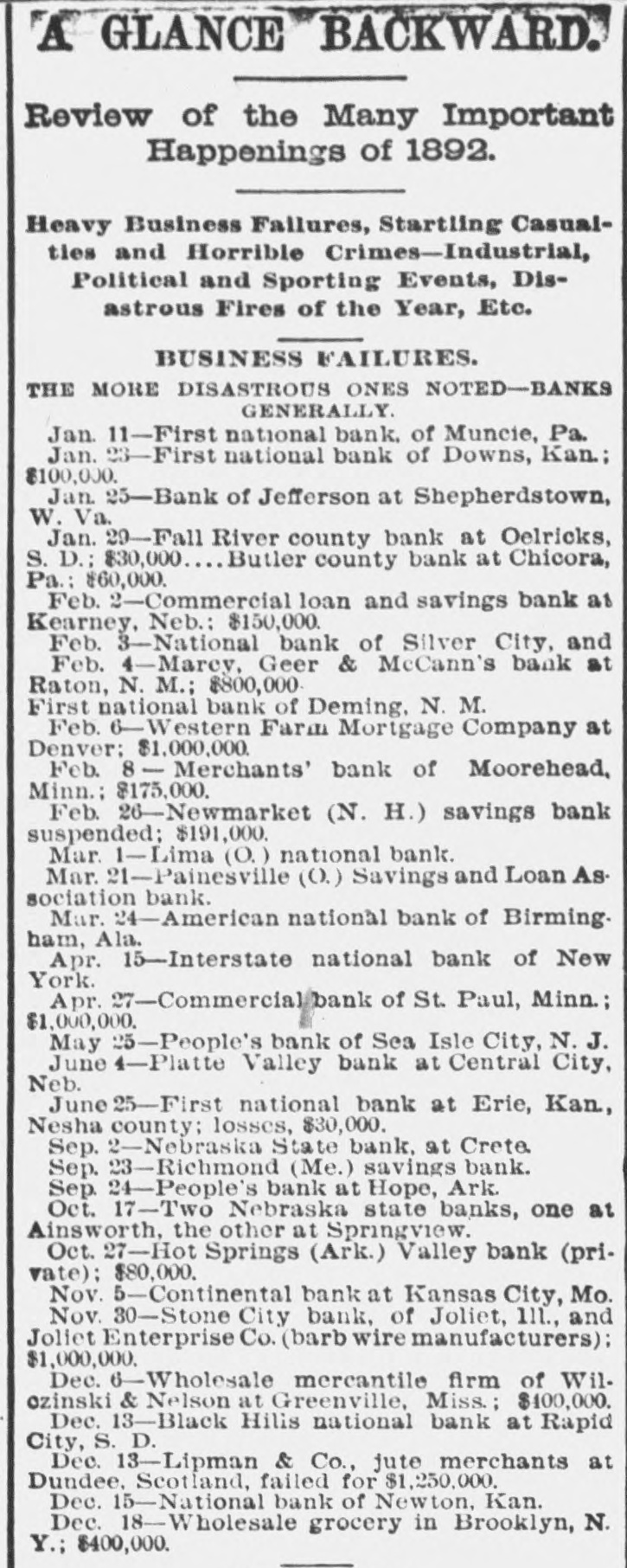

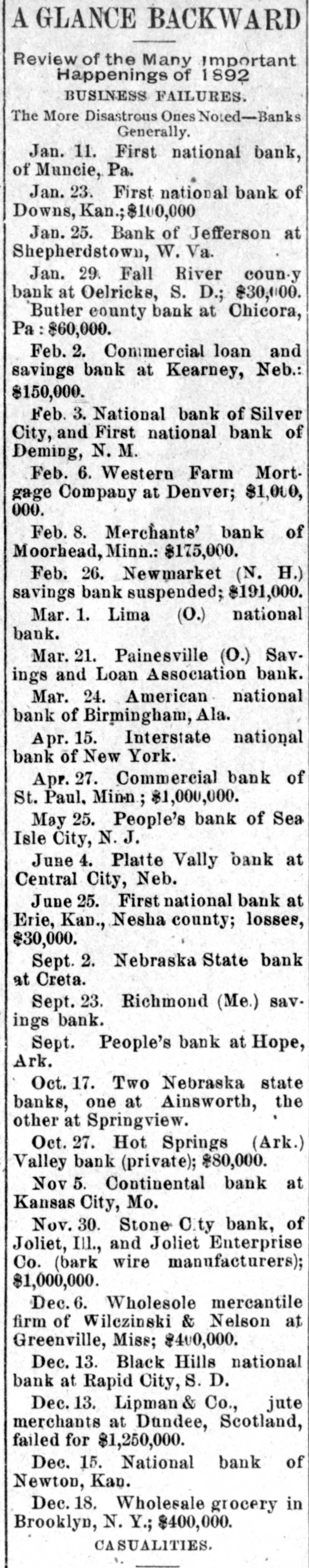

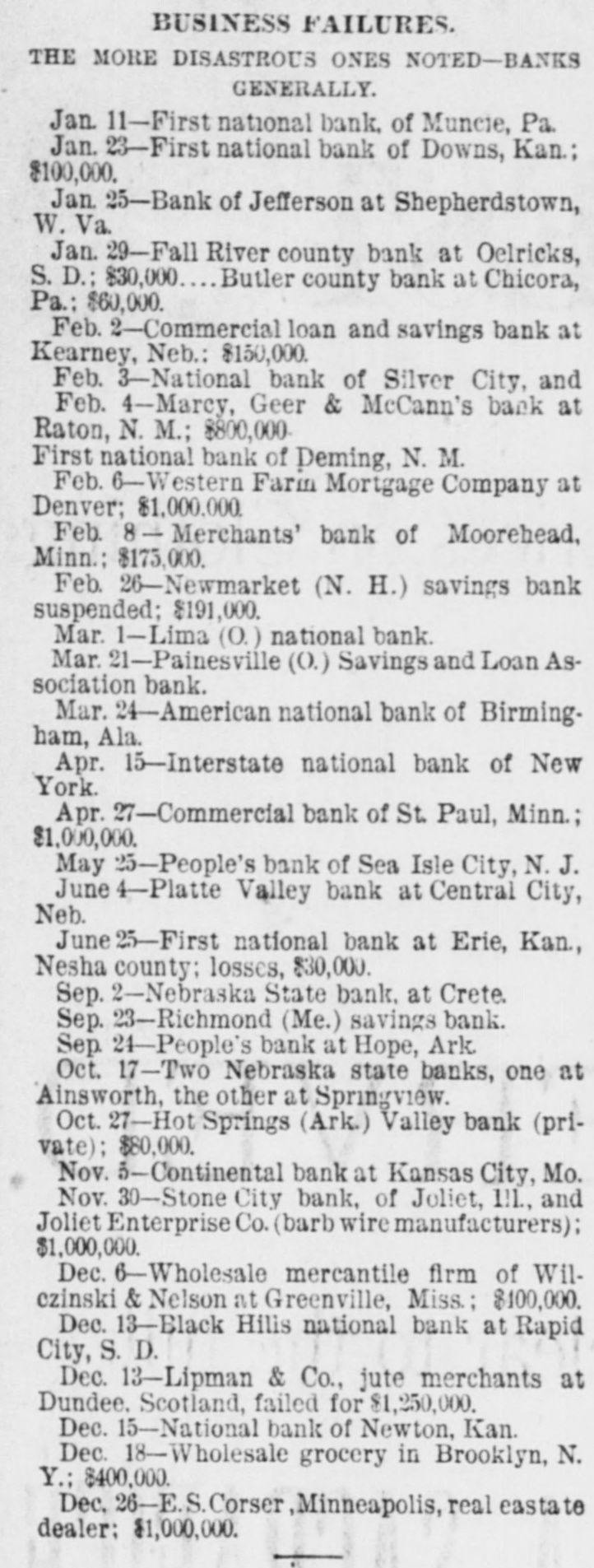

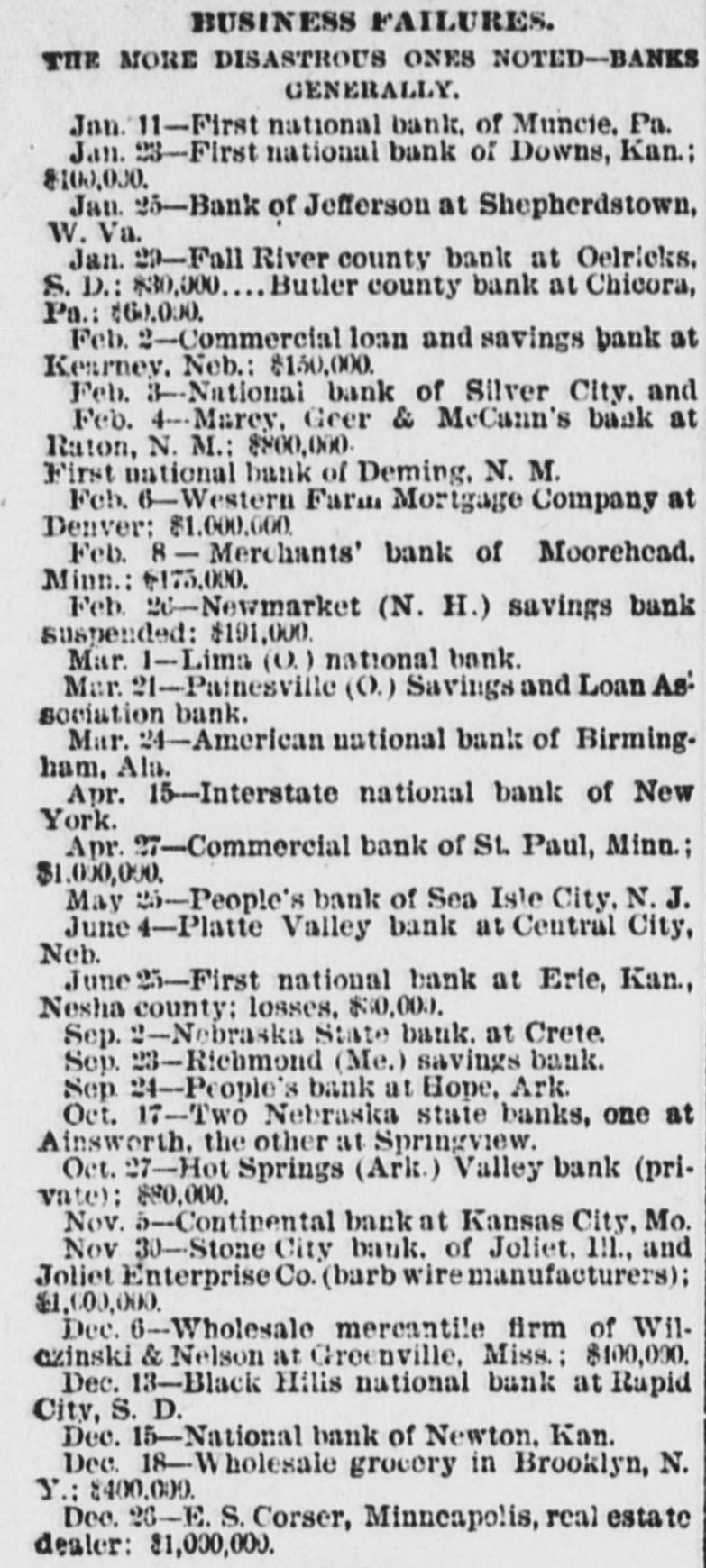

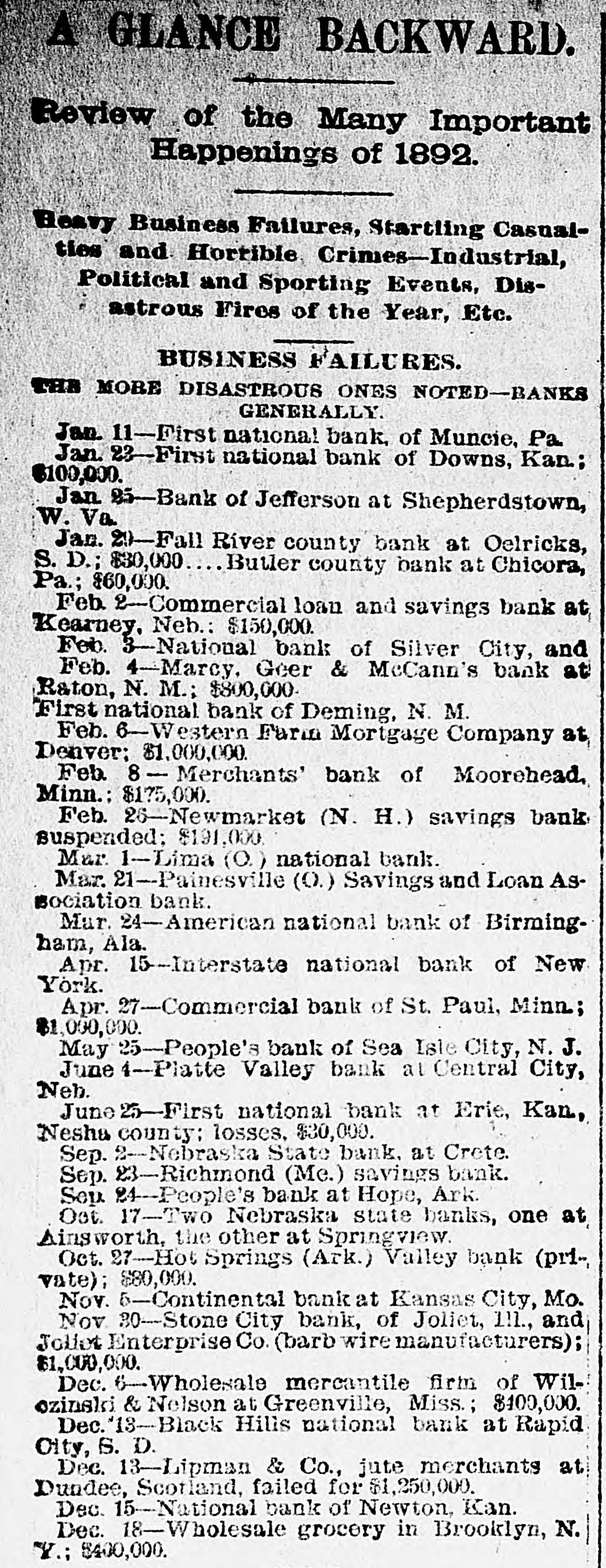

Article Text

NEWS PARAGRAPHS. THOMAS BATES, who murdered his wife in Bedford County, Tenn., was taken from jail at Shelbyville and lynched within fitty feet of the prison. Two hundred men dragged him from his cell. Mrs. Bates was found in her garden with her throat cut. Her husband was arrested and there was such strong proof of his guilt that the people concluded to lynch him. A COLORED character about town named Brooks Trout rushed into a restaurant at Rock Island, III., where his wife was eating supper with a man, and shot her twice. Escaping through the back way, he hurried to the steps of the Y. M. C. A. building, where he ended his own existence. The woman will re'JGAOD DR. ARTHUR B. ROSE, president of the South Carolina Agricultural Society, and president of the Phosphate Miners' Exchange, of Charleston, S. C., suicided by shooting himself. No cause is assigned for the deed. PAUL LAVOI, a brakeman, wasinstantly killed in a collision at Norway, Mich. The yard crew were taking an engine to the coal dock on the side track for coal, the crew being ordered to take a special to Iron Mountain. When near the main track it collided with two freight cars. Lavoi was on the foot-board of the yard engine, and the bumpers caught him, cutting him 'OM'T u! ENGLAND has obtained from Spain the minimum tariff on British goods imported into Spain and her colonies without granting any concessions in return. IT is reported at Berlin that the Queen of Spain has signed a decree granting minimum tariffs to Germany. A NOLLE has been entered at Chicago in the last case against George I. Gibson, ex-secretary of the Whisky Trust. The charge was attempting to blow up with dynamite the Schufeldt distillery, and the cause of the nolle was lack of sufficient evidence to convict. Two prominent business men of Boston, Frederick E. Small, president of the Boylston Riverside Land and Improvement Company, and John A. Allen, New England agent of the World's Fair Transportation Company, are under arrest on a charge of forgery. They are accused of selling forged certificates of membership in endowment and other fraternal orders. Theamount 'UMOUR you SI A LONG-STANDING feud, having its origin in local politics, between the Velch and McManus families, in San Francisco, culminated in that city on the 25th in an encounter in which Jack Welch shot and seriously wounded Cornelius McManus and was himself fatally stabbed in the abdomen by his victim. The two men were rival hotel keepers. THE boiler of the Consumers' Ice Company's works, on Magazine Street, New Orleans, exploded, wrecking the engine house and adjoining buildings. Two negroes who were passing at the moment were killed. The damage to property was $20,000. THE First National Bank at Erie, Kas., has been closed by the United States national bank examiner. The failure of one of the heavy stockholders is alleged as the cause. The heaviest loser is the county of Neosho, which had on deposit between $20,000 and $30,000. ARTHUR J. Yeo, a New York electrician, died of rvousapoplexy, brought on by testing currents by applying the wires to his tongue. MeN Jo B CURRERSON S 'M Albany, Ind.. died at Louisville, Ky., from the effects of grippe contracted last winter. He was 78 years old. THE P. Wilson Sons Co., wholesale dealers in saddlerv hardware at Cincinnati, have assigned. Liabilities and assets about $75,000. AN old gentleman named Baker, living near Paw Paw, Mich, while hiving лепивш some u! bees Jo SMATE B roused their ire, and was SO badly stung by them that he died in a few minutes. HERR FRANZIUS, a Berlin distiller, and his bookkeeper, named Bauer, have been arrested on a charge of defrauding the Imperial German Bank out of 52,000 marks by means of forged bills of exchange. AT Joplin, Mo., Elijah Lord, a rich mine owner and bank director, committed suicide. He placed a giant cartridge to his head, lighted the fuse and blew the top of his head off. Temporary insanity is alleged as the cause. HENRY NORDBERG, a real estate dealer at Portland, Ore., shot his sweetheart dead and then took the same medicine himself. Insan. Temp. THE North Dakota People's party convention has chosen William Lardner, of Deadwood, and James E. Kelly, of Flandea, for congressmen, and J. E. Kinser, of Meade; H. W. Smith, of Minnehaha; J. D. Snydam, of Walworth, and W. C. aldron, of Clark, for presidential electors; governor, A. L. Van Osdel, of Yankton; lieutenantgovernor, Col. M. M. Price, of Sanborn; auditor, G. W. Evarts, of Sully; secretary of state, S. G. Morgan, of Duell; treasurer, P. G. Paterson, of Brookings; attorney-general, W. H. Court, of Brule;superintendent of public instruction, Mrs. R. B. Haskell, of Spink; commissioner on labor and statistics, Otto Anderson, of Pennington. THE Commercial Hotel tSanger, Cal., was destroyed by fire. Six persons are said to have perished in the flames. MISS MAGGIE ADCOCK, a beautiful young woman of 18, was instantly killed by lightning at her summer home at Kingston Springs, Tenn. The lightning flash came in at the window and