Article Text

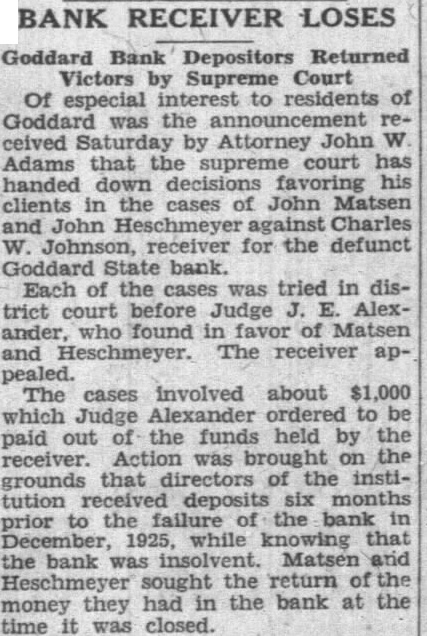

BANK RECEIVER LOSES Goddard Bank Depositors Returned Victors by Supreme Court Of especial interest to residents of Goddard was the announcement received Saturday by Attorney John W Adams that the supreme court has handed down decisions favoring his clients in the cases of John Matsen and John Heschmeyer against Charles W. Johnson, receiver for the defunct Goddard State bank. Each of the cases was tried in district court before Judge J. E. Alexander, who found in favor of Matsen and Heschmeyer. The receiver appealed. The cases involved about $1,000 which Judge Alexander ordered to be paid out of the funds held by the receiver. Action was brought on the grounds that directors of the institution received deposits six months prior to the failure of the bank in December, 1925, while knowing that the bank was insolvent. Matsen and Heschmeyer sought the return of the money they had in the bank at the time it was closed.