Article Text

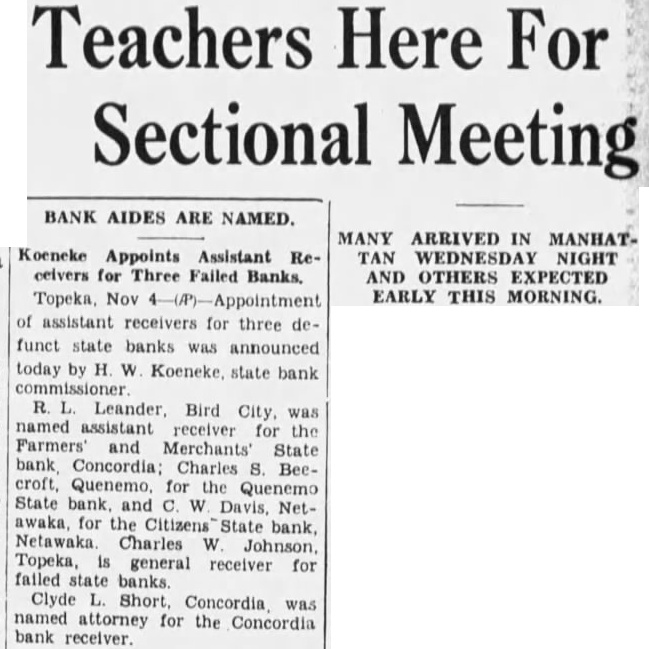

Teachers Here For Sectional Meeting BANK AIDES ARE NAMED. Koeneke Appoints Assistant ceivers Three Failed Banks. assistant receivers for three funct state banks was announced today by Koeneke bank commissioner Leander, Bird City, named assistant receiver for Farmers' Merchants' State bank Concordia; Charles Beefor the Quenemo State bank, and Netawaka, for the bank, Netawaka Charles Johnson, Topeka, general receiver for failed state Clyde Concordia was named attorney for the Concordia bank receiver. MANY ARRIVED IN TAN WEDNESDAY NIGHT AND OTHERS EXPECTED EARLY THIS MORNING.