Article Text

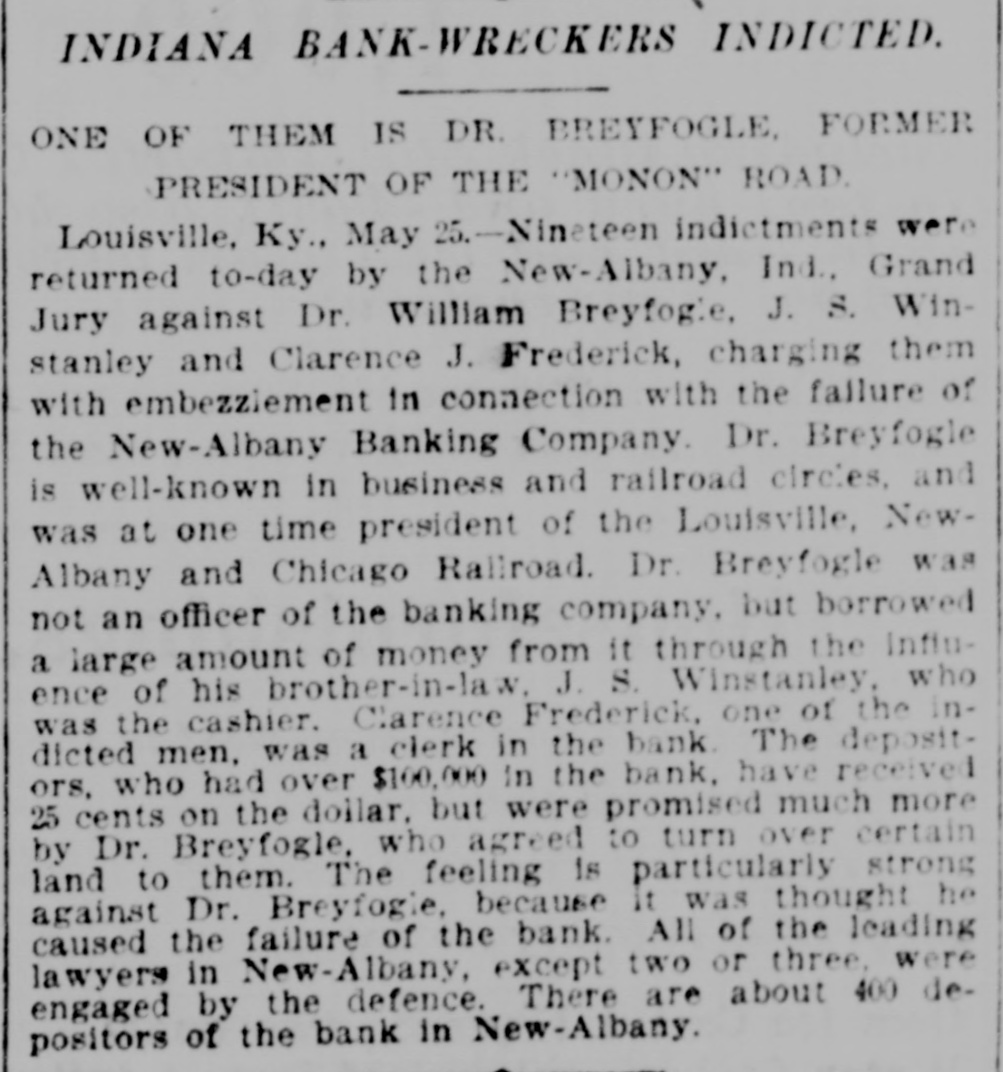

INDIANA BANK-WRECKERS INDICTED. ONE OF THEM IS DR. BREYFOGLE FORMER PRESIDENT OF THE "MONON" ROAD Louisville, Ky., May 25.-Nineteen indictments were returned to-day by the New-Albany, Ind., Grand Jury against Dr. William Breyfogle, J. S. Winstanley and Clarence J. Frederick, charging them with embezziement in connection with the failure of the New-Albany Banking Company Dr. Breyfogle is well-known in business and railroad circles. and was at one time president of the Louisville, NewAlbany and Chicago Railroad Dr. Breyfogle was not an officer of the banking company. but borrowed a large amount of money from it through the Influence of his brother-in-law J. S. Winstanley, who was the cashier. Clarence Frederick, one of the indicted men, was a clerk in the bank The depositors, who had over $100,000 in the bank. have received 25 cents on the dollar. but were promised much more by Dr. Breyfogle, who agreed to turn over certain land to them. The feeling is particularly strong against Dr. Breyfogle, because it was thought he caused the failure of the bank. All of the leading lawyers in New-Albany, except two or three were engaged by the defence. There are about 400 depositors of the bank in New-Albany.