Article Text

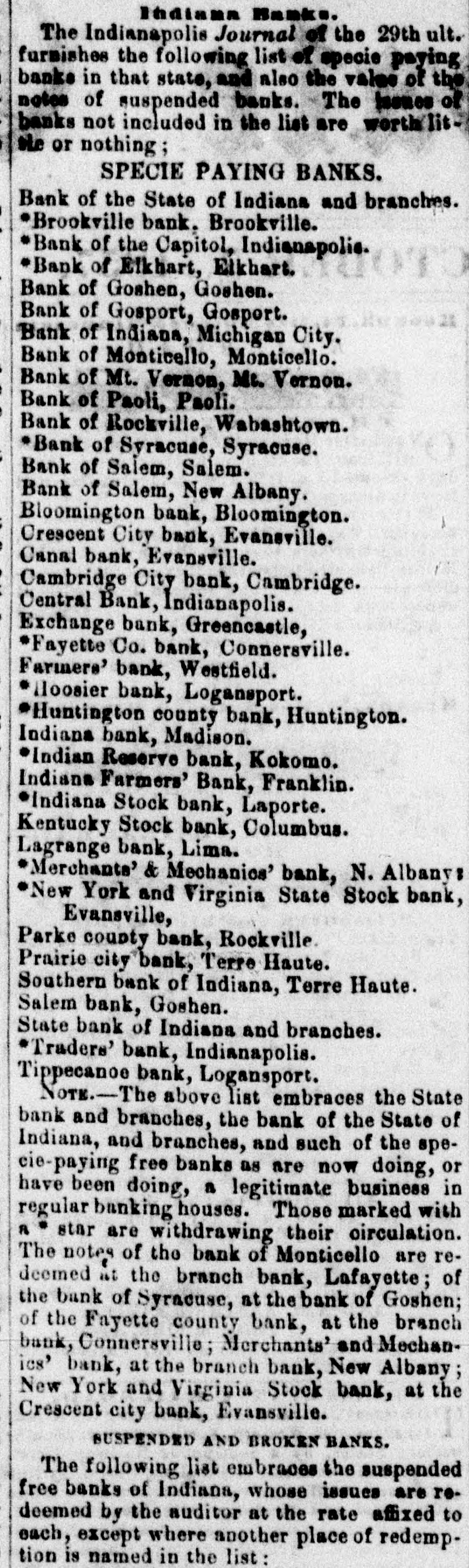

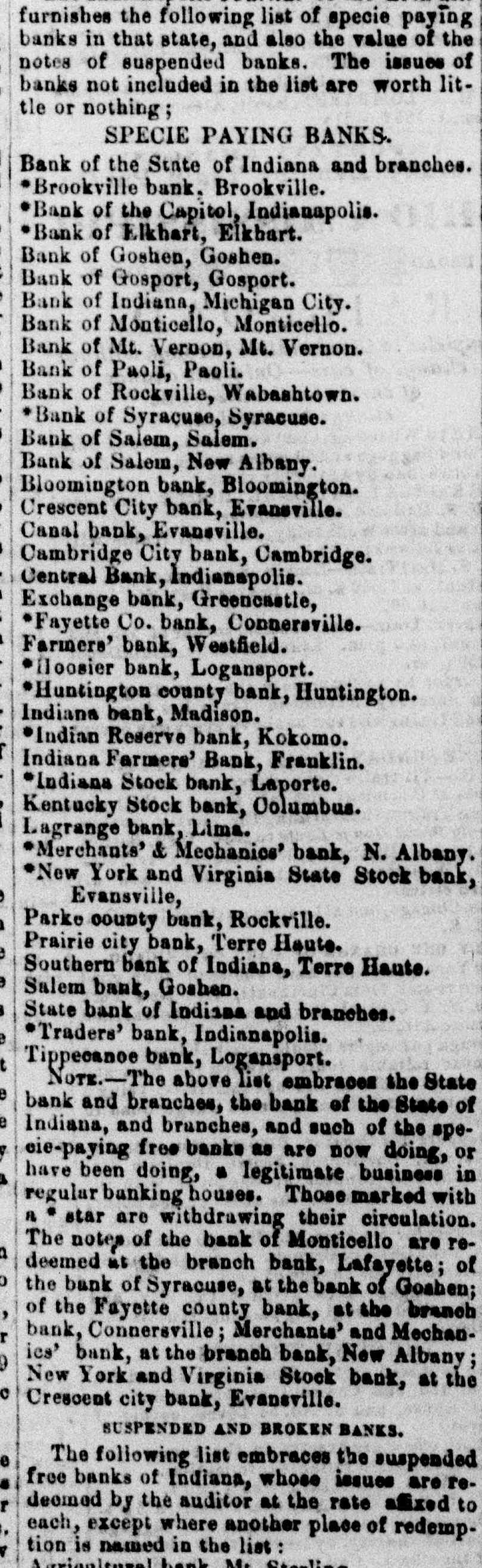

Indiana Banks. The Indianapolis Journal of the 29th ult. furmishes the following list of specie paying banks in that state, and also the value of the notes of suspended banks. The issues of banks not included in the list are worth the or nothing; SPECIE PAYING BANKS. Bank of the State of Indiana and branches. *Brookville bank, Brookville. Bank of the Capitol, Indianapolis. *Bank of Elkhart, Elkhart. Bank of Goshen, Goshen. Bank of Gosport, Gosport. Bank of Indiana, Michigan City. Bank of Monticello, Monticello. Bank of Mt. Vernon, Mt. Vernon. Bank of Paoli, Paoli. Bank of Rockville, Wabashtown. *Bank of Syracuse, Syracuse. Bank of Salem, Salem. Bank of Salem, New Albany. Bloomington bank, Bloomington. Crescent City bank, Evansville. Canal bank, Evansville. Cambridge City bank, Cambridge. Central Bank, Indianapolis. Exchange bank, Greencastle, "Fayette Co. bank, Connersville. Farmers' bank, Westfield. Hoosier bank, Logansport. Huntington county bank, Huntington. Indiana bank, Madison. "Indian Reserve bank, Kokomo. Indiana Farmers' Bank, Franklin. *Indiana Stock bank, Laporte. Kentucky Stock bank, Columbus. Lagrange bank, Lima. Merchants' & Mechanics' bank, N. Albany: New York and Virginia State Stock bank, Evansville, Parke county bank, Rockville. Prairie city bank, Terre Haute. Southern bank of Indiana, Terre Haute. Salem bank, Goshen. State bank of Indiana and branches. "Traders' bank, Indianapolis. Tippecanoe bank, Logansport. NOTE.-The above list embraces the State bank and branches, the bank of the State of Indiana, and branches, and such of the specie-paying free banks as are now doing, or have been doing, a legitimate business in regular banking houses. Those marked with a * star are withdrawing their oirculation. The notes of the bank of Monticello are redeemed at the branch bank, Lafayette; of the bank of Syracuse, at the bank of Goshen; of the Fayette county bank, at the branch bank, Connersville; Merchants' and Mechanics' bank, at the branch bank, New Albany; New York and Virginia Stock bank, at the Crescent city bank, Evansville. SUSPENDED AND BROKEN BANKS. The following list embraces the suspended free banks of Indiana, whose issues are redeemed by the auditor at the rate affixed to each, except where another place of redemption is named in the list: