Click image to open full size in new tab

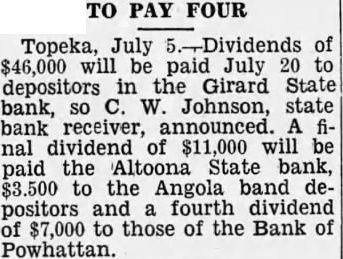

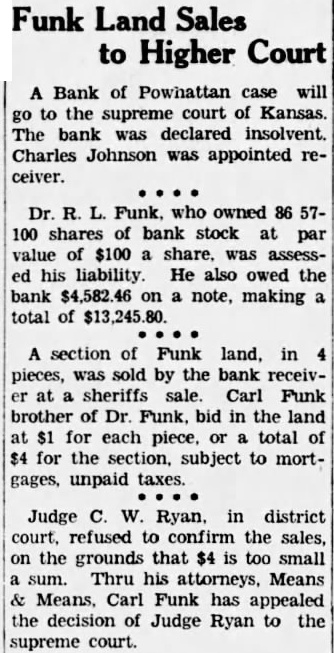

Article Text

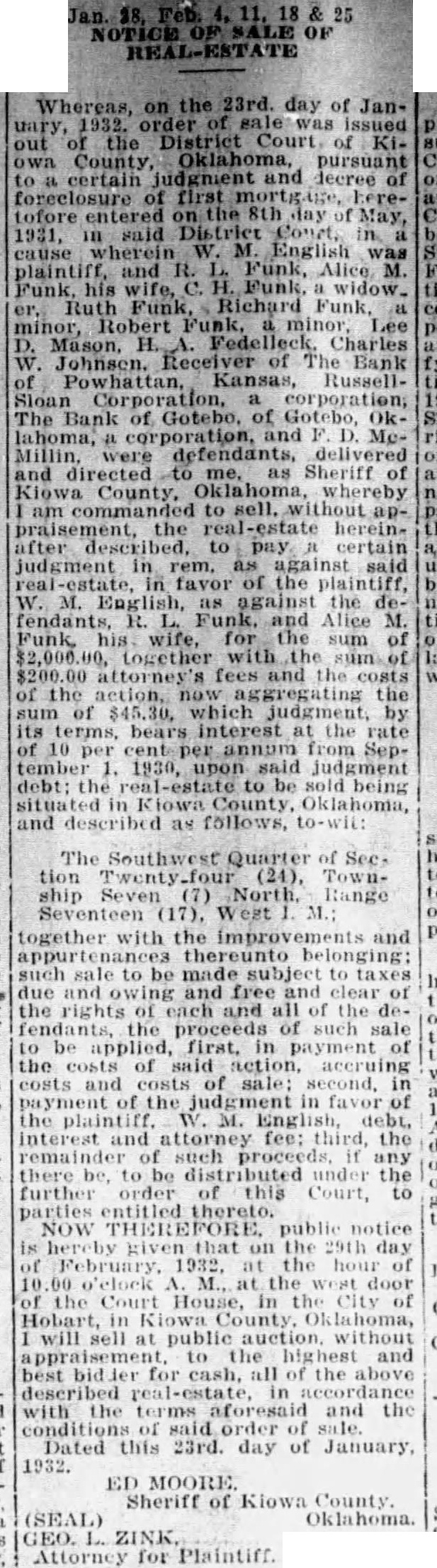

Jan. 25 OF REAL-ESTATE

Whereas, on the 23rd. day of Janout District Court KiCounty, Oklahoma, pursuant certain judgment decree foreclosure first 1931, said cause English plaintiff, and R. Funk, Alice M. his Funk, widow. Richard Lee Mason, Charles Receiver of Bank Powhattan, Kansas, RussellThe Gotebo, of corporation, and Mewere defendants, delivered and directed Sheriff County, Oklahoma, commanded sell. appraisement, the real-estate hereincertain judgment as against the fendants, R. Funk. Alice wife, sum the aggregating the sum of which judgment, its bears at rate 10 cent per judgment County as follows,

The Southwest of Sec. TownRange Seventeen West M. together with the improve thereunto be and and free clear the rights of each and all of the the proceeds such sale be applied first, payment the and of sale: the judgment in favor the the remainder any there be, be under the further order this Court, NOW THEREFORE, public on the 29th day the hour 00 M., at the House, in the at without the best bid for cash, all of the above the and the said Dated this 23rd. day of January, 1932.

ED MOORE Sheriff of Klown County.

(SEAL) Attorney for Plaintiff.