Article Text

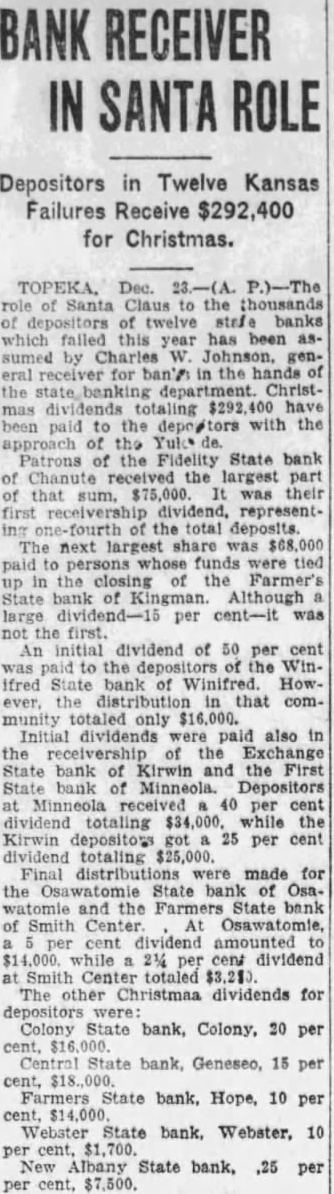

BANK RECEIVER IN SANTA Depositors in Twelve Kansas Failures Receive for Christmas. Dec. Santa Claus to the thousands depositors twelve banks which failed year has been assumed by genfor ban't in the the Christpaid with the of the Patrons of the Fidelity State bank the largest part $75,000. their dividend. representone-fourth the total deposits. next largest share persons funds were tied closing Farmer's State of Although large per cent-it was the first. An initial dividend of 50 per cent the of the ifred bank of Winifred. However. distribution that community totaled $16,000. Initial dividends were paid also in receivership of Exchange State bank of Kirwin and the First State bank Minneola. per cent dividend totaling while Kirwin depositors 25 per cent dividend totaling $25,000. Final distributions made for the State bank of Osathe State Smith Center Osawatomie, dividend amounted while cent dividend Smith totaled The other Christmaa dividends for were: Colony State bank, Colony, 20 per Central State bank, Geneseo, 15 per Farmers State Hope, 10 per Webster 10 Albany State bank, per per cent, $7,500.