Click image to open full size in new tab

Article Text

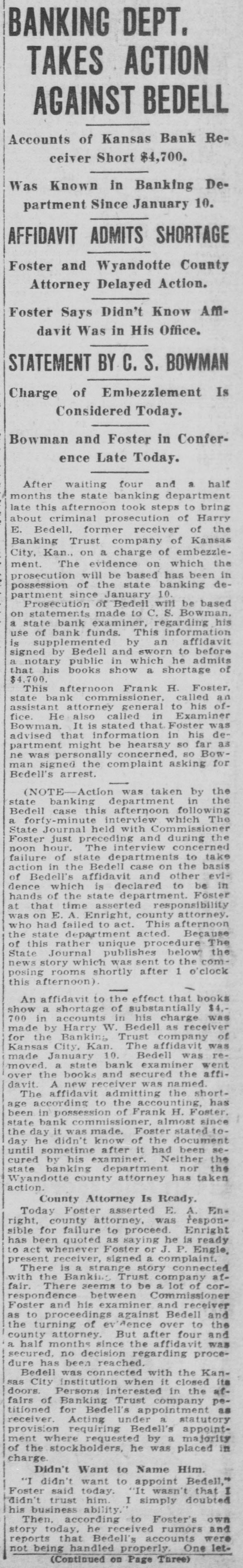

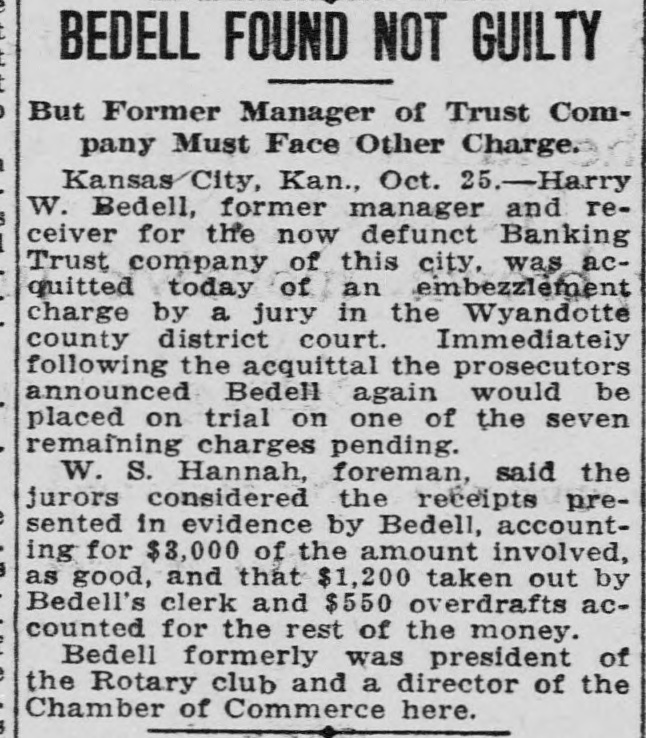

CLUBS MUST WORK AFFIDAVIT IS OUT Kansas C. of C. Executives Urge Bedell Shortage Statement Is a Closer Co-operation. Made Public Today. C. B. Merriam Tells of Tax ExFour Months Without Action on Part of State. empt Securities. The representatives of the classifiFrank H. Foster, state bank commissioner, has made public the affication clubs addressing the state condavit of Harry W. Bedell of Kansas ference of Executive Officers of City in which he admitted that an Chambers of Commerce this morning, audit of his books showed a shortage agreed that the clubs must work in of $4,700 in the receivership of the the closest co-operation with the Banking Trust company. The affidavit was made January 10. Bedell was Chambers, but that they have a defiremoved. But until Thursday no dinite and integral function to perform rect action was taken looking toward in community life which they are betcriminal prosecution. ter fitted to perform than is the Commissioner Foster has revised Chamber of Commerce. his first statements regarding the matter. He first stated that he did Every speaker agreed that membernot know of Bedell's affidavit at the ship in the Chamber of Commercetime he was removed and J. P. Angle the board clearinghouse of the comappointed as successor. Later Mr. munity activities-was an essential to Foster stated that the affidavit was the correct functioning of a classificacalled to his attention the day it was tion club. made and that he immediately disL. Chase Speaks. placed the receiver. Until Thursday, "The inspiration in community bettho, no prosecution was directed. terment which a classification club "From a conversation which I have brings into its community is bound to had with Mr. Bowman," said Comreact to the advantage of the Chammissioner Foster, "I recall that I was ber of Commerce," E. L. Chase, of in Kansas City, Mo., the day the BeKansas City, Mo., district governor of dell affidavit was made. Mr. Bowthe Kiwanis clubs, declared. R. N. man called me to the Kansas side, McEntire, past president of the Toshowed me the affidavit and I immediately removed Bedell." peka Rotary clubs, was the first speaker from the classification clubs. C. S. Bowman, whom Commissioner W. L. Dean, of Topeka, representaFoster mentions, was sent by him to tive from the Lions club, brought check up the receiver's work. Bowout the point that Chambers of Comman is a state bank examiner and he merce which work up rivalry in comswore to the complaint against Bedell. munity work between their various The charge of embezzlement is based classification clubs, make an error. on both the affidavit and statements "We want to be members of the which the former receiver is declared Chamber of Commerce first, and not to have made to Bowman last winter. to stress our membership in the classiFor four and a half months the affification club," Dean said. Judson S. davit was in the files of the state deWest, associate justice of the state supartment without action being taken. preme court, speaking for the CoWhen questioned regarding the matter Thursday Commissioner Foster stated Operative clubs, made suggestions to the Chamber of Commerce men as to that he did not know of the document until sometime after it was made. enterprises in which they might engage which would be sure to receive The Bedell Affidavit. the efficient and earnest support of The Bedell affidavit was made when the classification clubs. he was confronted with records of the Tells of Money and Credit. examination which showed the alleged The address of C. B. Merriam of shortage in his accounts. Following is the Central Trust company, on "Mona copy of the affidavit as given by Commissioner Foster at request of ey and Credit," followed by a discusThe State Journal: sion of the topic-by A. E. Van Petten, "State of Kansas, County of Wyandotte. president of the Pioneer Mortgage "H. W. Bedell of lawful age being duly company, provoked a discussion of sworn, deposes and says that he is the tax laws of the nation and the state receiver of the Banking Trust Co., a conwhich have created tax exempt secern formerly doing business in Kansas curities. City. Kan., that in the audit of the deputy bank commissioners of the state "Tax exempt securities are not only of Kansas, they find today the books show permitting wealthy men to evade taxa shortage in the cash of practically $4,ation on their wealth, but they are 700.00, the bank balance of the Home State withdrawing from the development Bank of Kansas City is now an overdraft and progress of the country, millions of $56.56, while the books of the Trust and billions of dollars, which is praccompany show a credit balance $4,143.44, and an overdraft of $499.76 allowed M. J. tically withdrawn from circulation," Herrington which he states he is personMerriam declared. "Tax exempt seally responsible for, and further deponent curities are the greatest single obstasayeth not. cle to development in the state of (Signed) HARRY W. BEDELL. Kansas today." Subscribed and sworn to 'before me this Other members of the conference 10th day of January, 1922 (Signed) EARL CLARK. agreed with him, the men discussing (Sal.) Notary Public. the proposition including W. E. My commission expires 2-5-'23." Holmes. chairman of the board of