Click image to open full size in new tab

Article Text

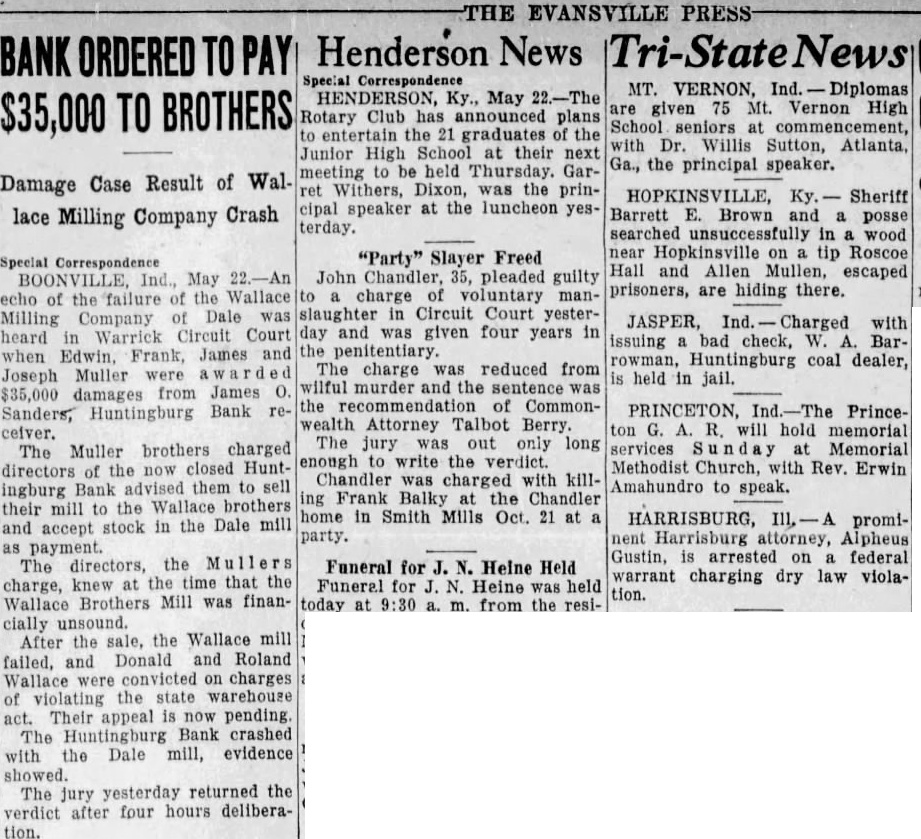

THE EVANSVILLE PRESS Henderson News Tri-State News BANK ORDERED PAY Special Correspondence MT. VERNON, Ind. Diplomas HENDERSON, Ky., May 22.-The are given 75 Mt. Vernon High $35,000 TO BROTHERS Rotary Club has announced plans School seniors at commencement, to entertain the 21 graduates of the

Damage Case Result of Wallace Milling Company Crash

Junior High School at their next meeting be held Thursday. Garret Withers, Dixon, was the principal speaker at the luncheon yesterday.

Special Correspondence "Party" Slayer Freed BOONVILLE, Ind., May 22.-An John Chandler, 35, pleaded guilty echo of the failure of the Wallace to charge of voluntary manMilling Company of Dale slaughter in Circuit Court yesterheard in Warrick Circuit Court day and was given four years in the penitentiary. when Edwin. Frank, James and The charge was reduced from Joseph Muller were wilful murder and the sentence was $35,000 damages from James O. the of CommonSanders, Huntingburg Bank rewealth Attorney Talbot Berry. ceiver. The jury was out only long The Muller brothers charged enough write the directors of the now closed HuntChandler was charged with killingburg Bank advised them to sell ing Frank Balky at the Chandler their mill the Wallace brothers home in Smith Mills Oct. 21 at a and accept stock in the Dale mill party. with Dr. Willis Sutton, Atlanta, Ga., the principal speaker.

HOPKINSVILLE, Ky. Sheriff Barrett E. Brown and a posse searched unsuccessfully in wood near Hopkinsville on tip Roscoe Hall Allen Mullen, escaped prisoners, are hiding there.

JASPER, Ind. Charged with issuing bad check, W. Barrowman, Huntingburg coal dealer, is held in jail.

PRINCETON, Ind.-The Princeton G. A. R. will hold memorial services Memorial Methodist Church, with Rev. Erwin Amahundro to speak.

HARRISBURG, III, promiHarrisburg attorney, Alpheus Gustin, is arrested on federal warrant charging dry law violation. as payment. The directors, the Mullers charge, knew at the time that the Wallace Brothers Mill was financially unsound. After the sale, the Wallace mill failed, and Donald and Roland Wallace convicted on charges of violating the state warehouse act. Their appeal is now pending. The Huntingburg Bank crashed with the Dale mill, evidence showed. The jury yesterday returned the verdict after four hours deliberation.