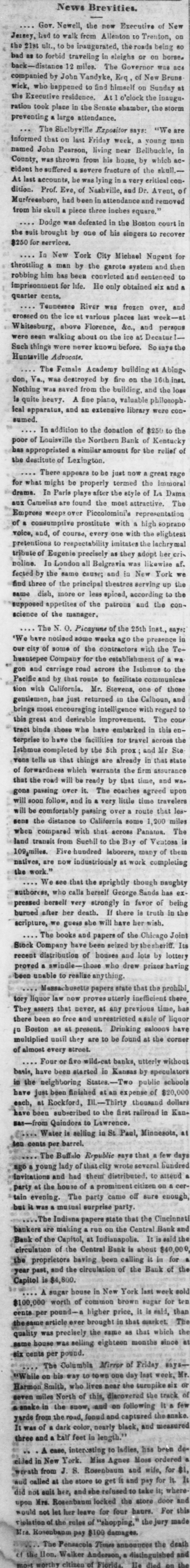

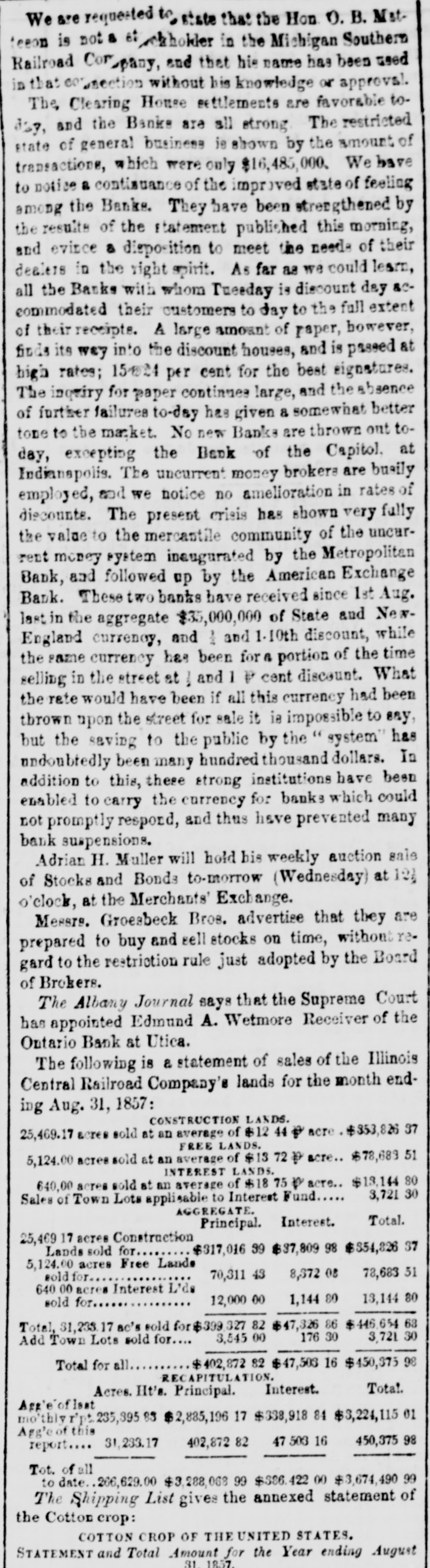

Article Text

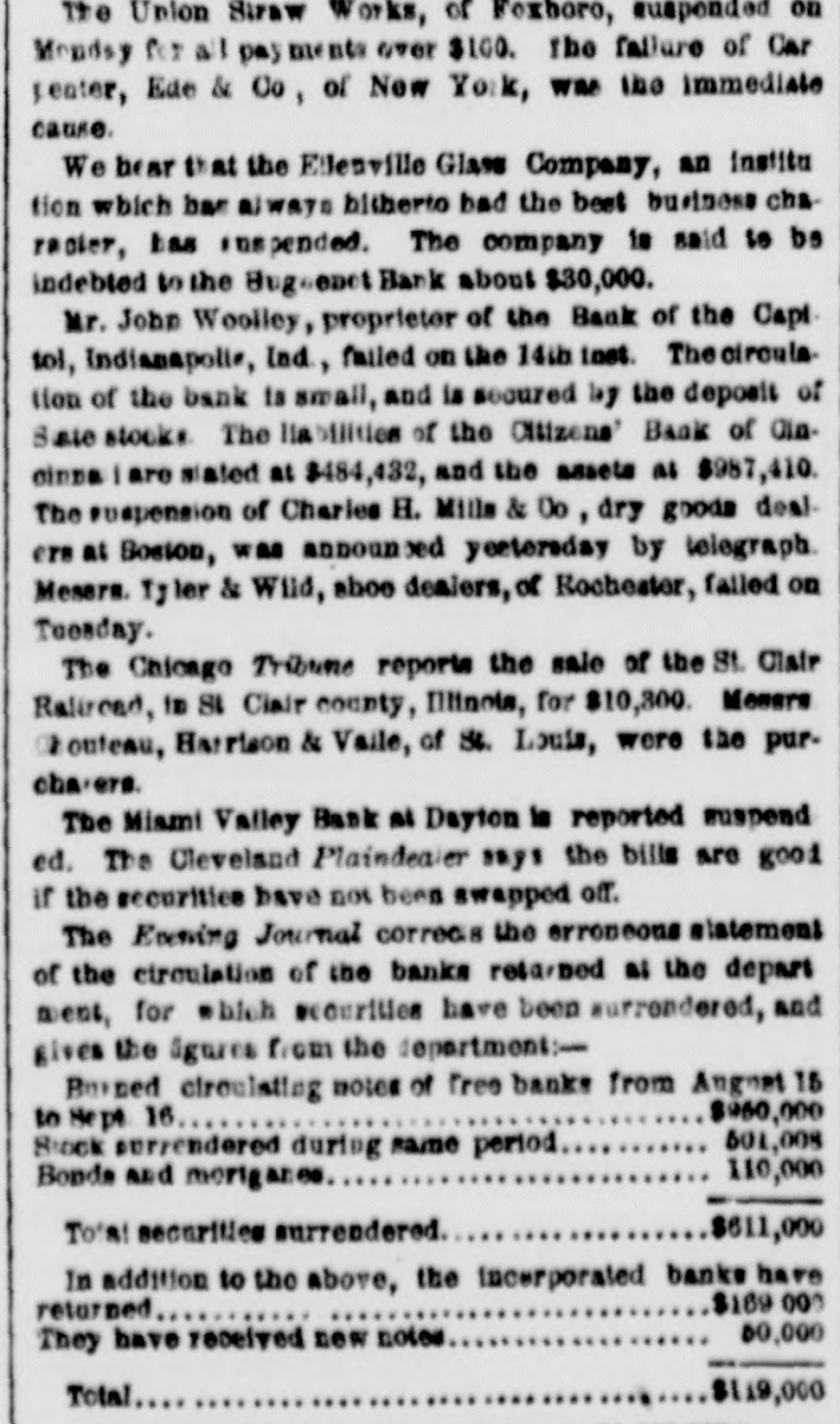

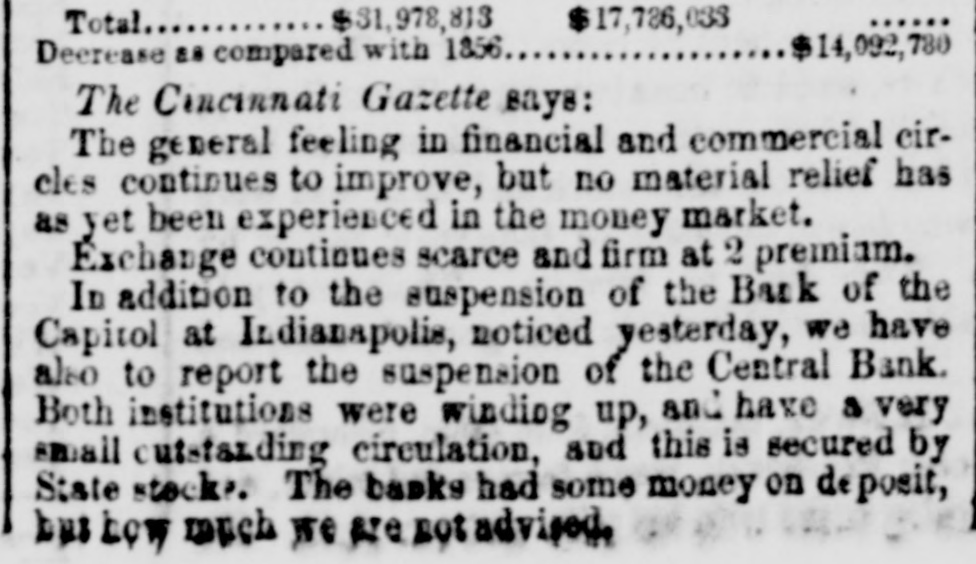

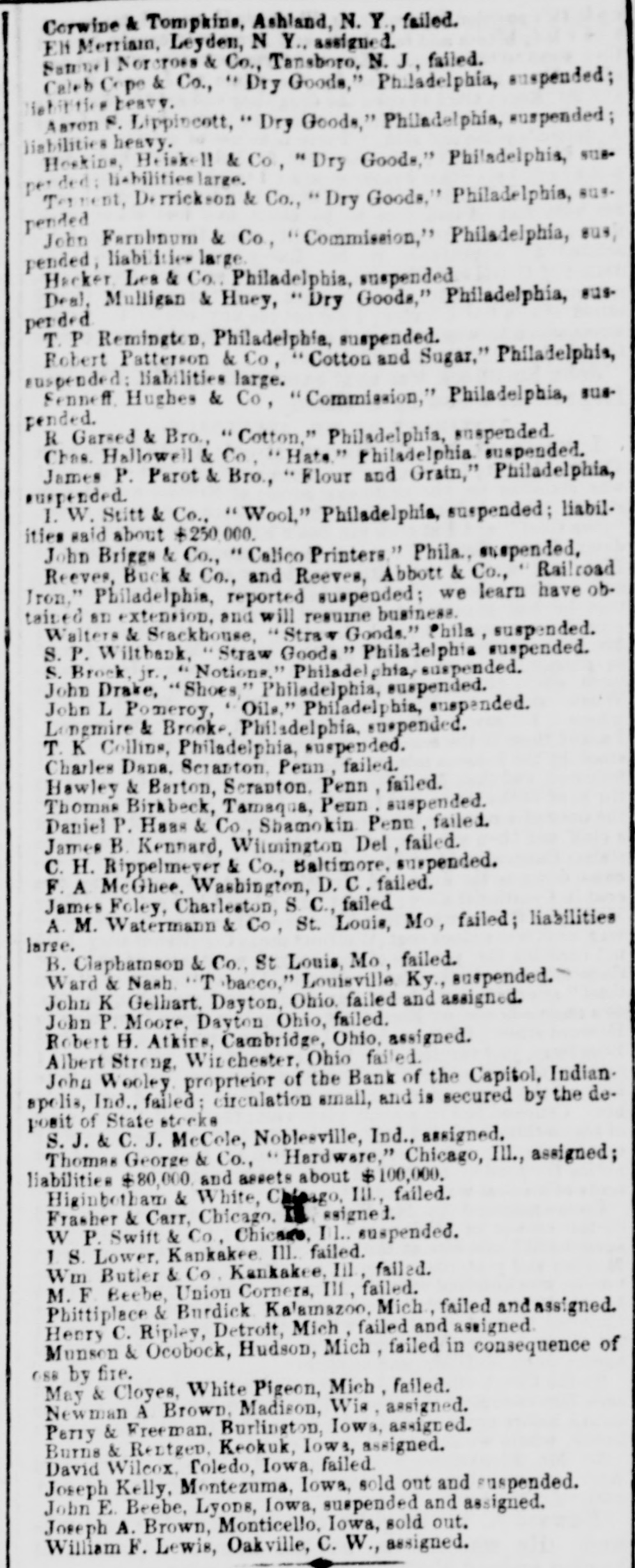

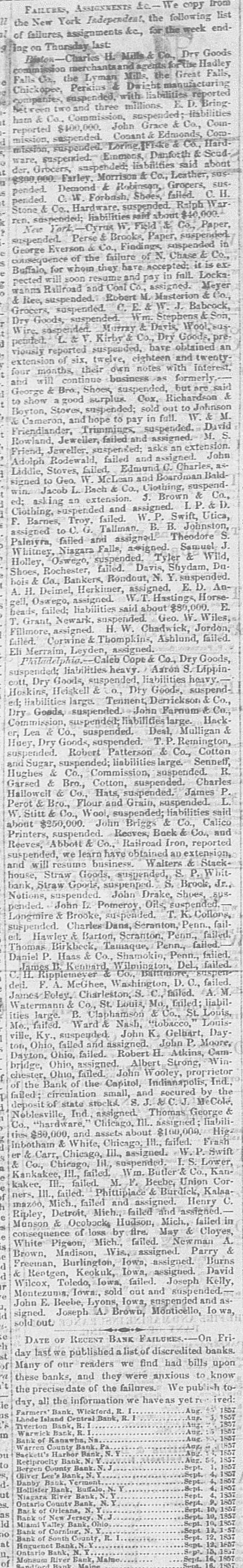

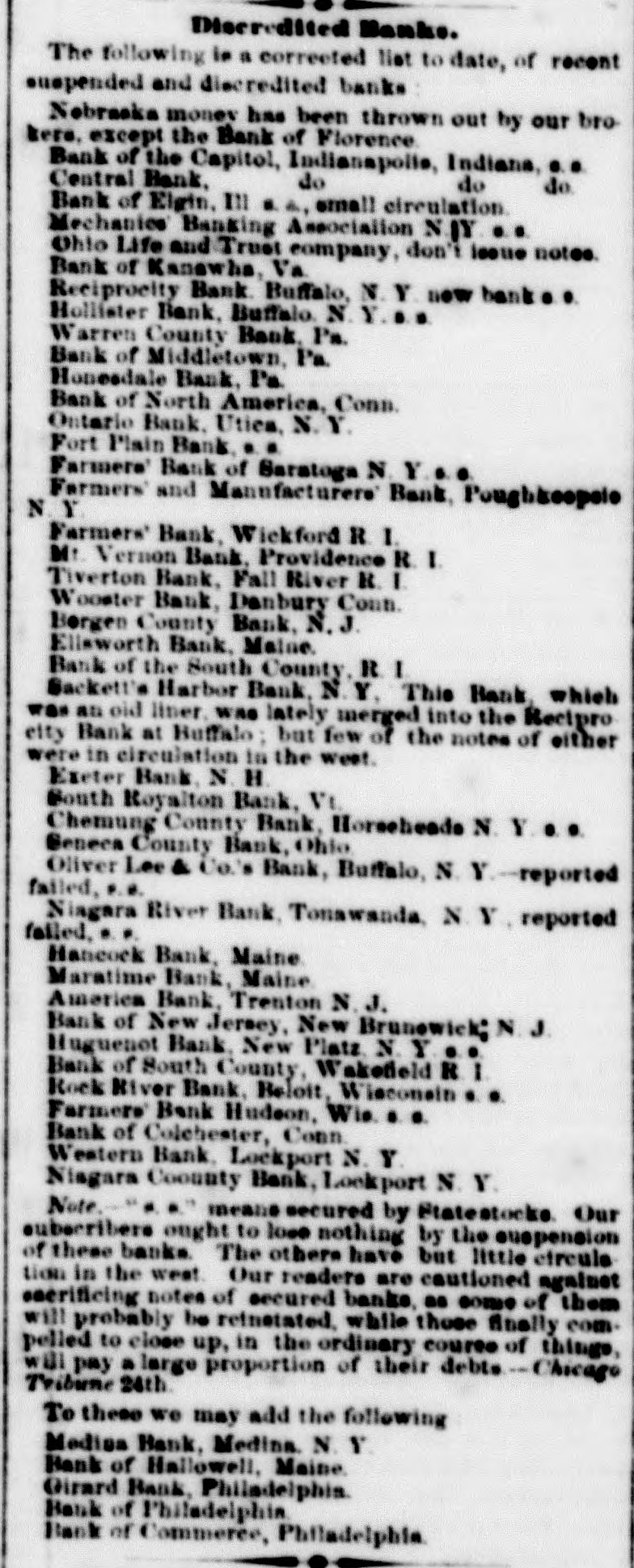

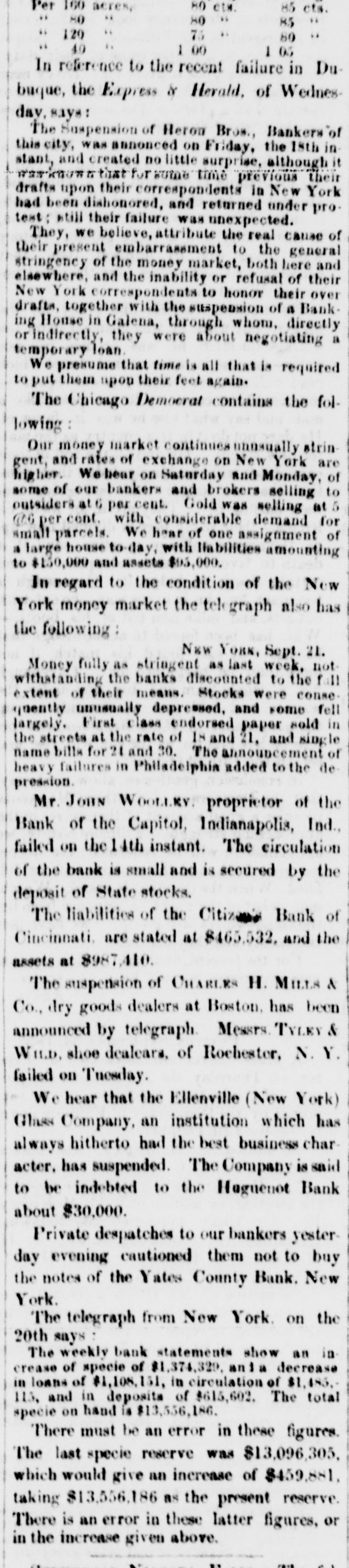

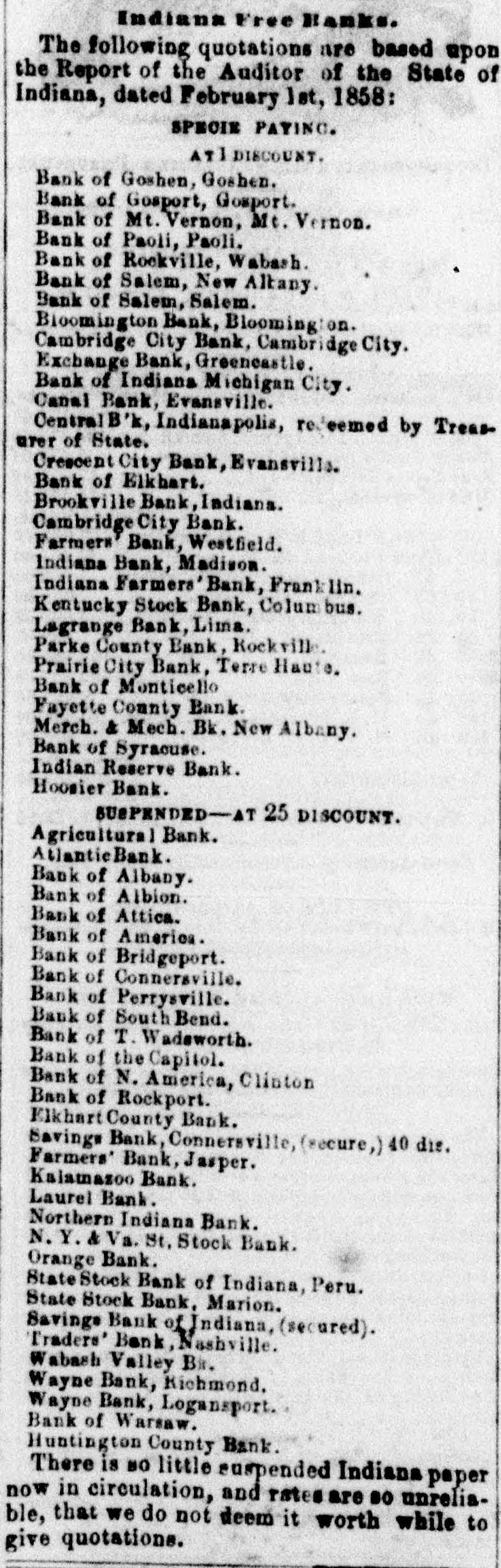

FAILURES, ASSIGNMENTS &-We copy from the New York Independent, the following list of failures, assignments &e, for the week ending on Thursday last: Piston Mills Co., Dry Goods commission merchantsand agents Hadley Falls Ca., the Lyman Mills. the Great Falls, Chickopee, Perkins Dwight manufacturing companies, suspended, with bilities reported het reen two and three millions. E. D. Bringham & Co., Commission, suspended;-liábilities reported $400,000. John Grace & Co., Commission, suspended. Consnt & Edmonds, Commission, suspended. Loring & Co., Hard ware, suspended." Emmons, Danforth & Scudder, Grocers, suspended; liabilities said about $390,000, Farley, Morrison & Co., Leather, suspended. Demond & Robinson, Grocers, suspended. 0.W. Forbash, Shees, failed. C. H. Stone & Co., Hardware, suspended. Ralph War ren. suspended; liabilities said about $40 000.New York. -Cyrus W. Field & Co., Paper, suspended. Perse & Brooks, Paper, suspended. George Everson & Co., Findings, suspended in consequence of the failure of N. Chase & Co., Buffalo, for whom they have accepted: it is expected will soon resume and pay in full. Lockswanns Railroad and Coal Co., assigned. Meyer & Ree, suspended. Robert M. Masterion & Co., Grocers, suspended. C. E&W. J. Babcock, Dry Goods, suspended. Wm. Stephens & Son, Wire. saspended. Murray & Davis, Wool, pended. L & V. Kirby & Co., Dry Goods, previously reported suspended, have obtained an extension of six, twelve, eighteen and twentyfour months, their own notes with interest, and will continue business as formerly. George & Bro, Shoes, suspended, but are said to show a good surplux Cox, Richardson & Boyton, Stores, suspended; sold out to Johnson & Cameron, and hope to pay in full. W. & M. Friendlander, Trimmings, suspended. David Rowland, Jeweller, failed and assigned. M. S. Friend, Jeweller, suspended; asks an extension. Adolph Rodewald, failed and assigned. John Liddle, Stoves, failed. Edmund Charles, as signed to Geo. W. McLean and Boardman Baldwin. Jacob L. Bach & Co., Clothing, suspended; asking an extension. J. Brown & Co., Clothing, suspended and assigned. LP. & D. F. Barnes, Troy, failed. W.P. Swift, Utica, assigned to C. G. Tallman. B. B. Johnston, Palmyra, failed and assigned. Theodore S. Whitney, Niagara Falls, assigned. Samuel J. Holley, Oswego, suspended. Tyler & Wild, Shoes, Rochester, failed. Davis, Shydam, Du. hois & Co., Bankers, Rondout, N. Y. suspended. A. H. Deimel, Herkiner, assigned. E. D. Angell, Oswego, assigned. W. T. Hastings, Horseheads, failed; liabilities said about $80,000. E. T. Grant, Newark, suspended. Geo. W. Wiles, Fillmore, assigned. H. W. Chadwick, Jordon, failed. Corwine & Thompkins, Ashlund, failed. Eli Merraim, Leyden, assigned. Philadelphia.-Caleb Cope & Co., Dry Goods, suspended; liabilities heavy. , Aaron Lippincott, Dry Goods, suspended, liabilities heavy.Hoskins, Heiskell & .o., Dry Goods, suspended; liabilities large. Tennent, Derrickson & Co., Dry. Goads, suspended. John Farnum Co., Commission, suspended; liabilities large. Hacker, Lea & Co., suspended. Deal, Mulligan & Huey, Dry Goods, suspended. T.P. Remington, suspended. Robert Patterson & Co., Cotton and Sugar, suspended; liabilities large. Senneff, Hughes & Co., Commission, suspended. R. Garsed & Bro., Cotton, suspended. Charles Hallowell & Co., Hats, suspended. James P Perot & Bro., Flour and Grain, suspended. L. W. Stitt & Co., Wool, suspended; liabilities said about $250,000. John Briggs & Co., Calico Printers, suspended. Recves, Back & Co., and Reeves, Abbott & Co., Railroad Iron, reported suspended, we learn have obtained an extension, and will resume business. Walters & Stackhouse, Straw Goods, suspended, S. P. Whitbank, Straw Goods, suspenped. S. Brock, Jr., Notions, suspended. John Drake, Shoes, suspended. John L. Pomeroy, Oils, suspended.Longmire & Brooke, suspended. T. K. Collons, suspended. Dana, Seranton, Penn., failed. Hawley it Barton, Scranton, Penn., failed. Thomas Birkbeck, Tamaque, Penn., failed. Daniel P. Haas & Co., Shamokin; Penn., failed. James B. Kennard, Wilmington, Del., failed. C.H. Ripplemeyer & Co., Battimore, suspended. F. A. McGhee, Washington, D. C., failed. James/Foley, Charleston, S. C., failed. A. M Watermann & Co., St. Louis, Mo., failed; liabilities large. B. Claphamson & Co., St. Louis, Me., failed. Ward & Nash, "tobacco," Louisville, Ky., suspended. John K. Gelbart, Dayton, Ohio, failed and assigned. John P. Moore, Dayton, Ohio, failed. Robert H. Atkins, Cambridge, Ohio, assigned. Albert Strong, Winchester, Ohio, failed. John Wooley, proprietor of the Bank of the Capitol, Indianapolis, Ind., failed; circulation small, and secured by the deposit of state stocks. S. J. & C.J. McCole, Noblesville, Ind., assigned. Thomas George & Co., "hardware," Chicago, III.. assigned; liabilities $80,000, and assets about $100,000 Higinbotham & White, Chicago, III., failed. Frash er & Carr, Chicago, III., assigned. -W. Swift & Co., Chicago, Iil, suspended. I.S. Lower, Kankakee, I!I., failed. Wm. Butler & Co., Kankakee, III., failed. M. F. Beebe, Union Corners, III., failed. Phittiplace & Burdick, Kalsamazóo, Mich., failed and assigned. Henry C. Ripley, Detroit, Mich., failed and assigned. Munson & Ocobacks Hudson, Mich, failed in consequence of loss by fire. May & Cloyes, White Pigeon, Mich., failed. Newman A. Brown, Madison, Wis, assigned. Parry & Freeman, Burlington, lown, assigned. Burns & Rentgen, Keokuk, Iowa, assigned. David was less Giled Inseph Kelly