Click image to open full size in new tab

Article Text

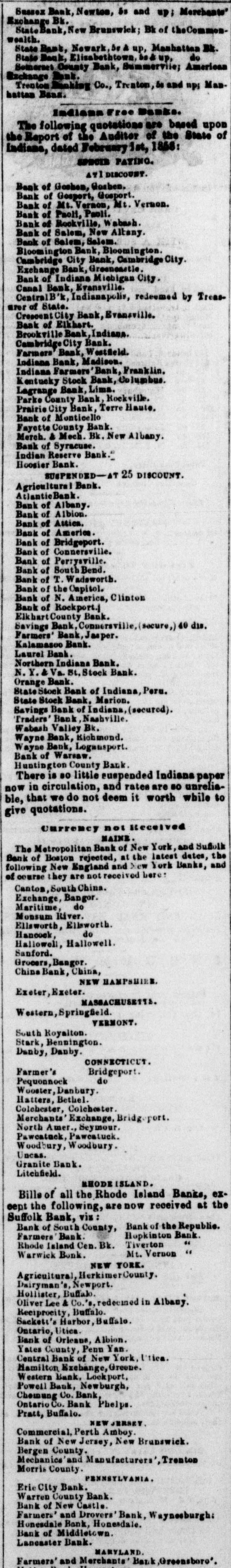

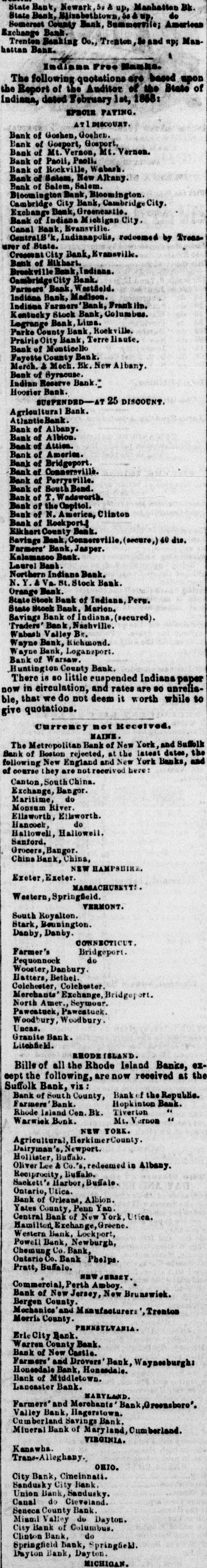

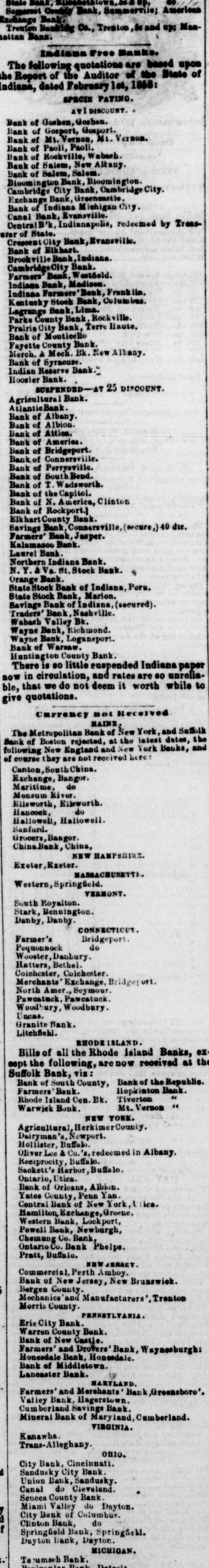

State Bank, Newark, bs & up, Manhatten Bk.

State Bank, Elizabethtown, és & up, do

Somerset County Bank, Summervile; American

Exchange Bank.

Trenton Banking Co., Trenton, be and up; Man-

hattan Bank.

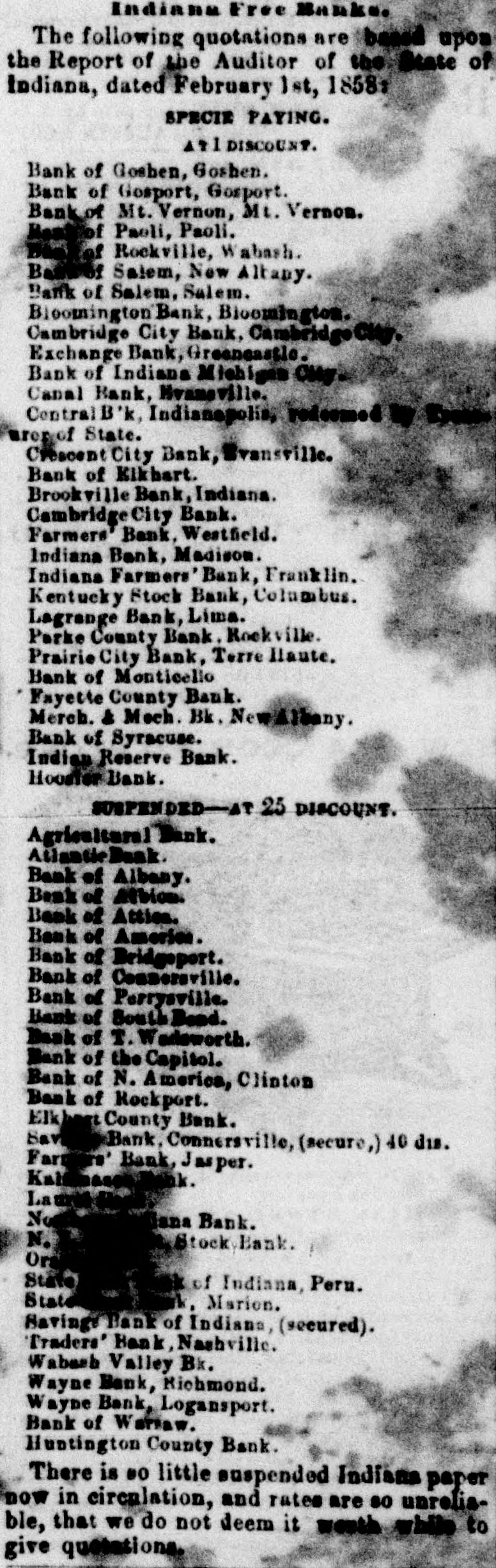

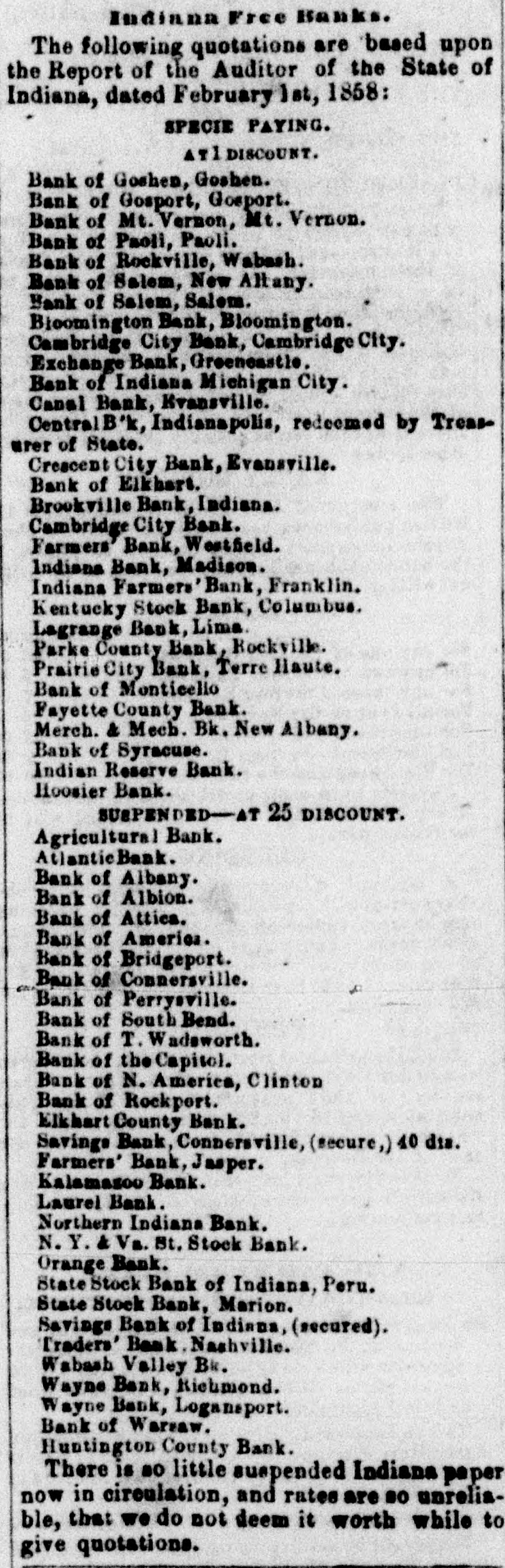

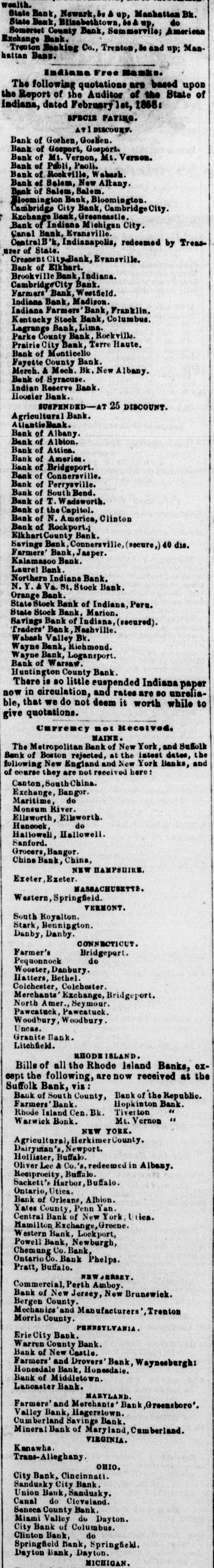

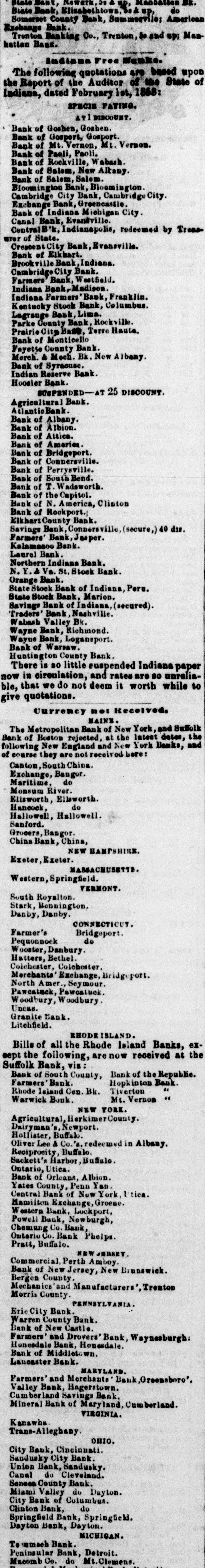

# Indiana Free Manks.

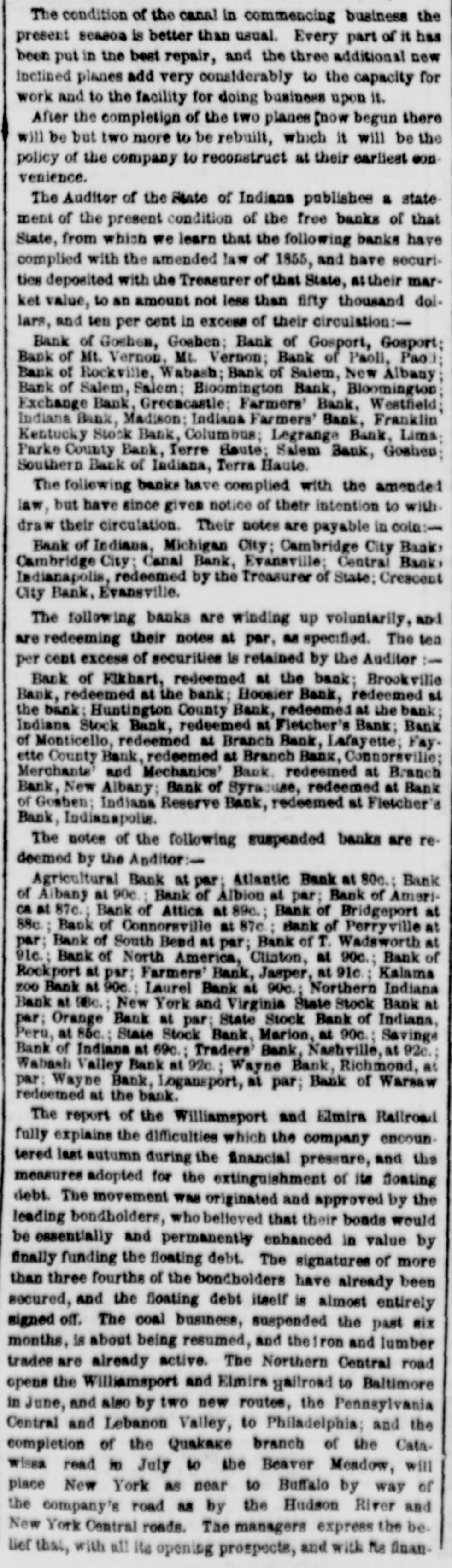

The following quotations are based upon the Report of the Auditor of the State of Indiana, dated February lat, 1868:

EPROIN PAYING.

ATI DISCOUAY.

Bank of Goshen, Goshen.

Bank of Gosport, Gosport.

Bank of Mt. Vernon, Mt. Vernon.

Bank of Paoli, Paoli.

Bank of Rockville, Wabash.

Bank of Balem, New Altany.le

Bank of Salem, Salem.

Bloomington Bank, Bloomington.

Cambridge City Bank, Cambridge City.

Exchange Bank, Greencastle.

Bank of Indiana Michigan City.

Canal Bank, Evansville.

Central B'k, Indianapolis, rodcemed by Treas-

urer of State.

Crossunt City Bank, Evansville.

Bank of Bikhart.

Brookville Bank, Indiana.

Cambridge City Bank.

Farmers Bank, Westfield.

Indiana Bank, Madison.

Indiana Farmers'Bank, Franklin.

Kentucky Stock Bank, Columbus.

Legrange Bank, Lima.

Parke County Bank, Rockville.

Prairie City Bank, Terre Haute.

Bank of Monticello

Fayette County Bank.

Merch. & Mech. Bk. New Albany.

Bank of Byracuse.

Indian Reserve Bank."

Hoosier Bank.

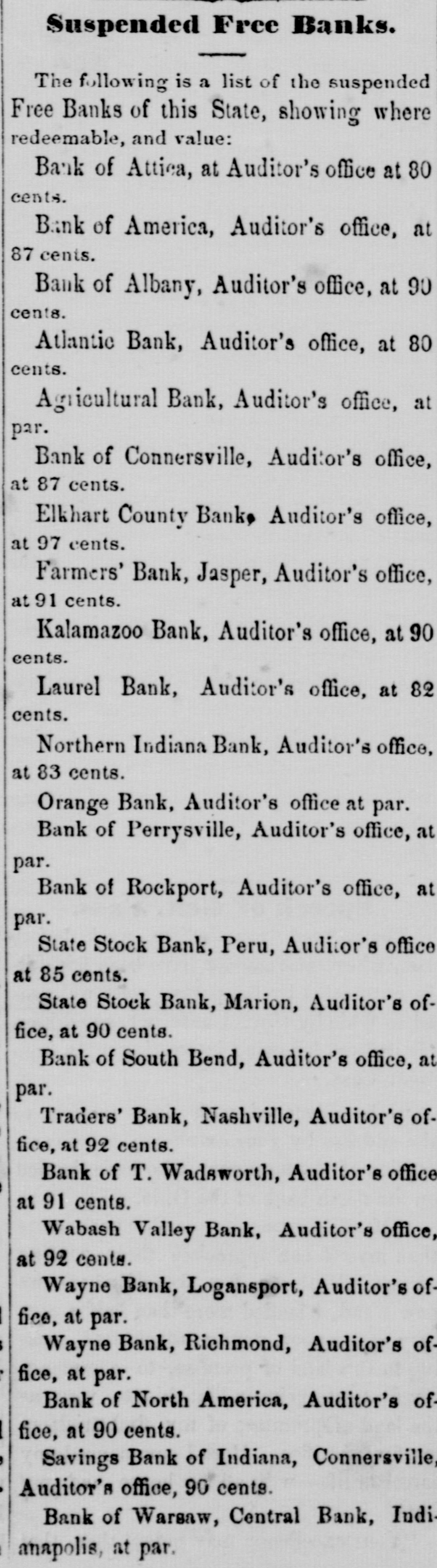

SUSPENDED-AT 25 DISCOUNT.

Agricultural Bank.

Atlantic Bank.

Bank of Albany.

Bank of Albion.

Bank of Attion.

Bank of America.

Bank of Bridgeport.

Bank of Commersvillä.

Bank of Perrysville.

Bank of South Bend.

Bank of T. Wadsworth.

Bank of the Ompitol.

Bank of N. America, Clinton

Bank of Rockport.

Kikhart County Bank.

Bavings Bank, Connereville, (secure,) 40 dis.

Farmers' Bank, Jasper.

Kalamasoo Bank.

Laurel Bank.

Northern Indiana Bank.

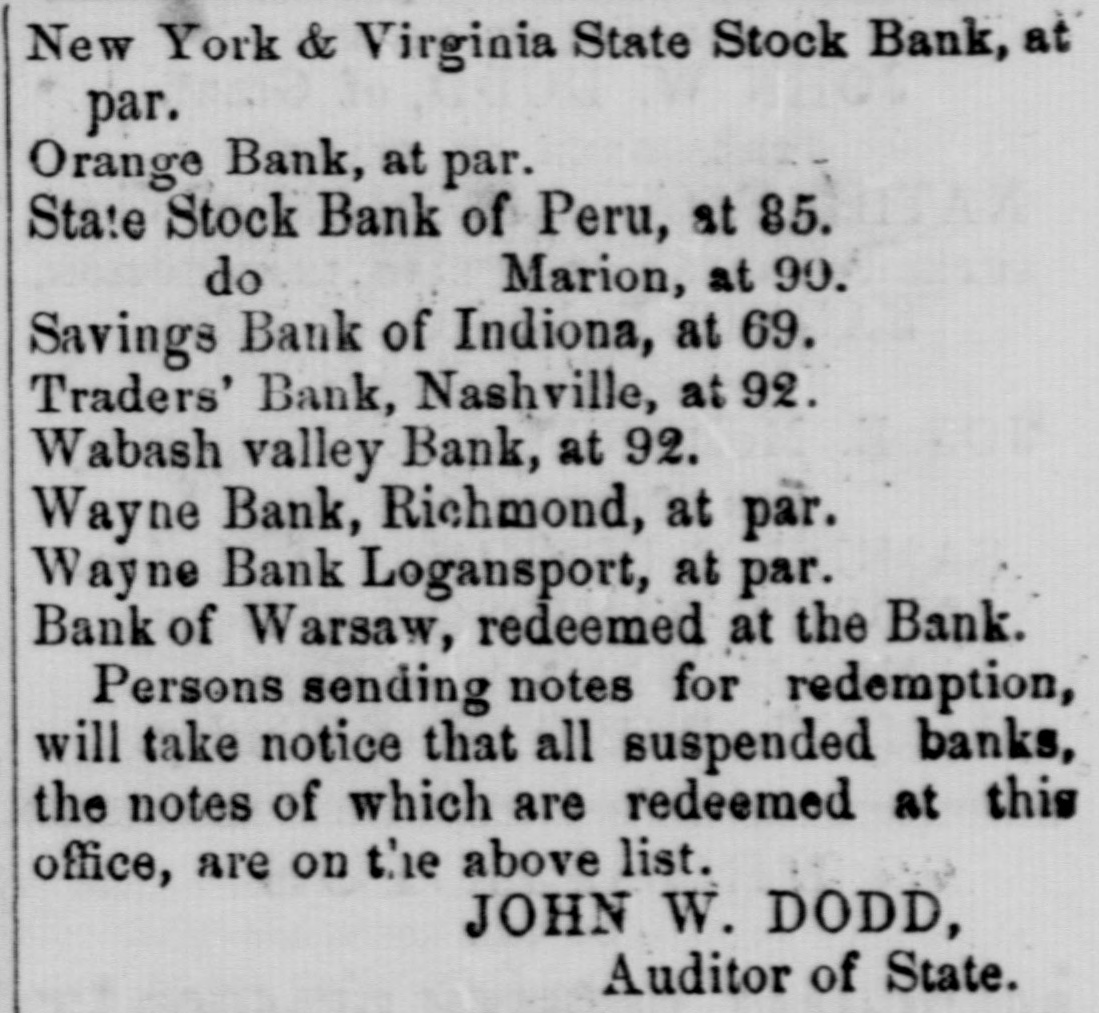

N. Y. & Va. St. Stock Bank.

Orange Bank.

State Stock Bank of Indiana, Peru.

State Stock Bauk, Marion.

Bavings Bank of Indiana, (secured).

'Traders' Bank, Nashville.

Wabash Valley Br.

Wayne Bank, Kichmond.

Wayne Bank, Logansport.

Bank of Warsaw.

Huntington County Bank.

There is so little cuspended Indians paper now in circulation, and rates are so unreliable, that we do not deem it worth while to give quotations.

# Currency not Received,

MAINE.

The Metropolitan Bank of New York, and Suffolk Bank of Boston rejected, at the latest dates, the following New England and New York Banks, and of course they are not received here:

Canton, South China.

Exchange, Bangor.

Maritime, do

Monsum River.

Ellsworth, Ellsworth.

Hancock, do

Hallowell, Halioweil,

Sanford,

Grocers, Bangor.

China Bank, China,

NEW HAMPSHIRE.

Exeter, Exeter.

MASSACHUSETT!.

Western, Springßeld.

VERMONT.

South Royalton.

Stark, Bounington.

Danby, Danby.

CONNECTICUT.

Farmer's Bridgeport.

Pequonnock do

Wooster, Danbury.

Hatters, Bethel.

Colchester, Colchester.

Merchants' Exchange, Bridgeport.

North Amer., Seymour.

Pawcatuck, Pawcatuck.

Woodbury, Woodbury.

Uncas.

Granite Bank.

Litenfield.

RHODE ISLAND.

Bills of all the Rhode Island Banke, except the following, are now received at the Suffolk Bank, viz:

Bank of South County, Bank of the Republie.

Farmers' Bank. Hopkinton Bank.

Rhode Island Con. Bk. Tiverton "

Warwick Bonk. Mt. Vernon "

NEW YORK.

Agricultural, Herkimer County.

Dairyman's, Newport.

Hollister, Buffalo.

Reciprocity, Buffalo.

Sackett's Harbor,

Oliver Lee & Co.'s, redeemed in Albany.

Ontario, Utica.

Buffalo.

Bank of Orleans, Albion.

Yates County, Penn Yan.

Central Bank of New York, Utica.

Hamilton, Exchange, Greene.

Western Bank, Lockport,

Powell Bank, Newburgh,

Chemung Co. Bank,

Ontario Co. Bank Phelps.

Pratt, Buffalo.

NEW JERSEY,

Commercial, Perth Amboy.

Bank of New Jersey, New Brunswiek.

Bergen County.

Mochanics and Manufacturers', Trenton

Morris County.

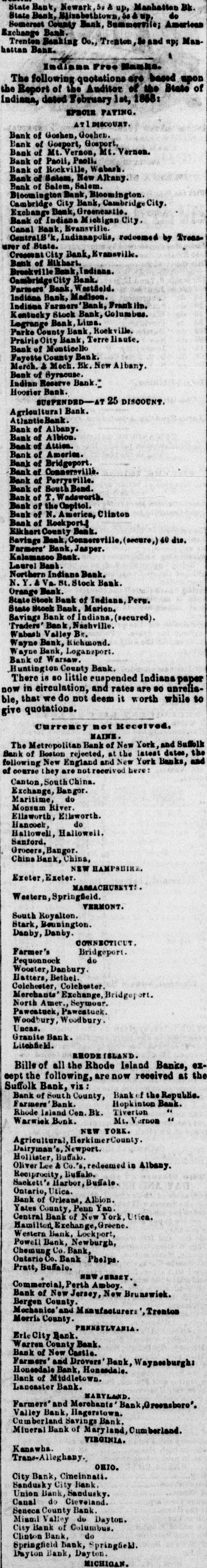

PENNSYLVANIA.

Eric City Bank.

Warren County Bank.

Bank of New Castie.

Farmers' and Drovers' Bank, Waynesburgh:

Honeedale Bank, Honasdale.

Bank of Middletown.

Lancaster Bank.

MARYLAND.

Farmers' and Merchants' Bank, Greensboro".

Valley Bank, Hagerstown.

Cumberland Savings Bank.

Mineral Bank of Maryland, Cumberland.

VIRGINIA.

Kanawha.

Trans-Alleghany.

ΟΠΙΟ.

City Bank, Cincinnati.

Sandusky City Bank.

Union Bank, Sandusky.

Canal do Cieveland.

Seneca County Bank.

Miami Valley de Dayton.

City Bank of Columbus.

Clinton Bank, do

Springfield Bank, Springfield.

Dayton Bank, Dayton.

MICHIGAN.