Click image to open full size in new tab

Article Text

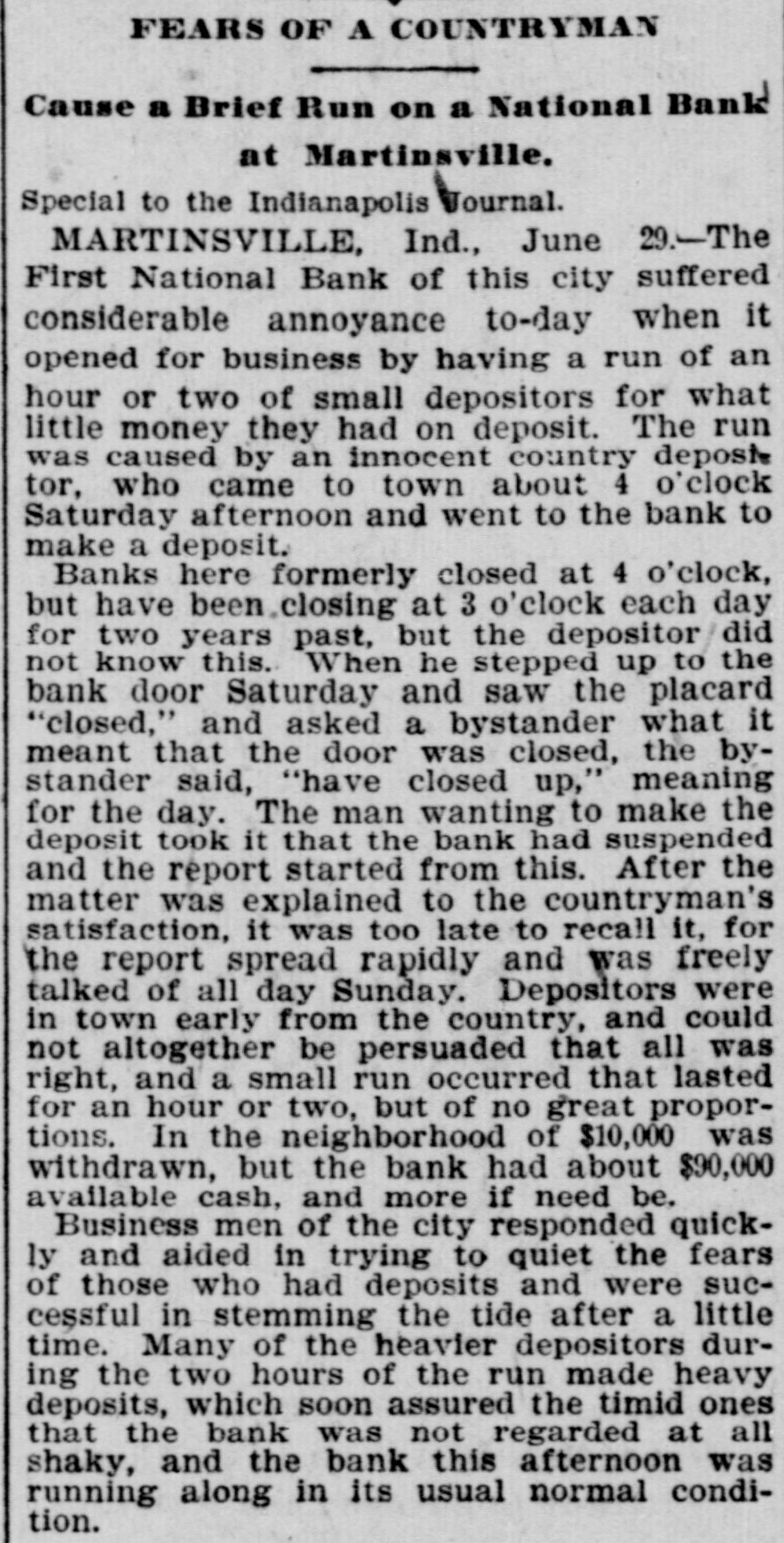

FEARS OF A COUNTRYMAN Cause a Brief Run on a National Bank at Martinsville. Special to the Indianapolis Vournal. MARTINSVILLE, Ind., June 29.-The First National Bank of this city suffered considerable annoyance to-day when it opened for business by having a run of an hour or two of small depositors for what little money they had on deposit. The run was caused by an innocent country deposit tor, who came to town about 4 o'clock Saturday afternoon and went to the bank to make a deposit. Banks here formerly closed at 4 o'clock, but have been closing at 3 o'clock each day for two years past, but the depositor did not know this. When he stepped up to the bank door Saturday and saw the placard "closed," and asked a bystander what it meant that the door was closed, the bystander said, "have closed up," meaning for the day. The man wanting to make the deposit took it that the bank had suspended and the report started from this. After the matter was explained to the countryman's satisfaction, it was too late to recall it, for the report spread rapidly and was freely talked of all day Sunday. Depositors were in town early from the country, and could not altogether be persuaded that all was right, and a small run occurred that lasted for an hour or two, but of no great proportions. In the neighborhood of $10,000 was withdrawn, but the bank had about $90,000 available cash, and more if need be. Business men of the city responded quickly and aided in trying to quiet the fears of those who had deposits and were successful in stemming the tide after a little time. Many of the heavier depositors during the two hours of the run made heavy deposits, which soon assured the timid ones that the bank was not regarded at all shaky, and the bank this afternoon was running along in its usual normal condition.