Article Text

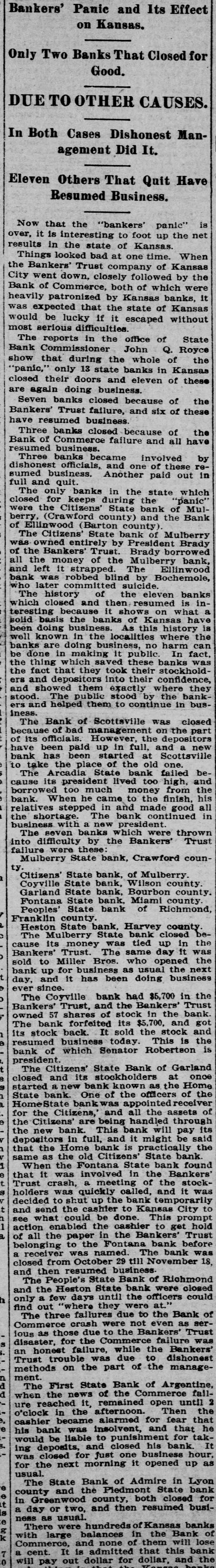

Bankers' Panic and Its Effect on Kansas. Only Two Banks That Closed for Good. DUETOOTHER CAUSES. In Both Cases Dishonest Management Did It. Eleven Others That Quit Have Resumed Business. is Now that the "bankers' panic" over, it is interesting to foot up the net results in the state of Kansas. Things looked bad at one time. When the Bankers' Trust company of Kansas City went down, closely followed by the Bank of Commerce, both of which were heavily patronized by Kansas banks, it was expected that the state of Kansas would be lucky if it escaped without most serious difficulties. The reports in the office of State Bank Commissioner John Q. Royce show that during the whole of the 'panic," only 13 state banks in Kansas closed their doors and eleven of these are again doing business. Seven banks closed because of the Bankers' Trust failure, and six of these have resumed business. Three banks closed because of the Bank of Commerce failure and all have resumed business. Three banks became involved by dishonest officials, and one of these resumed business. Another paid out in full and quit. The only banks in the state which closed for keeps during the panic' were the Citizens' State bank of Mulberry (Crawford county) and the Bank of Ellinwood (Barton county) The Citizens' State bank of Mulberry was owned entirely by President Brady of the Bankers' Trust. Brady borrowed all the money of the Mulberry bank, and left it strapped. The Ellinwood bank was robbed blind by Bochemole, who later committed suicide. The history of the eleven banks which closed and then resumed is ina teresting because it shows on what solid basis the banks of Kansas have been doing business. As this history is well known in the localities where the banks are doing business, no harm can be done in making it public In fact, the thing which saved these banks was the fact that they took their stockholders and depositors into their confidence, and showed them exactly where they stood. The public stood by the bankand helped them to continue in business. The Bank of Scottsville was closed because of bad management on the part of its officials. However, the depositors have been paid up in full, and a new bank has been started at Scottsville to take the place of the old one. The Arcadia State bank failed because its president lived too high, and borrowed too much money from the bank. When he came to the finish, his relatives stepped in and made good all in the shortage. The bank continued business with a new president. The seven banks which were thrown into difficulty by the Bankers' Trust failure were these Mulberry State bank, Crawford county Citizens' State bank, of Mulberry. Coyville State bank, Wilson county. Garland State bank, Bourbon county. Fontana State bank. Miami county Peoples State bank of Richmond, Franklin county Heston State bank. Harvey county. The Mulberry State bank closed because its money was tied up in the Bankers' Trust The same day it was sold to Miller Bros. who opened the bank up for business as usual the next day, and it has been doing business ever since. The Coyville bank had $5,700 in the Bankers' Trust, and the Bankers' Trust owned 57 shares of stock in the bank. The bank forfeited its $5,700, and got its stock back. It sold the stock and resumed business today This is the bank of which Senator Robertson is president The Citizens' State Bank of Garland closed and its stockholders at once started a new bank known as the Home State bank. One of the officers of the HomeState bank was appointed receive for the Citizens, and all the assets of the Citizens' are being handled through the new bank. This bank will pay its depositors in full, and it might be said that the Home bank is practically the same as the old Citizens' State bank. When the Fontana State bank found a that it was involved in the Bankers' Trust crash, meeting of the stockholders was quickly called, and it was decided to shut up the bank temporarily and send the cashier to Kansas City to see what could be done. This prompt action enabled the cashier to get hold of all the paper in the Bankers' Trust belonging to the Fontana bank before a receiver was named. The bank was closed from October 29 till November 18, and then resumed business. The People's State Bank of Richmond and the Heston State bank were closed only a few days until the officers could find out "where they were at.' The three failures due to the Bank of Commerce crash were not even as serious as those due to the Bankers' Trust disaster, for the Commerce failure was an honest failure, while the Bankers' Trust trouble was due to dishonest methods on the part of the management. The First State Bank of Argentine, when the news of the Commerce falld ure reached it. remained open until 2 o'clock in the afternoon. Then the cashier became alarmed for fear that e his bank was insolvent, and that he would be liable to punishment for taking deposits, and closed his bank. It was closed for just one business hour. for the next morning it opened up as usual. The State Bank of Admire in Lyon e county and the Pledmont State bank in Greenwood county, both closed for a day or two, and then resumed business as usual. There were hundreds of Kansas banks with large balances in the Bank of k Commerce, and none of them will lose a cent. It is admitted that this bank 0 will pay out dollar for dollar, and the