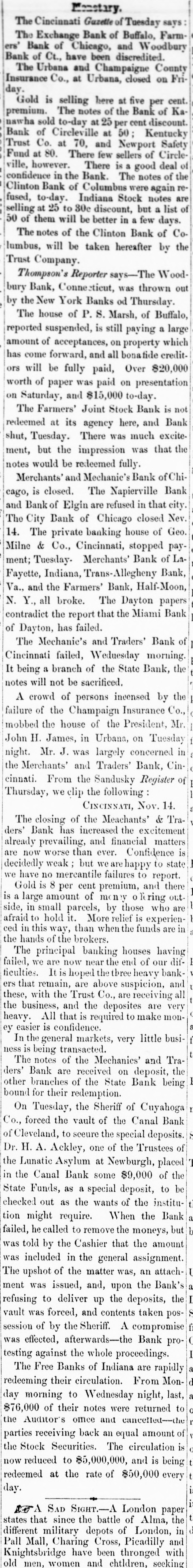

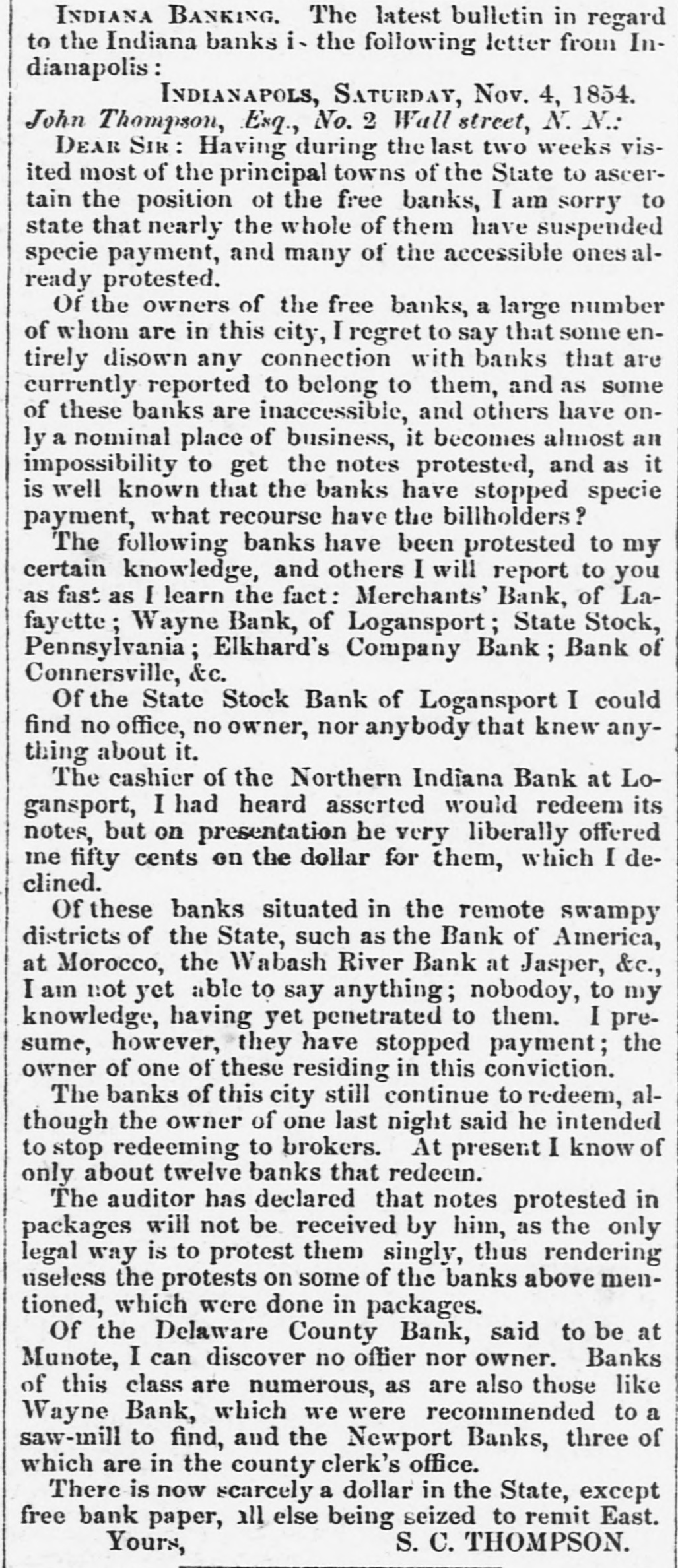

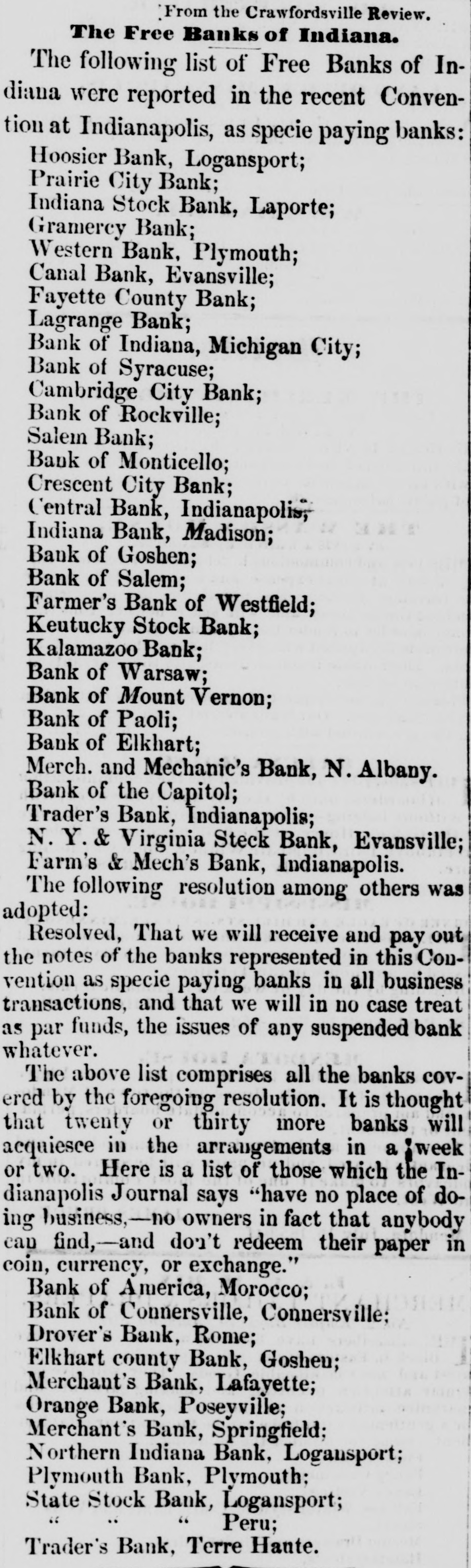

Article Text

From which it will be seen that the increase in receipts now amounts to 34,000 bales; the decrease in exports to Great Britain, 1,00; other foreign ports, 5,000; increase to France, 23,000. Total increase in exports, 17,000 bales. The Clearing House Exchanges were large to-day, $21,078,458. There was rather a more cheerful feeling in the Money market to-day, but the change was not very marked. The rates are as before noticed. Mr. Patchin, as we stated yesterday, has paid the money into Court for the Coupons of the 1st Mortgage Bonds of the Buffalo and New-York City Railroad, as the interest is advertised to be paid either at the Pratt Bank, Buffalo, or the Bank of Commerce, New-York. The latter institution will not be ready for & few days to pay coupons. We learn from Layfayette, Ind., that the Merchants' Bank of that place has suspended payment. The notes are selling in the street at 50 cents the dollar. The securities of this bank are all Indiana 58. The tolls collected in New-York City on the canals from commencement of navigation to Nov. 1, 1854, $301,461 35 are 40,380 38 Increase over last year The Penobscot Railroad advertised for sale at auction by A. C. Flagg, trustee, has been withdrawn. It is stated that the outstanding bonds have been retired, and the mortgage is to be discharged. The old contract for the construction of the road has been canceled, and payment in full made to the contractors. Mr. J. C. Tracy has been appointed Cashier of the Farmers' and Mechanics' Bank of Hartford, vice Geo. P. Bissell, resigned. A private banking establishment has been started in Hartford, Conn, under the style of George P. Bissell & Co., by D. F. Robinson, late President of the Hartford Bank; Calvin Day, of the firm of Day, Owen & Co., Hartford; and George P. Bissell, late Cashier of the Farmers' and Mechanics' Bank, Hartford. Among the references of this house are J. J. Palmer, President of the Merchants' Bank, and Duncan, Sherman & Co. The total net earned premiums of the Sun Mutual Office, for the year ending the 4th inst., were $1,916,753 03. The losses, expenses, reïnsurance, &c., for the same time, amounted to $1,881,927 67, leaving a profit of $34,825 36. The profits of the Company to the 4th of October, 1853, were $2,861,756, for which certificates have been paid off, including 36 P cent. of 1851, to the amount of $1,888,696. The assets of the Company, less its indebtedness, are $1,456,325 36. The Trustees announce that, notwithstanding the great marine insurance losses of the present year, the reserved fund of one million dollars remains unimpaired. Deeming it expedient to increase its capital, bereafter only one-half the profits of the Company will be appropriated to the redemption of the scrip until the accumulation shall reach at least two million dollars. The Trustees have declared & dividend interest to the let. inst. of 3 v cent. on the outstanding scrip of the Company, payable in cash on and after the 31st day of December next. The Louisville Courier states that the liabilities of G. H. Monsaratt & Co, of that city, who lately made an assignment, are about $80,000, while their available assets are estimated at $131,000. The failare of the house was precipitated, if not produced, by the fact of a confidential agent or carrier having defaulted with a large amount of funds, intrusted to him for transportation from Paducah to Louisville, for the benefit of the house. The amounts at the several depositories to the credit of the Treasurer of the United States on the 23d of October, were as follows: