Article Text

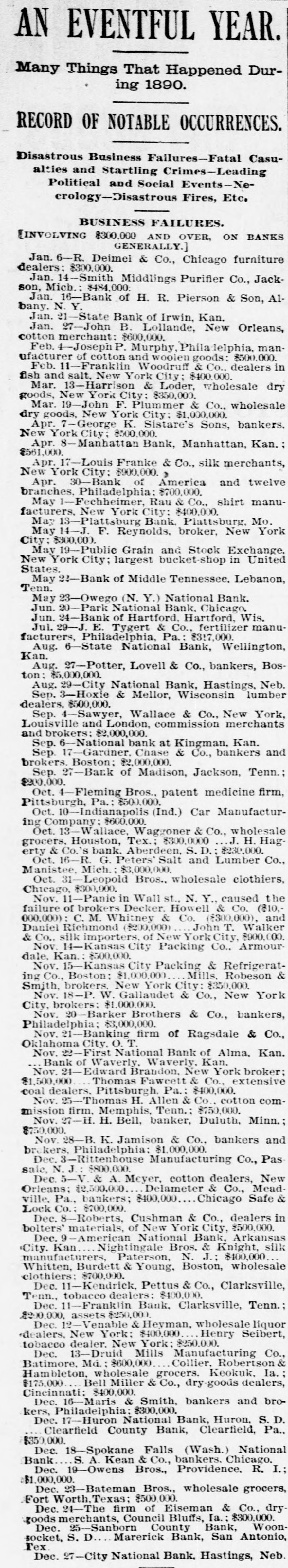

AN EVENTFUL YEAR. Many Things That Happened During 1890. RECORD OF NOTABLE OCCURRENCES. Disastrous Business Failures-Fatal Casualties and Startling Crimes-Leading Political and Social Events-Necrology-Disastrous Fires, Etc. BUSINESS FAILURES. [INVOLVING $300,000 AND OVER, ON BANKS GENERALLY.] Jan. 6-R. Deimel & Co., Chicago furniture dealers: $300,000. Jan. 14-Smith Middlings Purifier Co., Jackson, Mich.: $484,000: Jan. 16-Bank of H. R. Pierson & Son, Albany. N. Y. Jan. 21-State Bank of Irwin, Kan. Jan. 27-John B. Lollande, New Orleans, cotton merchant: $600,000. Feb. 4-Joseph P. Murphy, Phila delphia, manufacturer of cotton and woolen goods: $500.000. Feb. 11-Franklin Woodruff & Co., dealers in fish and salt. New York City; $400,000. Mar. 13-Harrison & Loder, wholesale dry goods, New York City: $350,000. Mar. 19-John F. Plummer & Co., wholesale dry goods, New York City: $1,000,000. Apr. 7-George K. Sistare's Sons, bankers. New York City; $500,000. Apr. 8-Manhattan Bank, Manhattan, Kan. $561,000. Apr. 17-Louis Franke & Co., silk merchants, New York City: $900,000. , Apr. 30-Bank of America and twelve branches, Philadelphia: $700,000. May 1-Fechheimer, Rau & Co., shirt manufacturers, New York City: $400,000. May 13-Plattsburg Bank. Plattsburg, Mo. May 14-J. F. Reynolds, broker, New York City: $300,000. May 19-Public Grain and Stock Exchange. New York City; largest bucket-shop in United States. May 22-Bank of Middle Tennessee. Lebanon, Tenn. May 23-Owego (N. Y.) National Bank. Jun. 20-Park National Bank. Chicago. Jun. 24-Bank of Hartford. Hartford, Wis. Jul. 29-J. E. Tygert & Co., fertilizer manufacturers, Philadelphia, Pa.: $317,000. Aug. 6-State National Bank, Wellington, Kan. Aug. 27-Potter, Lovell & Co., bankers, Boston: $5,000,000. Aug. 29-City National Bank, Hastings, Neb. Sep. 3-Hoxie & Mellor, Wisconsin lumber dealers. $500,000. Sep. 4-Sawyer, Wallace & Co., New York, Louisville and London, commission merchants and brokers: $2,000,000. Sep. 6-National bank at Kingman, Kan. Sep. 17-Gardner. Chase & Co., bankers and brokers. Boston; $2,000,000. Sep. 27-Bank of Madison, Jackson, Tenn.: $200,000. Oct. 4-Fleming Bros., patent medicine firm, Pittsburgh, Pa.: $500,000. Oct. 10-Indianapolis (Ind.) Car Manufacturing Company: $600,000. Oct. -Wallace, Waggoner & Co., wholesale grocers, Houston, Tex.; $300,0000 J. H. Hagerty & Co.'s bank. Aberdeen, S. D.; $230,000. Oct. 16-R. G. Peters' Salt and Lumber Co., Manistee, Mich. $3,000,000. Oct. 31-Leopold Bros., wholesale clothiers, Chicago, $300,000. Nov. 11-Panic in Wall st., N. Y., caused the failure of brokers Decker. Howell & Co. ($10,000.000): C.M. Whitney & Co. ($300.000), and Daniel Richmond ($200,000) John T. Walker & Co., silk importers, of New York City, $900,000. Nov. 14-Kansas City Packing Co., Armourdale, Kan.: $500,000. Nov. 15-Kansas City Packing & Refrigerating Co., Boston: $1,000,000. Mills. Robeson & Smith, brokers. New York City: $350,000. Nov. 18-P. W. Gallaudet & Co., New York City, brokers: $1,000,000. Nov. 20 -Barker Brothers & Co., bankers, Philadelphia; $3,000,000. Nov. 21-Banking firm of Ragsdale & Co., Oklahoma City. O. T. Nov. 22-First National Bank of Alma, Kan. Bank of Waverly, Waverly, Kan. Nov. 24-Edward Brandon, New York broker: $1,500,000. Thomas Fawcett & Co., extensive coal dealers. Pittsburgh. Pa.: $400,000. Nov. 25-Thomas H. Allen & Co., cotton commission firm. Memphis, Tenn.: $750,000. Nov. 27-H. H. Bell, banker, Duluth, Minn.; $750,000. Nov. 28-B. K. Jamison & Co., bankers and bro kers, Philadelphia: $1,000,000. Dec. 3-Rittenhouse Manufacturing Co., Passaie, N.J.: $800,000. Dec. 5-V. & A. Meyer, cotton dealers, New Orleans: $2,500,000. Delameter & Co., Meadville. Pa., bankers; $400,000 Chicago Safe & Lock Co.: $700,000. Dec. 8-Roberts, Cushman & Co., dealers in bolters' materials, of New York City, $500,000. Dec. 9-American National Bank, Arkansas City. Kan Nightingale Bros. & Knight, silk manufacturers, Paterson, N. J.; $400,000 Whitten, Burdett & Young, Boston, wholesale clothiers: $700,000. Kendriol Bettug