Article Text

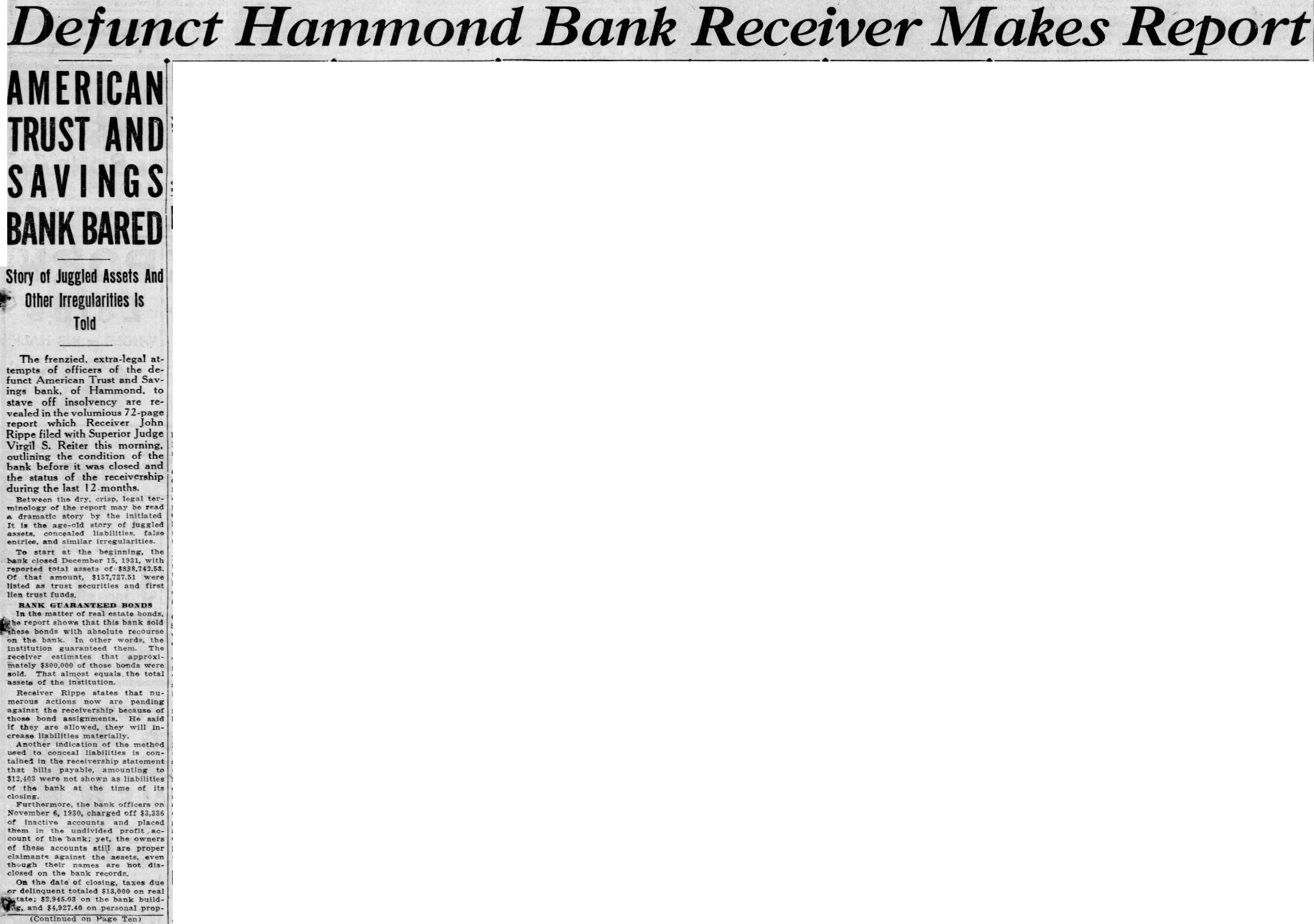

Defunct Hammond Bank Receiver Makes Report AMERICAN TRUST AND SAVINGS BANK BARED Story of Juggled Assets And Other Irregularities Is Told The frenzied. extra-legal attempts of officers of the defunct American Trust and Savings bank. of Hammond, to stave off insolvency are revealed in the volumious 72-page report which Receiver John Rippe filed with Superior Judge Virgil S. Reiter this morning, outlining the condition of the bank before it was closed and the status of the receivership during the last 12 months. Between the dry. crisp, legal terminology the report may dramatic story by the initiated It is the age-old of juggled false entries, and similar irregularities. To start at the the bank closed reported total that amount, listed as trust securities and first lien trust BANK GUARANTEED BONDS In shows this bank sold bonds with absolute recourse words, the receiver mately of sold. That equals the total of the institution. Receiver Rippe states that numerous are pending against the receivership those assignments. He said they will inliabilities materially. the method conceal liabilities is contained the receivership statement payable, bank at the time of its closing. the bank officers November 6, 1930, charged off $3,336 of accounts and placed them the undivided profit count of the bank; the owners of these accounts still are proper claimants against the assets, even though their names closed on the bank records. On the date of closing, taxes due delinquent totaled real the bank build$4,927.40 on personal prop(Continued on Page Ten)