Article Text

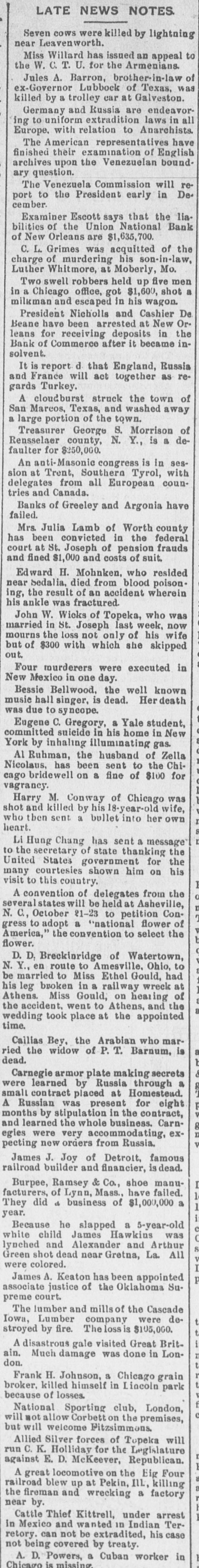

LATE NEWS NOTES. Seven cows were killed by lightning near Leavenworth. Miss Willard has issued an appeal to the W. C. T. U. for the Armenians. Jules A. Barron, brother-in-law of ex-Governor Lubbock of Texas, was killed by a trolley car at Galveston. Germany and Russia are endeavoring to uniform extradition laws in all Europe. with relation to Anarchists. The American representatives have finished their examination of English archives upon the Venezuelan boundary question. The Venezuela Commission will report to the President early in De. cember. Examiner Escott says that the liabilities of the Union National Bank of New Orleans are $1,635,700. C. L. Grimes was acquitted of the charge of murdering his son-in-law, Luther Whitmore, at Moberly, Mo. Two swell robbers held up five men in a Chicago office, got $1,600, shot a milkman and escaped in his wagon. President Nicholls and Cashier De Beane have been arrested at New Or. leans for receiving deposits in the Bank of Commerce after it became insolvent. It is report d that England, Russia and France will act together as regards Turkey. A cloudburst struck the town of San Marcos, Texas, and washed away a large portion of the town. Treasurer George S. Morrison of Rensselaer county, N. Y., is a defaulter for $250,000. An anti-Masonic congress is in session at Trent, Southern Tyrol, with delegates from all European countries and Canada. Banks of Greeley and Argonia have failed. Mrs. Julia Lamb of Worth county has been convicted in the federal court at St. Joseph of pension frauds and fined $1,000 and costs of suit. Edward H. Mohnken, who resided near Sedalia, died from blood poisoning, the result of an accident wherein his ankle was fractured. John W. Wicks of Topeka, who was married in St. Joseph last week, now mourns the loss not only of his wife but of $300 with which she skipped out. Four murderers were executed in New Mexico in one day. Bessie Bellwood, the well known music hall singer, is dead. Her death was due to syncope. Eugene C. Gregory, a Yale student, committed suicide in his home in New York by inhaling illuminating gas. Al Ruhman, the husband of Zella Nicolaus, has been sent to the Chicago bridewell on a fine of $100 for vagrancy. Harry M. Conway of Chicago was shot and killed by his 18-year-old wife, who then sent a bullet into her own heart. Li Hung Chang has sent a message to the secretary of state thanking the United States government for the many courtesies shown him on his visit to this country. I A convention of delegates from the 0 several states will be held at Asheville, N. C., October 21-23 to petition Congress to adopt a "national flower of America," the convention to select the flower. D. D. Breckinridge of Watertown, N. Y., en route to Amesville, Ohio, to be married to Miss Ethel Gould, had his leg broken in a rail way wreck at Athens. Miss Gould, on hearing of the accident, went to Athens, and the B wedding took place at the appointed time. Callias Bey. the Arabian who married the widow of P. T. Barnum, is dead. & Carnegie armor plate making secrets were learned by Russia through a small contract placed at Homestead. A Russian was present for eight months by stipulation in the contract, and learned the whole business. Carnegies were very accommodating, expecting new orders from Russia. James J. Joy of Detroit, famous railroad builder and financier, is dead. Burpee, Ramsey & Co., shoe manufacturers, of Lynn, Mass., have failed. They did d business of $1,000,000 a year. Because he slapped a 5-year-old white child James Hawkins was lynched and Alexander and Arthur S Green shot dead near Gretna, La. All were colored. James A. Keaton has been appointed P associate justice of the Oklahoma Supreme court. The lumber and mills of the Cascade Iowa, Lumber company were det stroyed by fire. The loss is $105,000. A disastrous gale visited Great Britain. Much damage was done in London. Frank H. Johnson, a Chicago grain broker, killed himself in Lincoln park because of losses. National Sporting club, London, will not allow Corbett on the premises, but will welcome Fitzsimmons. Allied Silver forces of Topeka will run C. K. Holliday for the Legislature against E. D. McKeever, Republican. A great locomotive on the Eig Four railroad blew up at Pekin, ILL, killing the fireman and wrecking a factory near by. Cattle Thief Kittrell, under arrest in Mexico and wanted in Indian Terretory. can not be extradited, his case not being covered by treaty. A. D. Powers, a Cuban worker in Chicago is missing.