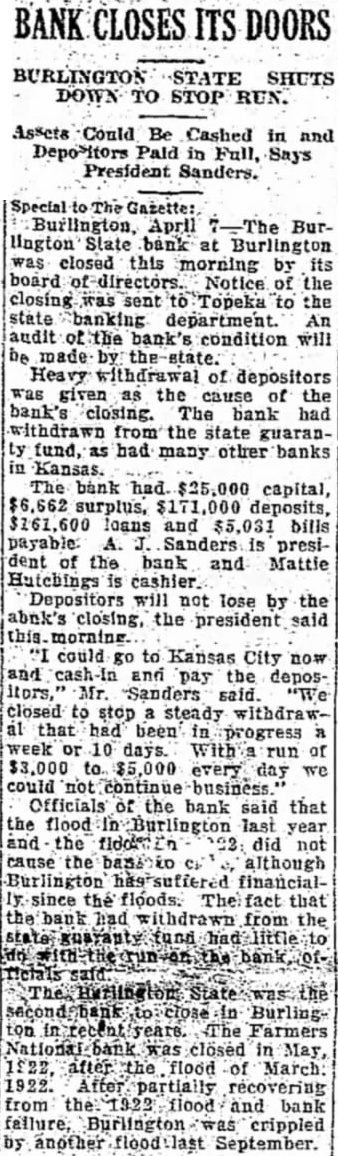

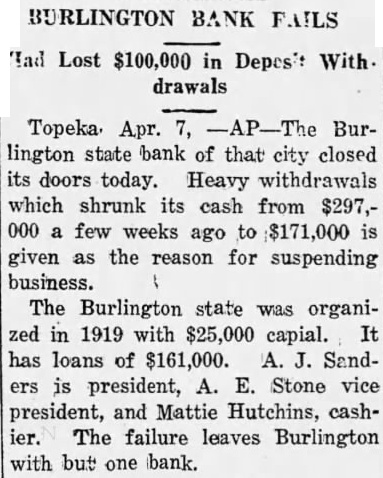

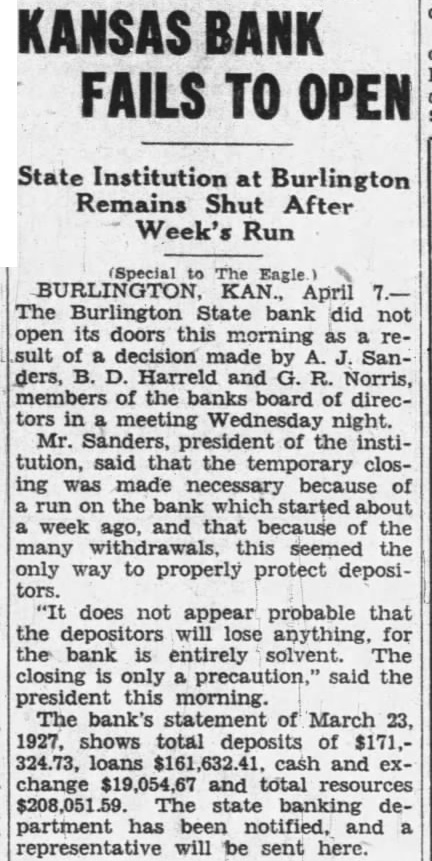

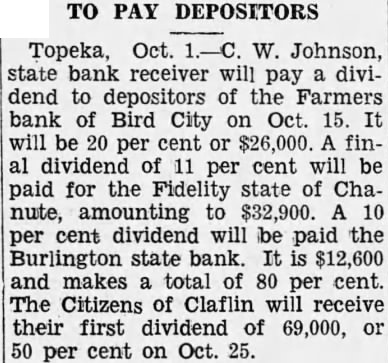

Article Text

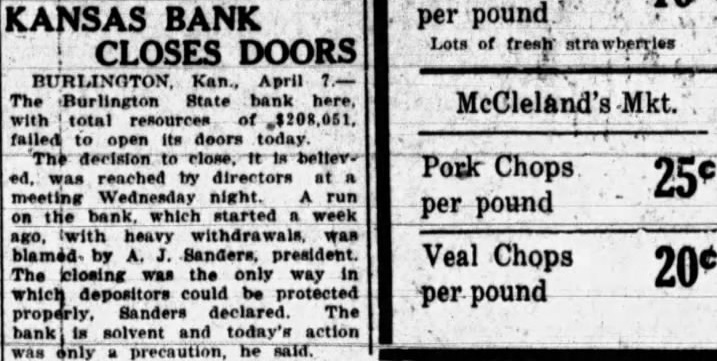

KANSAS BANK per pound Lots of fresh strawberries CLOSES DOORS BURLINGTON, Kan., April ?The Burlington State bank here, McCleland's Mkt. with total resources of $208,051. failed to open its doors today The decision to close, It is believPork Chops ed. was reached by directors at a 25c meeting Wednesday night. A run per pound on the bank. which started a week ago, (with heavy withdrawals, was blamed. by A. J. Sanders, president. Veal Chops 20¢ The closing was the only way in which depositors could be protected per pound properly, Sanders declared. The bank is solvent and today's action was only precaution, he said.