Click image to open full size in new tab

Article Text

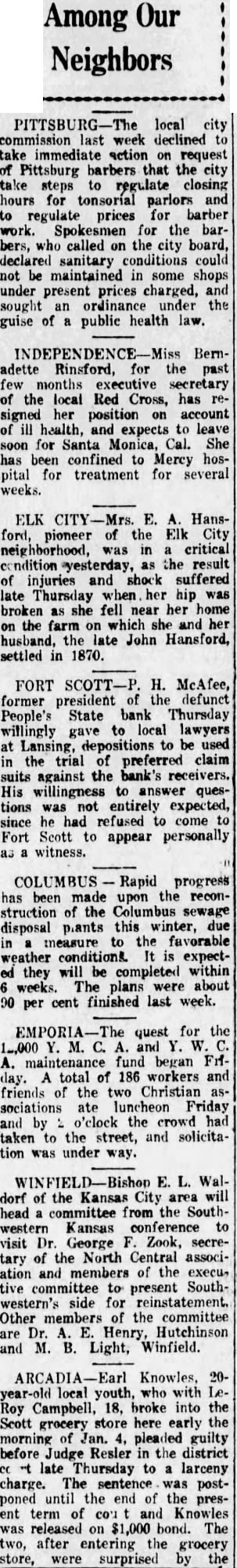

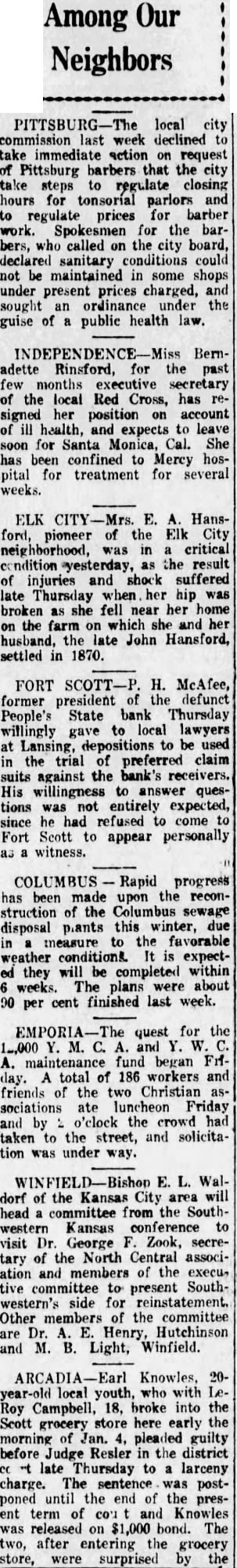

Among Our Neighbors local city last week declined action request Pittsburg barbers that the city regulate closing hours for pariors and regulate prices for barber work. for the barbers, who called on the city board, declared sanitary conditions could not be some shops under present prices charged, sought an under the guise of public health law.

Bernadette Rinsford, for the few months secretary the local Red Cross, has signed position account health, expects leave for Santa She has been confined Mercy pital treatment for several weeks.

ELK E. Hansford, pioneer of the Elk City neighborhood, was in critical the result injuries shock suffered late Thursday when hip was broken fell near her home the farm on which and John Hansford, settled 1870.

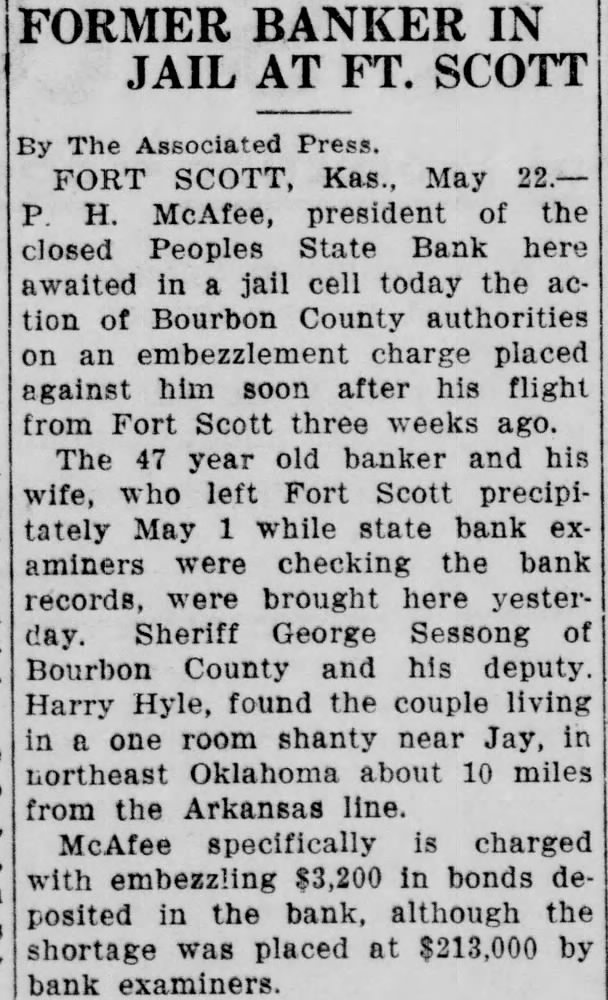

FORT H. former president defunct People's State bank Thursday willingly to local lawyers gave at Lansing, used trial of preferred claim suits against the bank's His willingness answer questions entirely expected, since he had refused come Fort Scott appear personally witness. progress has been made upon the reconstruction the Columbus sewage disposal this winter, due measure the favorable weather conditions. expectthey completed within weeks. about per cent finished last week. quest for the maintenance fund began total of 186 workers and friends the Christian sociations Friday and by o'clock the crowd taken to the street, solicitation under way.

E. Waldorf of the Kansas City area will head committee from the Southwestern Kansas to visit Dr. George Zook, secretary the North association and members the execu, tive to present Southwestern's side for reinstatement. Other the committee Henry, Hutchinson are and M. Light, Winfield.

Knowles, 20youth, with Campbell, 18, broke into the Scott store here early the grocery morning pleaded guilty before Judge Resler the district Thursday larceny charge. The postponed until the end the present term of and was released on $1,000 bond. The two, after entering grocery store, were surprised the