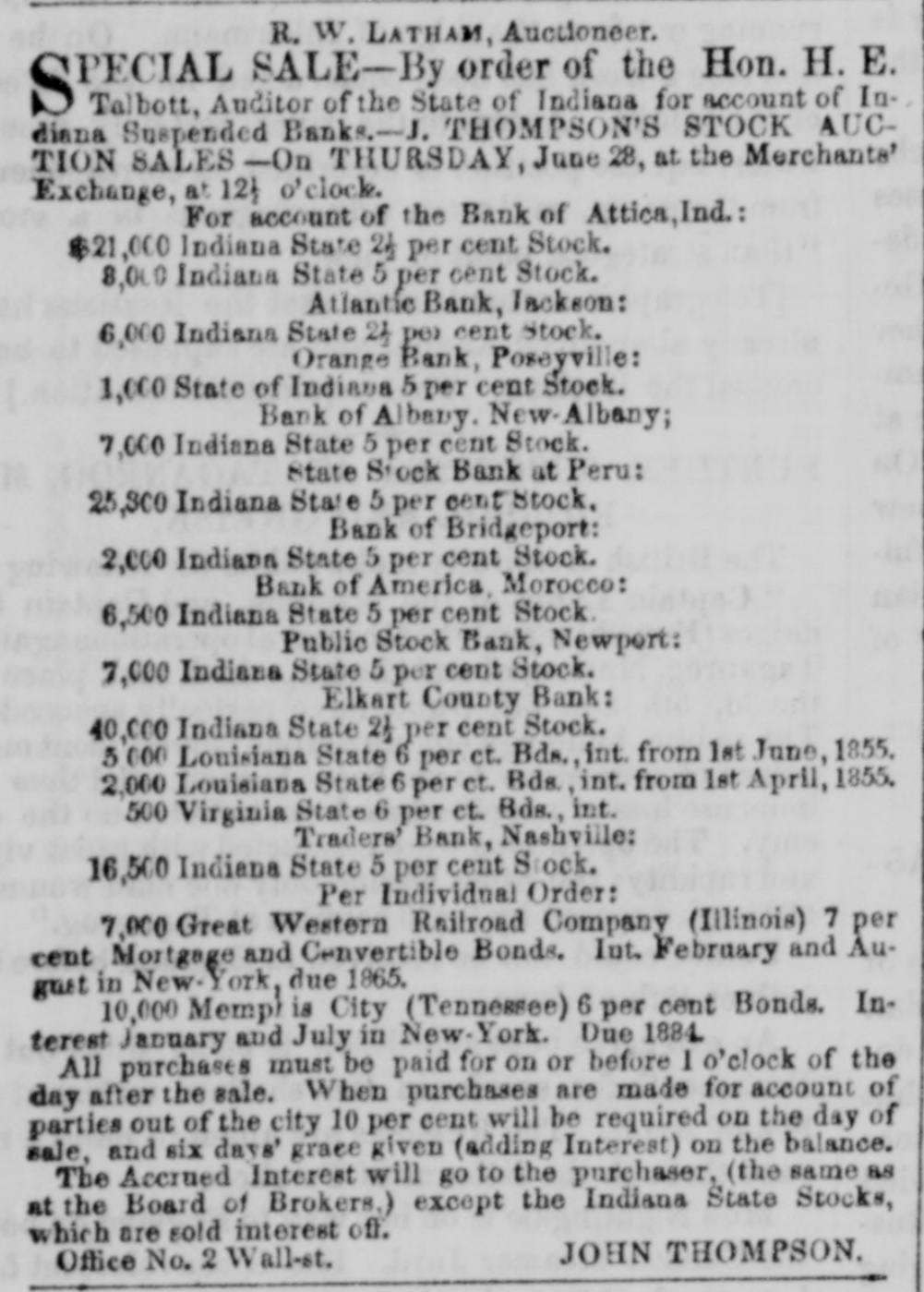

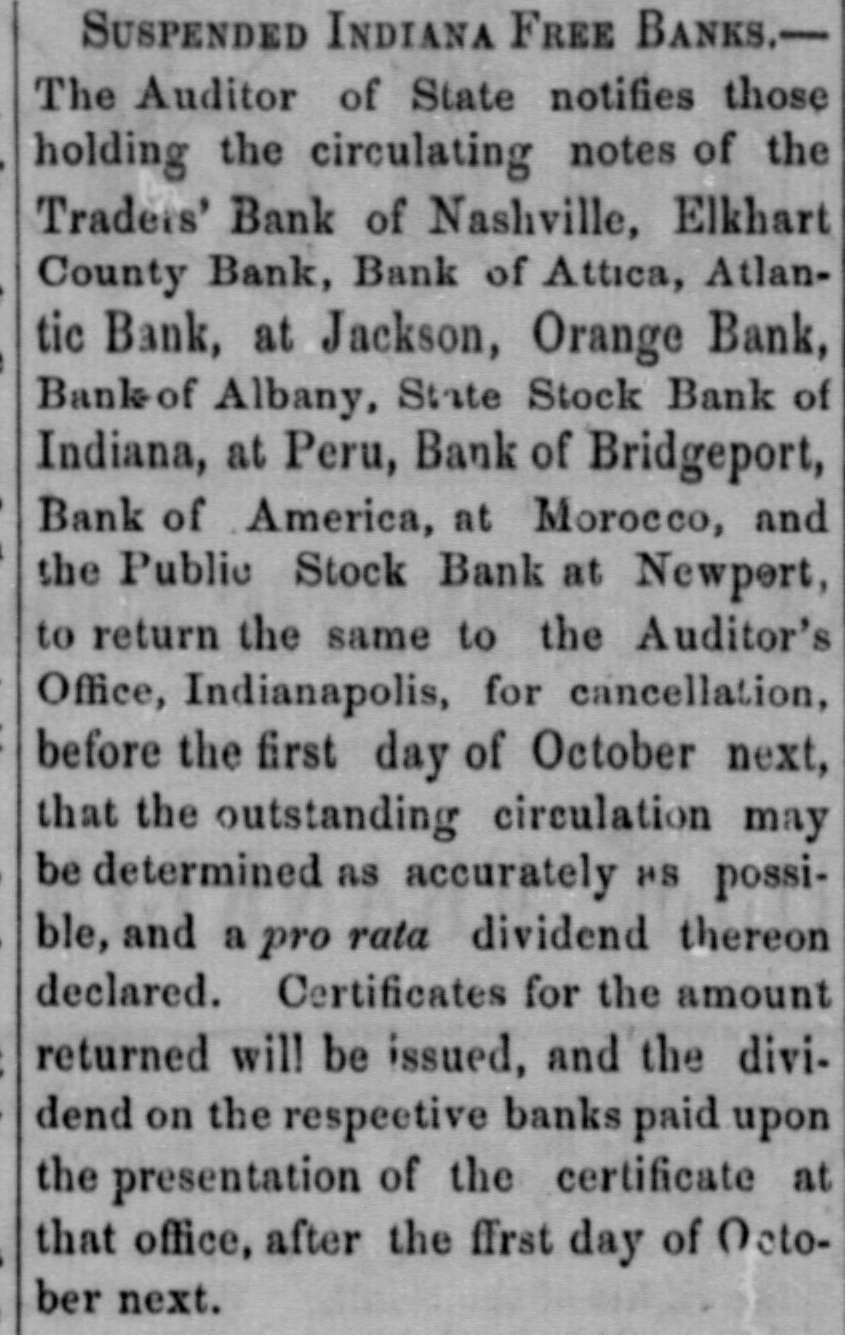

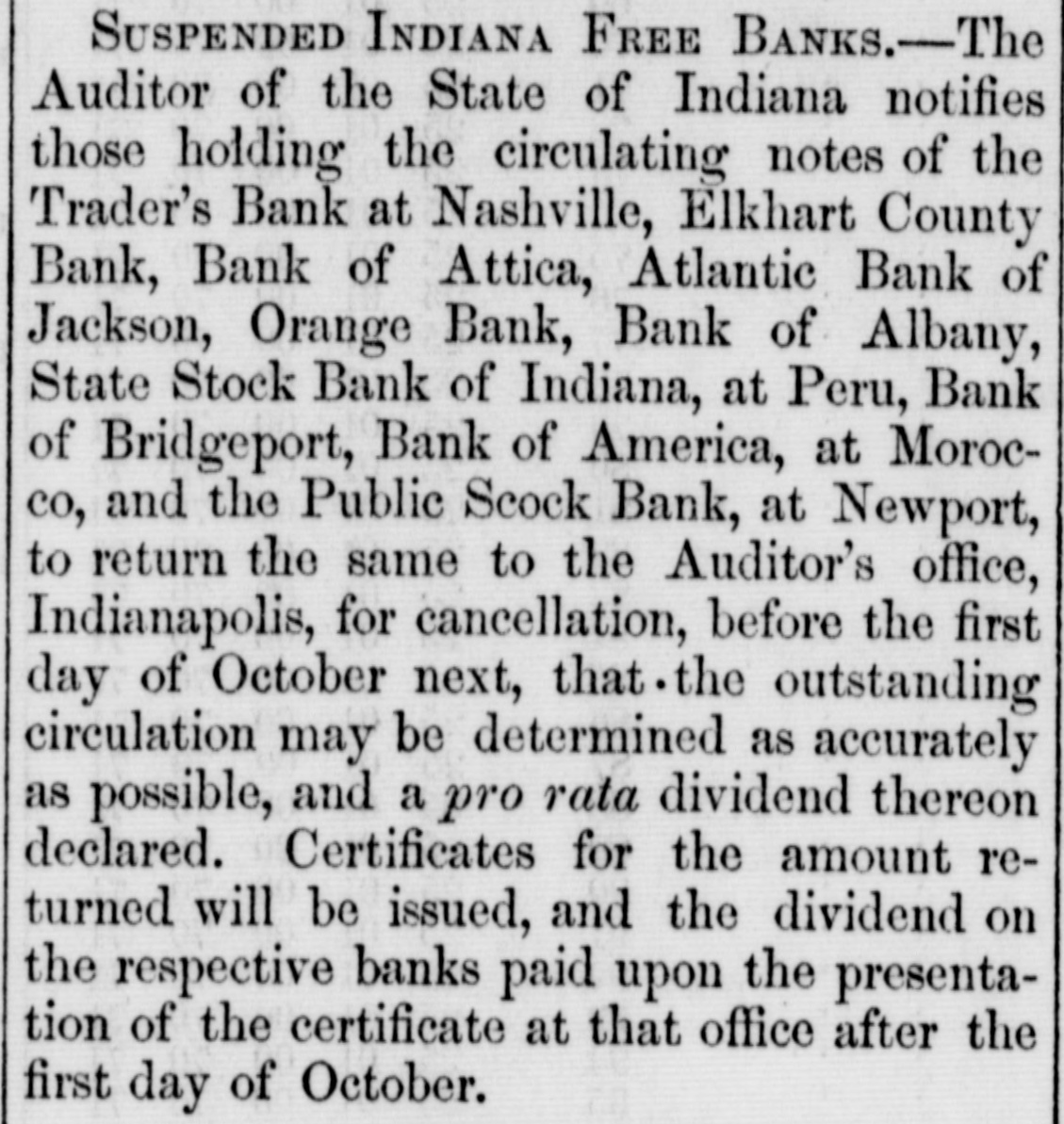

FRANKLIN AND HIS CREW.From official information which we publish to-day, there no longer exists a doubt but the fate of the North-West Pas. sage explorers are forever sealed-they have been starved to death! In imagination we see them, pale and emaciated, wandering over the polar seas vainly searching for food, with no human eye to pity and no arm to save. At last nature's tired frame can no longer endure the pangs of hunger, and gently they lay them down on their cold beds and resign themselves into the arms of death.Perhaps as they closed their eye-lids visions of home, kindred, friends swept before them-perhaps they were once more in the midst of the family circle with their wives and little ones, and the fire blazed warmly on the hearth. Then, the vision vanished, and the awful reality crowded upon the brain that they must die! But why should we picture the scene? It is vivid enough in the minds of all. last fitful fever's o'er and they sleep well." Let them rest calmly in their icy graves. History will record their heroic efforts to discover the North-West passage, and thereby open new fields of interest to the civilized world. THE INDIANA BANKS. There is so much said now-a-days respecting the solvency and insolvency of the State Stock Banks of Indiana, that we give the following schedule of those banks which are reported broken, extracted from the report of the Auditor of the State. We think the bills of most of the Indiana Banks are good, and that the present panic will soon subside, still it would be well for our citizens to keep as much of the money out of their hands as possible-this is the safest course. Those who hold bills on those Banks not known absolutely to be broken, need not give themselves any alarm. By holding on they will be obliged to sacrifice no more than they will be by allowing the brokers to shave them. But hear what the Auditor says: Bank of Connersville. Capital $1,000,000: total circulation, $517,681. Secured by Indiana 5 and 21-2 per cents, and Ohio 6 per cents. Elkhart Co. Bank, at Goshen. Capital $500,000; total circulation $320,000. Secured by North Carolina 6 per cents, and Louisiana 6 per cents. Bank of Rensselaer. Capital $500,000 total circulation $114,000. Secured by Pennsylvania 5 per cents and Louisiana 6 per cents. Bank of America, at Morocco. Capital $500,000; total circulation $49,218. Secured by Pennsylvania 5s and Indiana 6 per cents stocks. State Stock Bank, at Jamestown. Capital $600,000; total circulation $337,000. Secured by Virginia and Ohio 6 per cents. Bank of Attica. Capital $300,000; total circulation $144,479. Secured by Indiana 5 per cents and Virginia 6. per cents. Northern Indiana Bank, at Logansport. Capital $200,000; total circulation $100,000. Secured by Indiana 5 per cents and Missouri 6 per cents. Western Bank, at Plymouth. Capital $200,000; total circulation, $100,000. Secured by Indiana 5 per cents and Virginia 6 per cents. State Stock Security Bank, Newport. Capital $250,000 total circulation $100,000. Secured by Indiana and Penn. 5s and Virginia 6 per cents. Drover's Bank, Rome. Capital $250,000; total circulation $49,798. Secured by Indiana 5 per cents. State Stock Bank, Marion. Capital $600,000; total circulation $75,000. Secured by Louisiana and Virginia 6 per cents. Public Stock Bank, Newport. Capital $200,000 total circulation $109,314. Secured by Indiana 1-2 and 5 per cents. Hosier Bank, Logansport. Capital $200,000; total circulation $49,985. Secured by Missouri and Louisiana 6 per cts. From the same report, says the Madison (Ind.) Daily Banner, it appears that the aggregate capital of the free banks is $32,900,000, and the total. circulation $7,426,067. Herewe have a " capital of nearly four and a half to one of debt," and yet the public must be shaved from two to ten per cent. on the paper of these banks.