Article Text

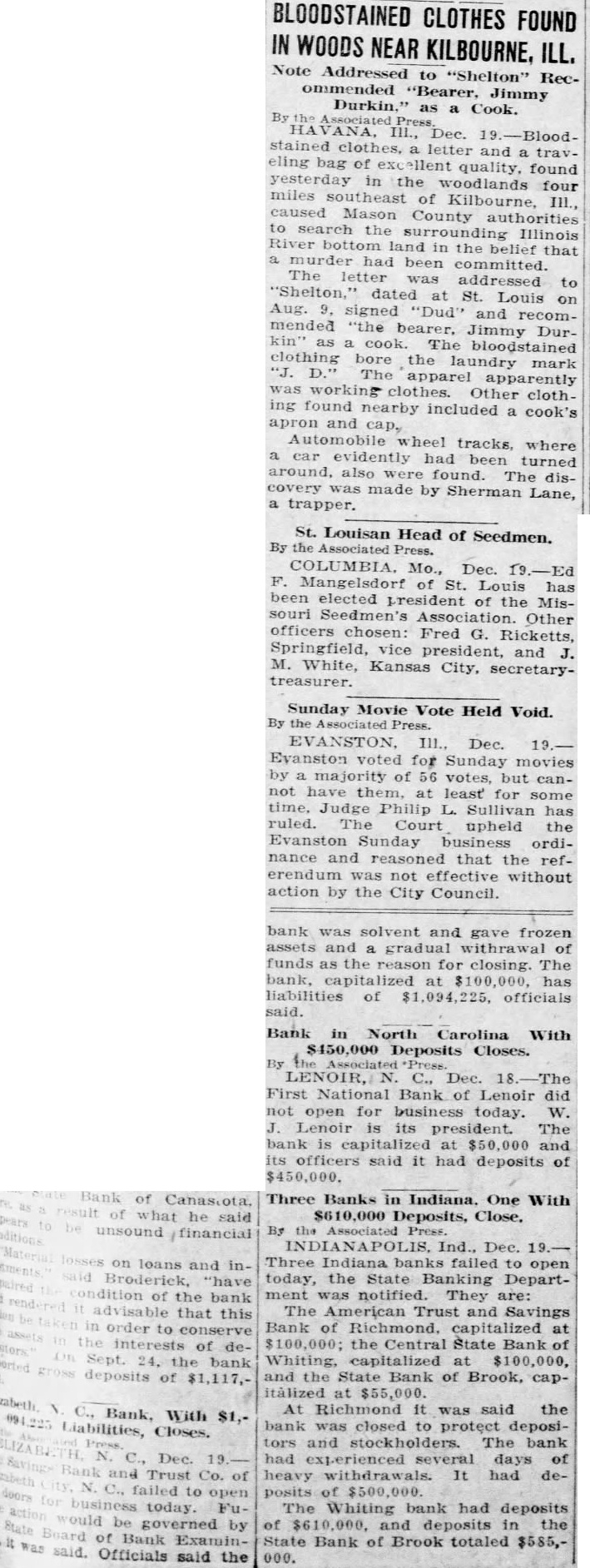

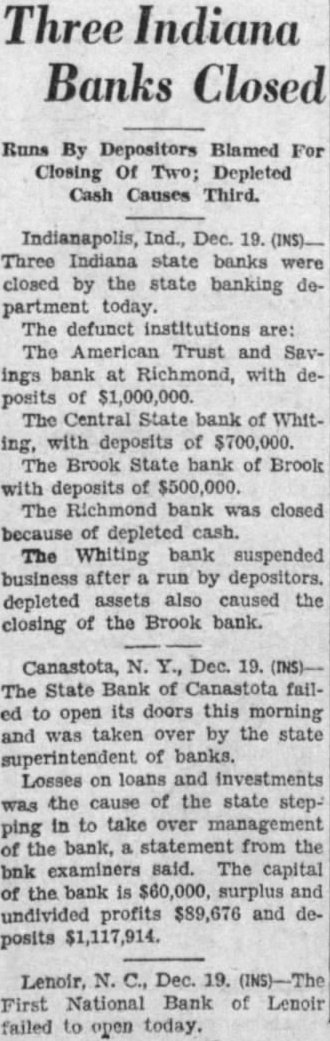

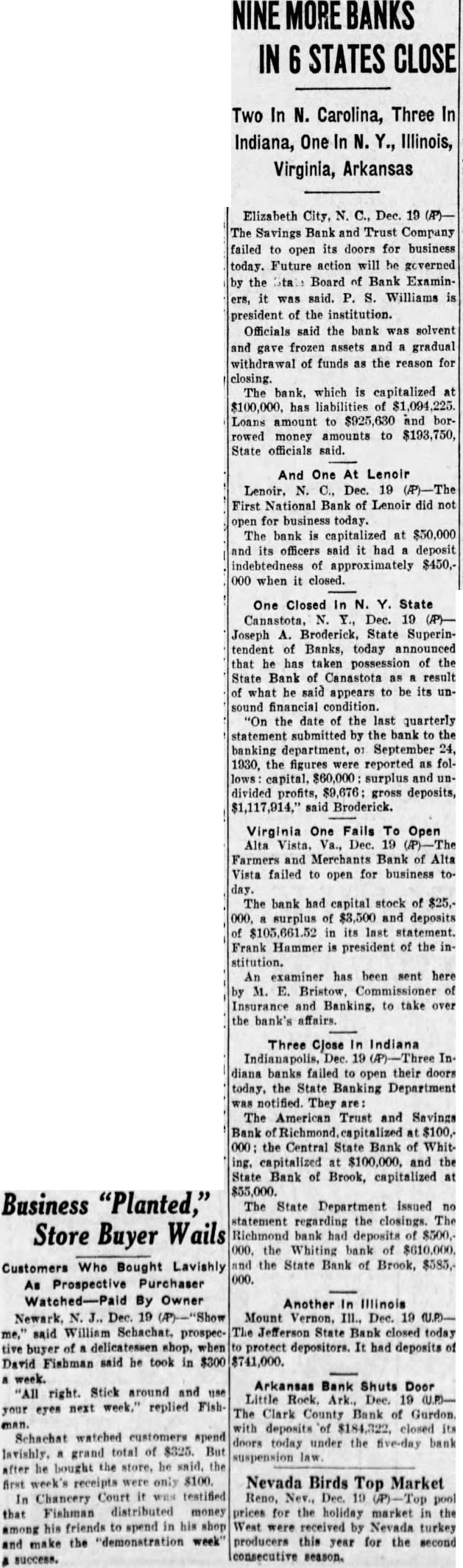

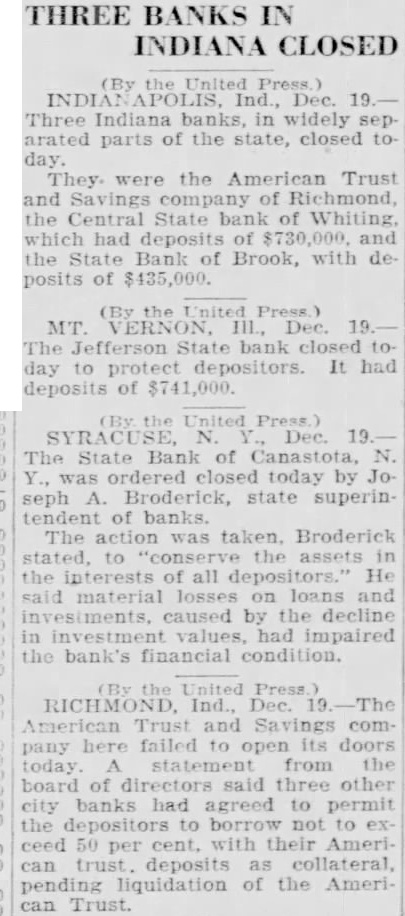

BLOODSTAINED CLOTHES FOUND IN WOODS NEAR KILBOURNE. ILL. Note Addressed to "Shelton" Recommended "Bearer. Jimmy Durkin." as a Cook. the HA VANA, Press. Dec. 19.-Bloodstained clothes. a letter and a traveling bag of exc ellent quality, found yesterday in the woodlands four miles southeast of Kilbourne, III., caused Mason County authorities to search the surrounding Illinois River bottom land in the belief that a murder had been committed. The letter was addressed to "Shelton," dated at St. Louis on Aug. 9, signed "Dud" and recommended "the bearer. Jimmy Durkin as a cook. The bloodstained clothing bore the laundry mark "J. D." The apparel apparently was working clothes. Other clothing found nearby included a cook's apron and cap, Automobile wheel tracks. where a car evidently had been turned around, also were found. The discovery was made by Sherman Lane, a trapper. St. Louisan Head of Seedmen. By the Associated Press. COLUMBIA. Mo., Dec. 19.-Ed F. Mangelsdorf of St. Louis has been elected president of the Missouri Seedmen's Association. Other officers chosen: Fred G. Ricketts, Springfield, vice president, and J. M. White, Kansas City, secretarytreasurer. Sunday Movie Vote Held Void. By the Associated Evanston voted for Sunday movies by a majority of 56 votes, but cannot have them, at least for some time. Judge Philip L. Sullivan has ruled. The Court upheld the Evanston Sunday business ordinance and reasoned that the referendum was not effective without action by the City Council. bank was solvent and gave frozen assets and a gradual withrawal of funds as the reason for closing. The bank, capitalized at $100,000, has liabilities of $1,094,225, officials said. Bank in North Carolina With $450,000 Deposits Closes. By the Associated LENOIR, N. C., Dec. 18.-The First National Bank of Lenoir did not open for business today. W. J. Lenoir is its president. The bank is capitalized at $50,000 and its officers said it had deposits of $450,000. Three Banks in Indiana, One With $610,000 Deposits, Close, By the Press. INDIANAPOLIS. Ind., Dec. 19.Three Indiana banks failed to open today, the State Banking Department was notified. They are: The American Trust and Savings Bank of Richmond. capitalized at 100,000; the Central State Bank of Whiting, capitalized at $100,000, and the State Bank of Brook, capitàlized at $55,000. At Richmond it was said the bank was closed to protect depositors and stockholders. The bank had experienced several days of heavy withdrawals. It had deposits of $500,000. The Whiting bank had deposits of $610,000, and deposits in the State Bank of Brook totaled $585,000.