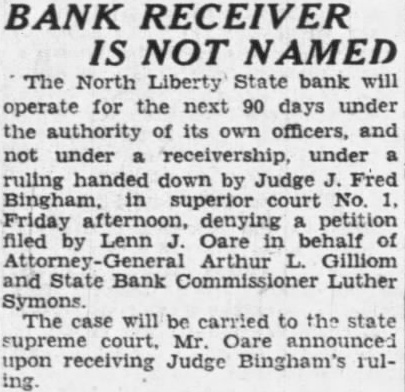

Article Text

BANK RECEIVER IS NOT NAMED The North Liberty State bank will operate for the next 90 days under the authority its own officers, and under receivership, under ruling handed down by Judge Fred superior court No. Friday afternoon, denying petition filed Lenn Oare in behalf Arthur Gilliom and State Bank Commissioner Luther Symons. The will be carried to the state Mr. upon receiving Judge Bingham's rul-