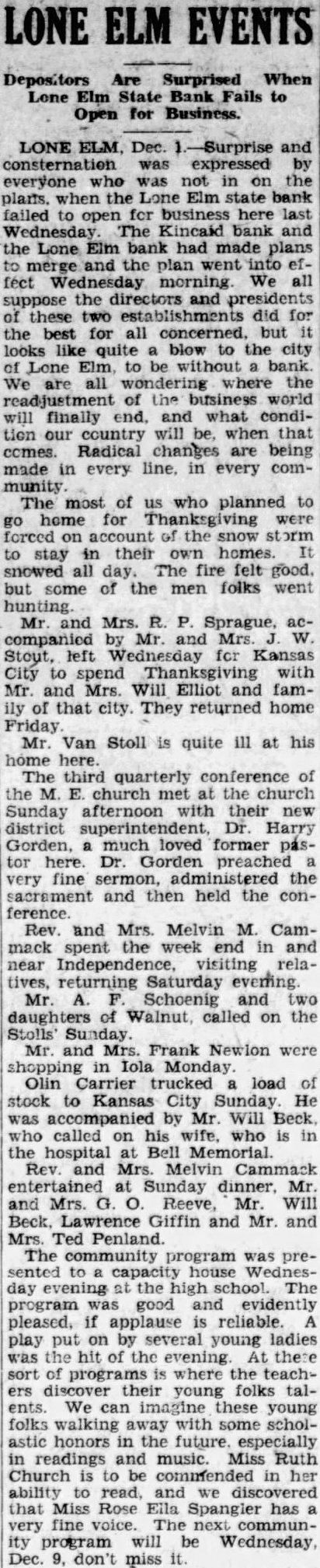

Article Text

LONE ELM Are Surprised When Lone Elm State Bank to Open for Business. LONE and consternation was expressed by everyone who was not in on the when the Lone Elm state bank failed to open for business here last Wednesday The Kincaid bank and the Lone Elm bank had made plans the plan went into fect Wednesday morning We all suppose the directors and presidents these two did for the best for all but looks like quite blow to the city Lone Elm, to be without bank We all wondering where the readjustment of the business world will finally end, and what condiour country will when that comes Radical changes are being made in every in every community The most of us who planned to home for were forced on account stay their own homes. snowed all day. The fire felt good. some of the men folks went Mr. Mrs. Sprague, companied by Mr. and Mrs. Stout, left Wednesday Kansas City to spend Thanksgiving with Mr and Mrs. Will Elliot and famof that city. They returned home Friday Mr. Van Stoll is quite ill at home here. The third quarterly the church met the church Sunday afternoon with their new district superintendent, Harry Gorden, much loved former pastor here. Dr. Gorden preached fine sermon, the sacrament and then held the conference. Rev. and Mrs. Melvin M. Cammack spent the week end and near Independence, visiting returning Saturday everning. Mr. Schoenig and two daughters of Walnut, called on the Stolls' Sunday. Mr. and Mrs. Frank Newlon were shopping in Iola Monday Olin Carrier trucked load stock to Kansas City Sunday He accompanied by Mr. Will Beck called on his wife. who is the hospital Bell Memorial Rev. Mrs. Melvin Cammack entertained Sunday dinner, Mr. and Mrs. Mr. Will Beck, Lawrence Giffin and Mr. and Mrs. Ted Penland. The community program was presented capacity house Wednesevening the high school. The program good and evidently pleased, applause is reliable. play put on by several young ladies the hit the evening At there of where the teachtheir young folks talents. We these young folks walking with some scholastic honors in the future. especially in readings and music. Miss Ruth Church commended in her ability read, and that Miss Rose Ella Spangler has very fine voice. The next ity program will be Wednesday, Dec. don't miss