Click image to open full size in new tab

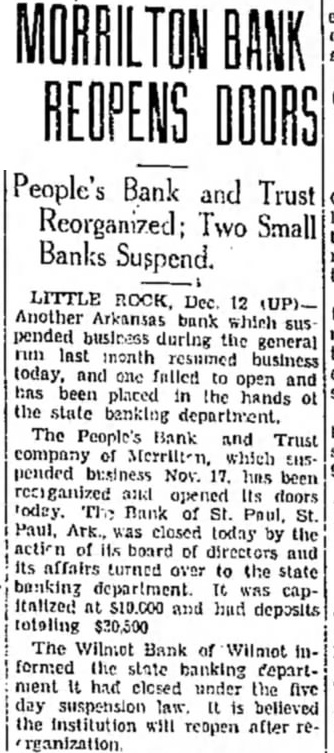

Article Text

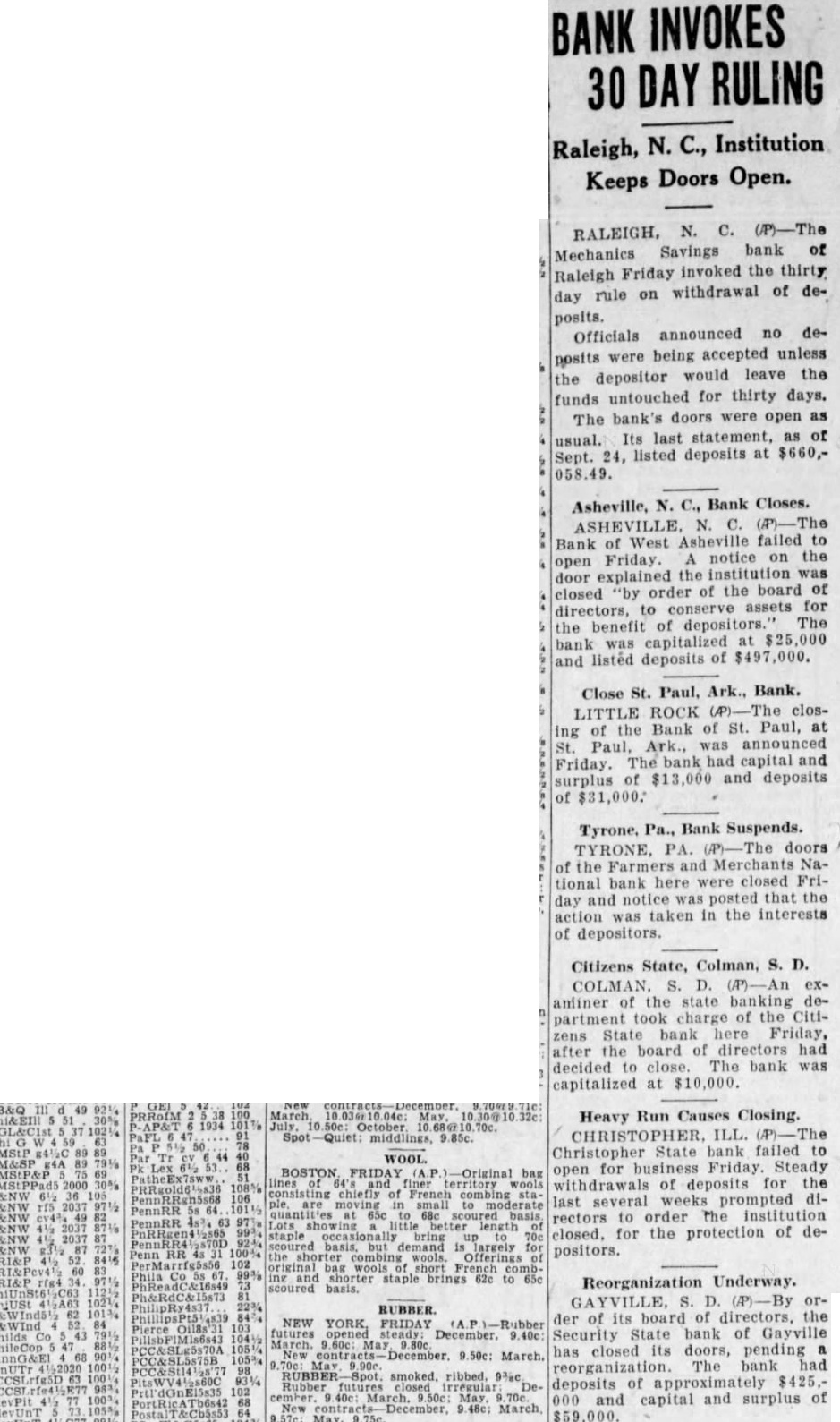

BANK INVOKES 30 DAY RULING

Raleigh, N. C., Institution Keeps Doors Open.

RALEIGH, N. C. (/P)-The Mechanics Savings bank of Raleigh Friday invoked the thirty day rule on withdrawal of deposits. Officials announced no deposits were being accepted unless the depositor would leave the funds untouched for thirty days. The bank's doors were open as usual. Its last statement, as of Sept. 24, listed deposits at $660,058.49.

Asheville, N. C., Bank Closes. ASHEVILLE, N. C. The Bank of West Asheville failed to open Friday. A notice on the door explained the institution was closed "by order of the board of directors, to conserve assets for the benefit of depositors. The bank was capitalized at $25,000 and listed deposits of $497,000.

Close St. Paul, Ark., Bank. LITTLE ROCK The closing of the Bank of St. Paul, at St. Paul, Ark., was announced Friday. The bank had capital and surplus of $13,000 and deposits of $31,000:

Tyrone, Pa., Bank Suspends. TYRONE, PA. The doors of the Farmers and Merchants National bank here were closed Friday and notice was posted that the action was taken in the interests of depositors.

Citizens State, Colman, S. D. COLMAN, S. D. (A)-An examiner of the state banking department took charge of the Citizens State bank here Friday, after the board of directors had decided to close. The bank was capitalized at $10,000.

Heavy Run Causes Closing. CHRISTOPHER, ILL. The Christopher State bank failed to open for business Friday. Steady withdrawals of deposits for the last several weeks prompted directors to order the institution closed, for the protection of depositors. Reorganization Underway.

GAYVILLE, S. D. (P)-By order of its board of directors, the Security State bank of Gayville has closed its doors, pending a reorganization. The bank had deposits of approximately $425.000 and capital and surplus of $59,000.