Click image to open full size in new tab

Article Text

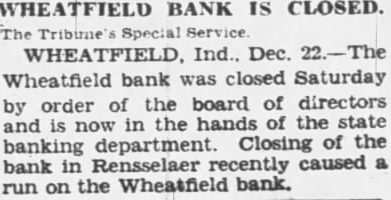

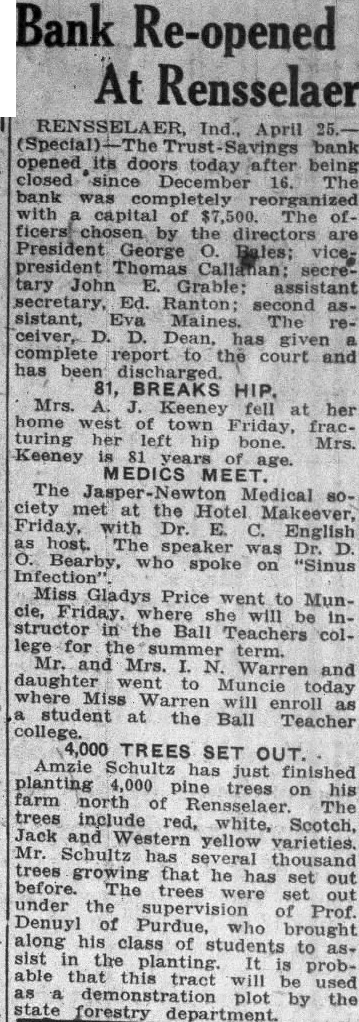

Bank Re-opened At Rensselaer

Ind., April bank opened its doors being closed December 16. The completely capital The ofby the President George president tary John Grable: assistant Ed. second sistant, Eva ceiver, Dean, has given report the court and has 81, BREAKS HIP. Mrs. Keeney her home Friday, turing Mrs. Keeney MEDICS MEET. The Medical the Makeever, Friday, with English The Dr. spoke "Sinus Miss Gladys Price went to Muncie, where will the Ball Teachers term. Mrs. Warren and Muncie where Miss student at the Ball Teacher college. 4,000 TREES SET OUT. Amzie Schultz just finished 4,000 trees on farm north Rensselaer The include Scotch, Jack and Schultz trees growing that he before. The trees set under the supervision of Prof. Denuyl Purdue, who brought along his class of students to the planting. probable will used plot the state forestry