Click image to open full size in new tab

Article Text

# HIATT'S NAME NOT MUCH IN EVIDENCE IN

# HIS MANY TRANSACTIONS IN REAL ESTATE

W. H. Blodgett, staff correspondent, Mississippi, called at the Brock build-

of the Indianapolis News, has made an ing, in Anderson, and informed Mrs.

Investigation and E. F. Hiatt's specula- Myrtle Cloyd, agent for the Brock

tions. The appended article from the Realty company, that Mr. McLemore

News is one of a series: had taken over the building and that

the rental was to be paid to him.

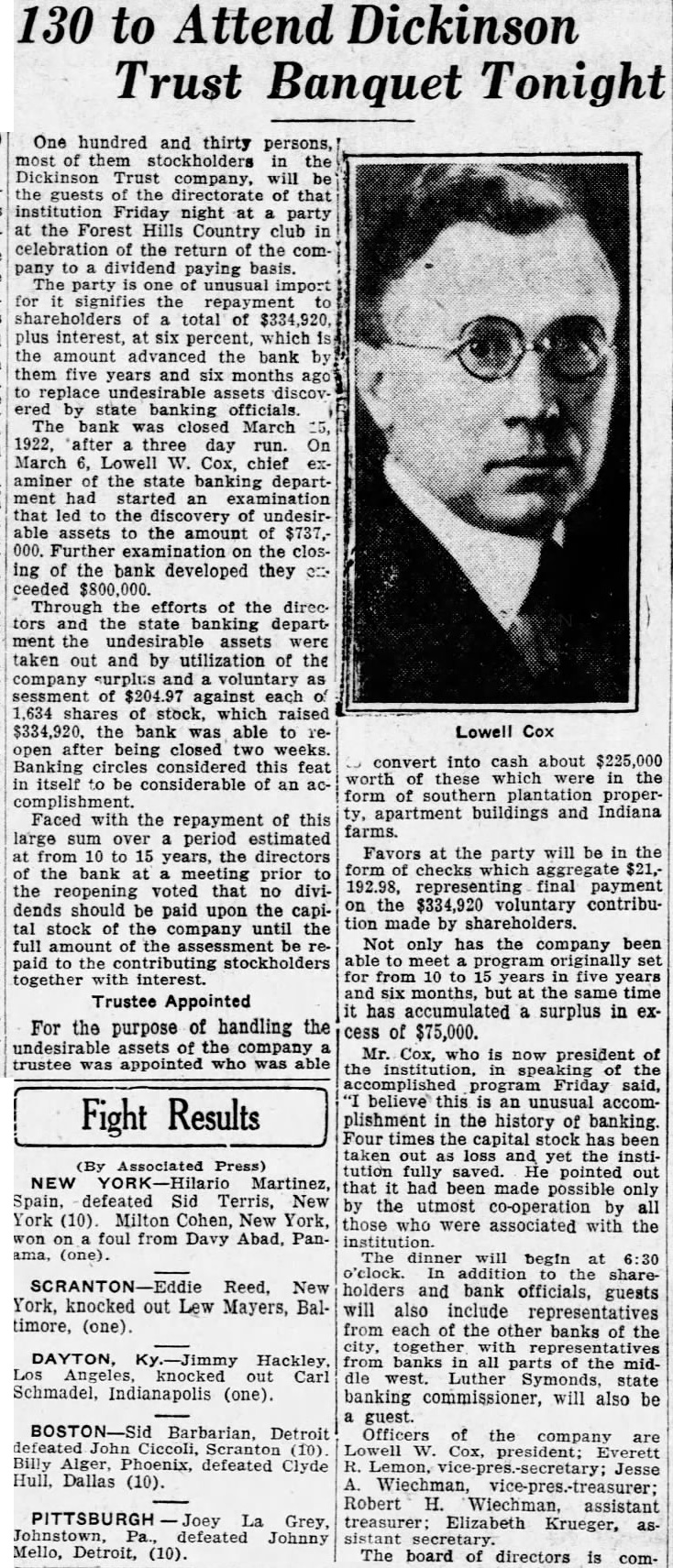

RICHMOND, Ind., April 6.-The spe-

cial committee that is making an in-

vestigation of the affairs of Edgar F.

Hiatt, former president of the Dickin-

son Trust company, which was closed

a short time ago by the state banking

department after it was revealed that

there was a shortage of $661,000 in the

bank and which has now been reopen-

ed, has found that Hiatt's name did

not appear in many deals in real estate

the committee says he made with the

money and securities belonging to the

trust company. This was particularly

true in his methods of handling apart-

ment buildings.

Mr. Hiatt's plan, as set out to the

committee, was to use the money and

securities of the trust company to

finance a deal for an apartment, using

land dealers to carry the deal

through. His plan, it is said, was to

organize a stock company for the pur-

chase of the particular apartment prop-

erty he had in mind. This company

would issue common stock to two or

three persons in the company that was

to take over the particular apartment

building that Hiatt was after. Then

a certain amount of preferred stock

would be issued to the members of

the company, but this stock had no

voting power.

Payment of Dividends

These shares of stock would be reg-

istered through the Dickinson Trust

company and the stockholders would

have no knowledge of the actual own-

ers of the securities that were used in

the deal. The investigating commit-

tee asserts that not only would Hiatt

take money and securities from the

Dickisnon Trust company to finance

the apartment deals, but he would take

money from the Dickinson Trust com-

pany to pay dividends on the stock

that was to buy the apartment.

Besides this, it is asserted by the

investigating committee that Hiatt

would use the money and securities

of the Dickinson Trust company to

repair and maintain the property. At

different times Hiatt was interested

in the Glass block, at Marion; the

Brock block, at Anderson; the Wayne

apartments, at Richmond; the Maxim

building, at Newcastle. As far as has

been learned by the investigating com-

mittee Hiatt at this time has no equit-

ies in any of these properties from

which the stockholders of the Dickin-

son Trust company can get returns.

The deal by which Hiatt obtained

an interest in the Brock block, at An-

derson, was started by Albert Gregg,

real estate operator in Richmond. Mr.

Gregg said that Mr. Hiatt asked him

to look over the building at Anderson,

and later told him to take a deed to

the building and manage the property.

After six months, Gregg says, Mr.

Hiatt said that the building had been

turned over to the Brock Realty com-

pany.

What Records Show

An examination of the records at

Anderson by the investigating com-

*mittee shows that Albert W. Gregg,

of Richmond, bought the Brock apart-

ment building from Frank Brock, of

Anderson, for a sum of approximately

$160,000. At the time of the sale there

were two mortgages on the property,

one for $40,000 held by the Provident

Life and Trust company, of Philadel-

phia, and the other for $33,000 held by

the Citizens bank, at Anderson.

The Brock Realty company, of An-

derson, was organized with a capital

stock of $225,000, which capitalization

was later reduced to $200,000. The

stockholders and officers of the Brock

Realty company were Albert W.

Gregg, president; Robert J. Buck, sec-

retary, and Edgar F. Hiatt. The $33,-

000 mortgage held by the Citizens'

bank, at Anderson, was released in

July, 1921, by an Indianapolis bank.

The understanding is that Mr. Brock

in disposing of the property accepted

about $60,000 worth of notes for the

building and that some of those notes

have later proved to be of doubtful

As to Rental Money

This rental money, it was under-

stood, was paid to Mr. McLemore up

until February 1, of this year, and

since that time the rental money has

turned the building back to Mr. Hiatt

account because Mr. McLemore has

turned the building bac kto Mr. Hiatt.

The Dickinson Trust company was

the depository for the funds of the

Brock Realty compnay. The Brock

Oil Products company, of which Frank

Brock was president, is in the hands

of a receiver, the former stockholders

of the concern having had the Ander-

son Trust company appointed to that

position.

The Wayne Apartment company of

Richmond was originally formed by

John W. Mueller, Turner W. Hadley

and Wilfred Jessup, with a capital

stock of $50,000, but a few days later

the articles of incorporation were

changed to provide for $100,000 of

common stock and the same amount

of preferred stock. Edgar F. Hiatt

was a stockholder in this company

and the claim of the investigation com-

mittee is that the property was really

bought by Hiatt with the money of

the Dickinson Trust company, that the

expenses were kept up by funds of

the Dickinson Trust company, that div-

idends on the preferred stock issued

by the company were paid from funds

of the Dickinson Trust company, and

that the rentals of the Wayne apart-

ment went to Mr. Hiatt, and that Mr.

Mueller, Mr. Hadley and Mr. Jessup

received no benefits from the deal

and, as far as has been ascertained,

received no money or securities that

was the property of the Dickinson

Trust company.

Hiatt in Background

The same way of obtaining control

was used in getting the Maxim build-

ing at Newcastle, it is said. The in-

vestigating committee has not yet

gone far enough into the Newcastle

end of the deal to determine whether

or not Hiatt still has an interest in

that building or whether there is any

chance for the stockholders of the

Dickinson Trust company, which was

reorganized and the bank reopened

last week, to be reimbursed for the

money the committee says Hiatt put

into the building.

The committee has found few in-

stances where Hiatt appeared promi-

nently in these real estate deals. He

did not appear to any great extent

in the real estate deals of Indianapolis

and for that reason he did not pay

any taxes in Marion county on the

property in which he was interested.

It has been reported to the investi-

gation committee that on the Chicago

properties Hiatt received about $92,-

000 a year in rentals, and that none

of this money was turned in to the

Dickinson Trust company, although

the money and securities of the Dick-

inson Trust company were used ac-

cording to the committee's statement

in financing the Chicago deals. Be-

cause of these things, members of

the committee believe that Hiatt still

has resources that have for some rea-

son not been turned over to the stock-

holders of the Dickinson Trust com-

pany, and a probe will be made to

ascertain whether this condition real-

ly exists. Friends of Mr. Hiatt say

that bad trades and general conditions

in the real estate market is the cause

of the failure, and Mr. Hiatt to a friend

said that he felt satisfied that if he

had not been interferred with he would

have been able to work out all of the

deals and no one would have lost any-

thing. It is understood that Mr. Hiatt

does not deny he used the money and

securities of the Dickinson Trust com-

pany in financing certain of these

deals, and will, it is thought, in a short

time make a public statement setting

forth all the details of his participation

in affairs that caused the failure of the

Dickinson Trust company.