Article Text

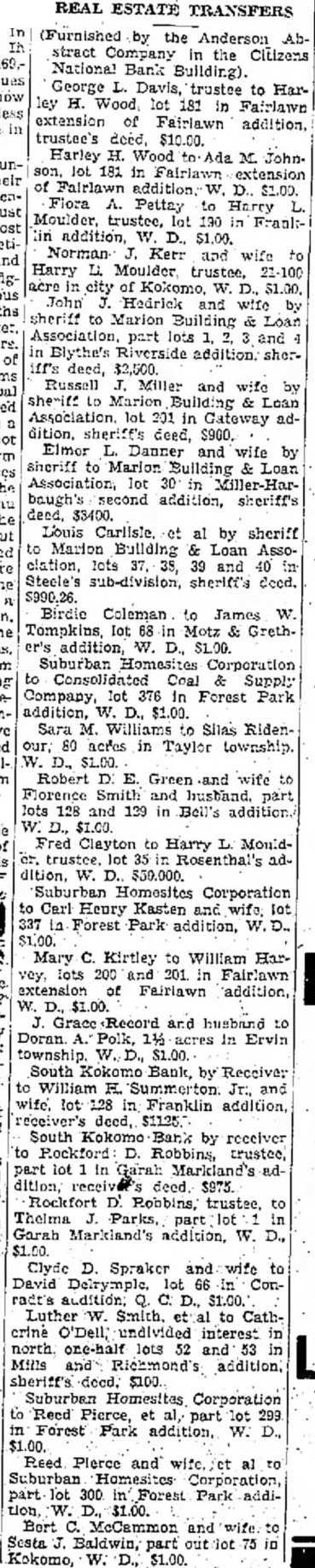

(Continued from Page One) qualifications for the particular recognized by all. being Fears of Creditors Should the case taken creditors feel. other county. that the receivercording would much more expenship sive than administered here. All of the receivership must the costs borne the bank's assets. out that the more receivership the expensive greater the loss the Attorney Herron out of the and could not city Wednesday for Information regardbe any additional to what ing his plans his answer and motion. He his pleadings court filed by the office assistant, Goldie Perry. herShe discharged self an attorney. the work assigned her without comment. If Mr. Herron really to for change of means venue from the county, the fact will be revealed Saturday, the hearday Attorney Herron is president of the Howard County Bar Association the veterans of the one legal had experience in bank liquidation served along with Grover Bishop in winding up of Trust the affairs the failed SeptemThe creditors of that ber, approximately cents on the dollar. South Kokomo Bank Pending Saturday, also. State Banking Competition by Symons for South Kokomo Bank, for the which was closed on October 23, at the same time the Citizens National Bank The creditors that operations. have prepared petition institution asking that Carl Showalter be receiver. he having indicatwillingness to serve same terms Mr. proximately willing to accept for George was liquidating the Trust. Whether some shareholder the South likely Bank and that Kokomo be sent out of the county too, not been change Creditors of the institulearned. know no such tion say they being under that none develops. press hope Citizens generally express hope that Attorney Herron his and not press for sider motion change of venue from the county Trust case, and that the Peoples that ever motion in the South Kokomo offered Bank case. practically, seems be impressed that the receiverships the creditors of the planned two institutions would be the most economical and most satisfactory that could devised, and that they that the affairs would the banks would be administered honestly, and the best interests every way those directly concerned. and the community as whole. MOTORS DIVIDEND New York, Nov. General Motors Corporation dividend of cents terly share the common stock.