Article Text

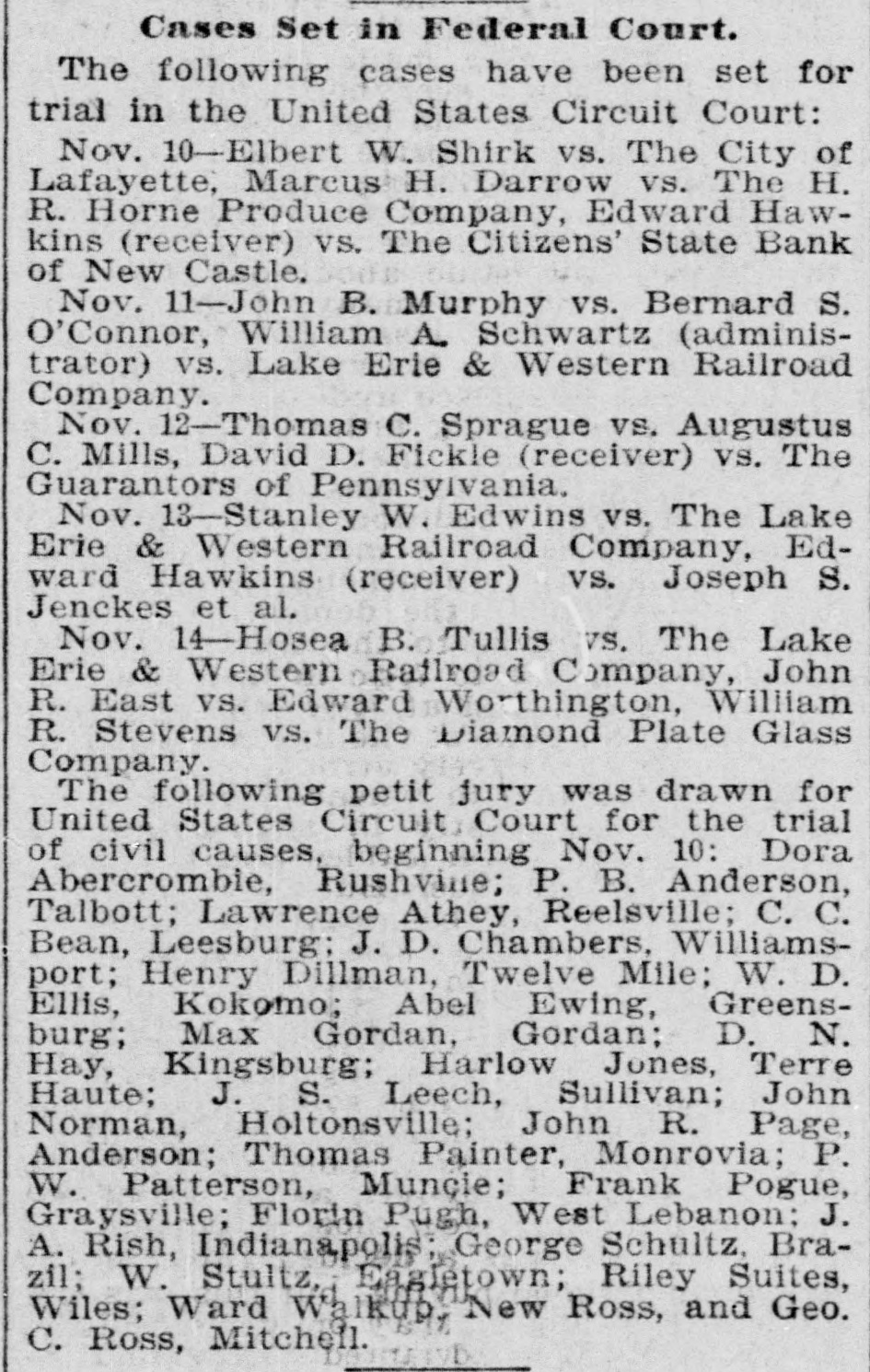

Cases Set in Federal Court. The following cases have been set for trial in the United States Circuit Court: Nov. 10-Elbert W. Shirk vs. The City of Lafayette, Marcus H. Darrow vs. The H. R. Horne Produce Company, Edward Hawkins (receiver) vs. The Citizens' State Bank of New Castle. Nov. 11-John B. Murphy vs. Bernard S. O'Connor, William A. Schwartz (administrator) vs. Lake Erie & Western Railroad Company. Nov. 12-Thomas C. Sprague vs. Augustus C. Mills, David D. Fickle (receiver) vs. The Guarantors of Pennsylvania. Nov. 13-Stanley W. Edwins vs. The Lake Erie & Western Railroad Company, Edward Hawkins (receiver) vs. Joseph S. Jenckes et al. Nov. 14-Hosea B. Tullis vs. The Lake Erie & Western Railroad Company, John R. East vs. Edward Worthington, William R. Stevens vs. The Diamond Plate Glass Company. The following petit jury was drawn for United States Circuit Court for the trial of civil causes, beginning Nov. 10: Dora Abercrombie, Rushvine; P. B. Anderson, Talbott; Lawrence Athey, Reelsville; C. C. Bean, Leesburg: J. D. Chambers, Williamsport; Henry Dillman, Twelve Mile; W. D. Ellis, Kokomo; Abel Ewing, Greensburg; Max Gordan, Gordan; D. N. Hay, Kingsburg; Harlow Jones, Terre Haute; J. S. Leech, Sullivan; John Norman, Holtonsville; John R. Page, Anderson; Thomas Painter, Monrovia; P. W. Patterson, Muncie; Frank Pogue, Graysville; Florin Pugh, West Lebanon: J. A. Rish, Indianapolis; George Schultz, Brazil; W. Stultz, Eagletown; Riley Suites, Wiles; Ward Walkup, New Ross, and Geo. C. Ross, Mitchell.