Click image to open full size in new tab

Article Text

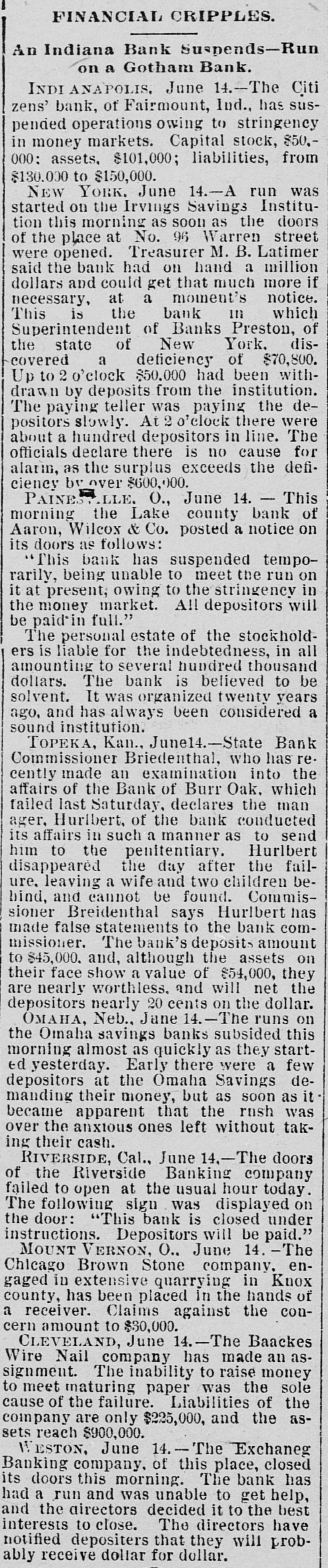

FINANCIAL CRIPPLES. An Indiana Bank Suspends-Run on a Gotham Bank. INDI ANAPOLIS. June 14.-The Citi zens' bank, of Fairmount, Ind., has suspended operations owing to stringency in money markets. Capital stock, $50.000: assets, $101,000; liabilities, from $130.000 to $150,000. NEW YORK. June 14.-A run was started on the Irvings Savings Institution this morning as soon as the doors of the place at No. 96 Warren street were opened. Treasurer M. B. Latimer said the bank had on hand a million dollars and could get that much more if necessary, at a moment's notice. This is the bank in which Superintendent of Banks Preston, of the state of New York, discovered a deficiency of $70,800. Up to 2 o'clock $50.000 had been withdrawn by deposits from the institution. The paying teller was paying the depositors slowly. At 2 o'clock there were about a hundred depositors in line. The officials declare there is no cause for alarm, as the surplus exceeds the deficiency by over $600,000. PAINE. = LLE. O., June 14. - This morning the Lake county bank of Aaron, Wilcox & Co. posted a notice on its doors as follows: This bank has suspended temporarily, being unable to meet the run on it at present, owing to the stringency in the money market. All depositors will be paid in full." The personal estate of the stockholders is liable for the indebtedness, in all amounting to several hundred thousand dollars. The bank is believed to be solvent. It was organized twenty years ago, and has always been considered a sound institution. TOPEKA, Kan., June14.-State Bank Commissioner Briedenthal, who has recently made an examination into the affairs of the Bank of Burr Oak. which failed last Saturday, declares the man ager, Hurlbert, of the bank conducted its affairs in such a manner as to send him to the penitentiary. Hurlbert disappeared the day after the failure, leaving a wife and two children bebind, and cannot be found. Commissioner Breidenthal says Hurlbert has made false statements to the bank commissioner. The bank's deposits amount to $45,000. and, although the assets on their face show a value of $54,000, they are nearly worthless. and will net the depositors nearly 20 cents on the dollar. OMAHA, Neb., Jane 14.-The runs on the Omaha savings banks subsided this morning almost as quickly as they started yesterday. Early there were a few depositors at the Omaha Savings demanding their money, but as soon as it became apparent that the rush was over the anxious ones left without taking their cash. RIVERSIDE, Cal., June 14,-The doors of the Riverside Banking company failed to open at the usual hour today. The following sign was displayed on the door: "This bank is closed under instructions. Depositors will be paid." MOUNT VERNON, O., June 14. -The Chicago Brown Stone company. engaged in extensive quarrying in Knox county, has been placed in the hands of a receiver. Claims against the concern amount to $30,000. CLEVELAND, June 14.-The Baackes Wire Nail company has made an assignment. The inability to raise money to meet maturing paper was the sole cause of the failure. Liabilities of the company are only $225,000, and the assets reach $900,000. WESTON, June 14. - The Exchaneg Banking company. of this place, closed its doors this morning. The bank has had a run and was unable to get help, and the airectors decided it to the best interests to close. The directors have notified depositers that they will probably receive dollar for dollar.