Article Text

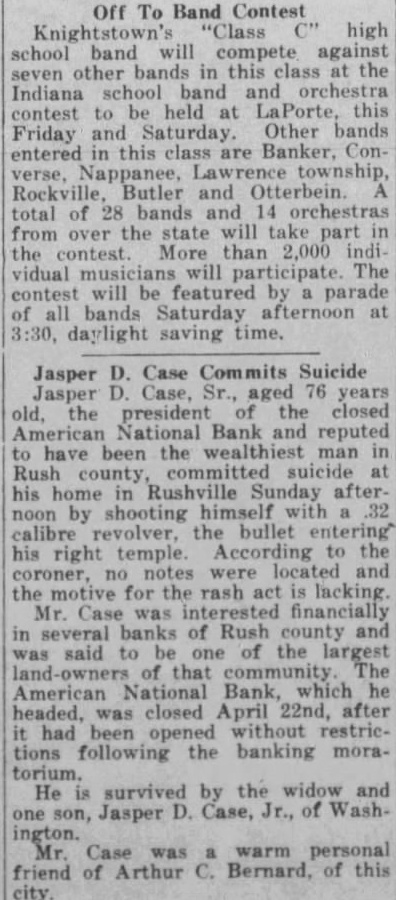

Off To Band Contest Knightstown's "Class high school band compete against seven other bands in this class at the Indiana school band orchestra contest to held at LaPorte, this and Saturday. Other bands Friday entered this class are Banker, ConNappanee, Lawrence Rockville, Butler total of 28 bands and orchestras from over the state will take part the than 2,000 vidual musicians participate. contest will be featured by parade of all bands Saturday daylight saving time. Jasper Case Commits Suicide Case, aged 76 years Jasper the president of the closed National Bank and reputed have been the man Rush county, his home in Rushville Sunday afterby shooting calibre revolver, the bullet entering his According to the right coroner, notes the motive for the rash act lacking Case was financially several banks of Rush county and said one of the largest of that community American National Bank, which closed April 22nd, after was been opened without restrictions following the banking moratorium. He survived by the widow and Case, Jr., Washson, Jasper ington. Case was warm personal friend of Arthur Bernard, of this city.