Click image to open full size in new tab

Article Text

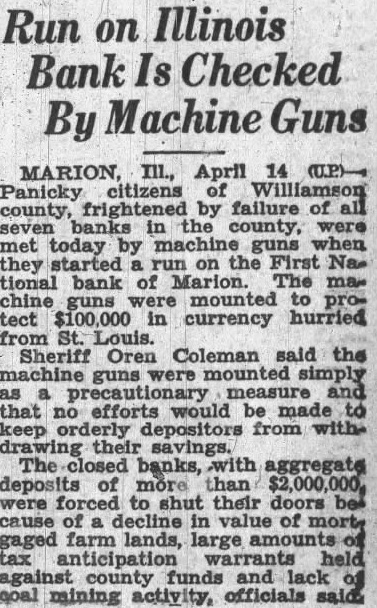

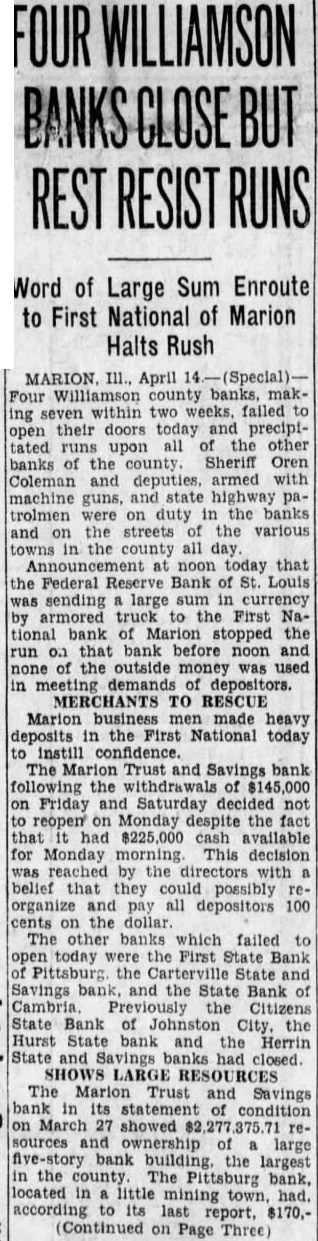

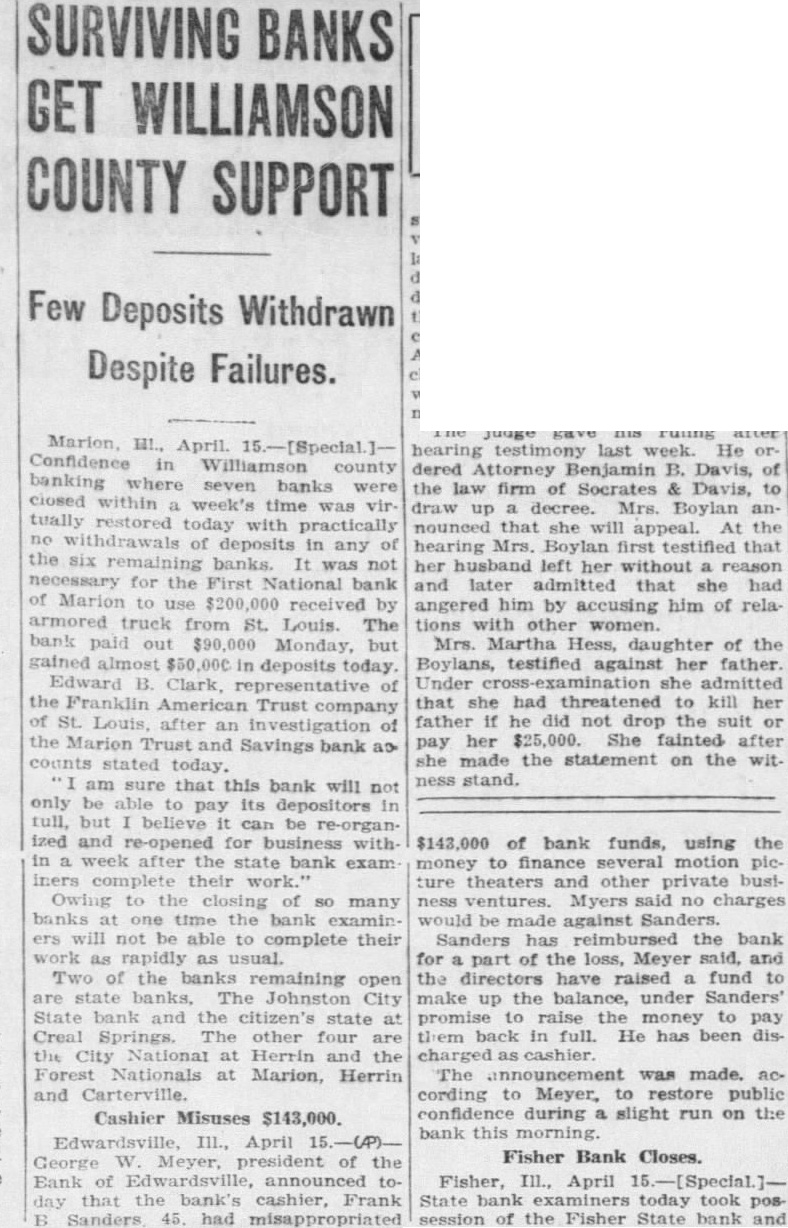

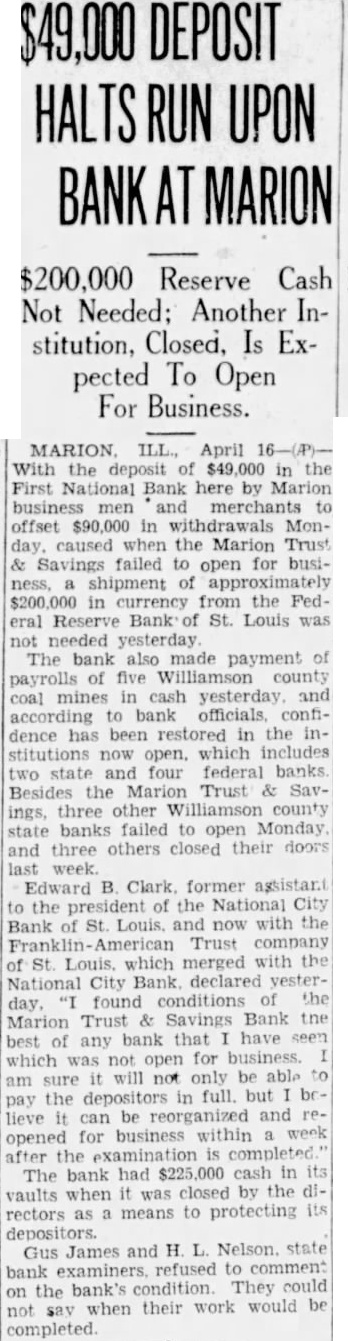

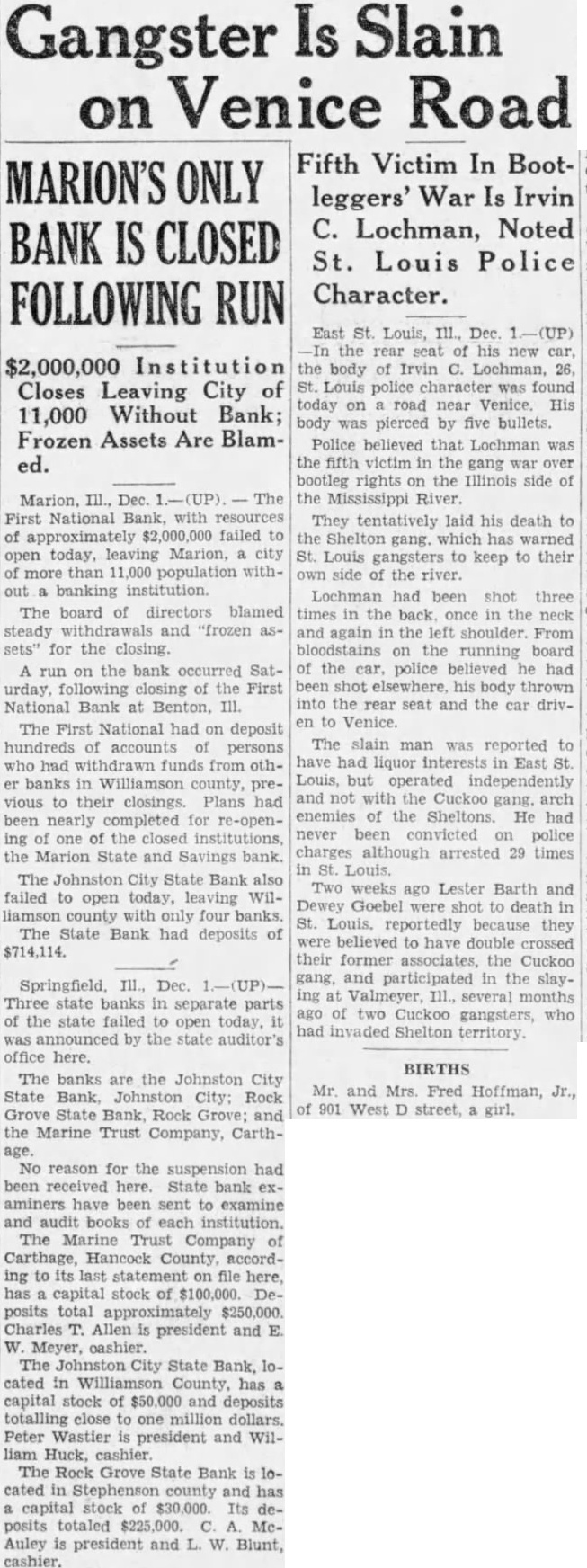

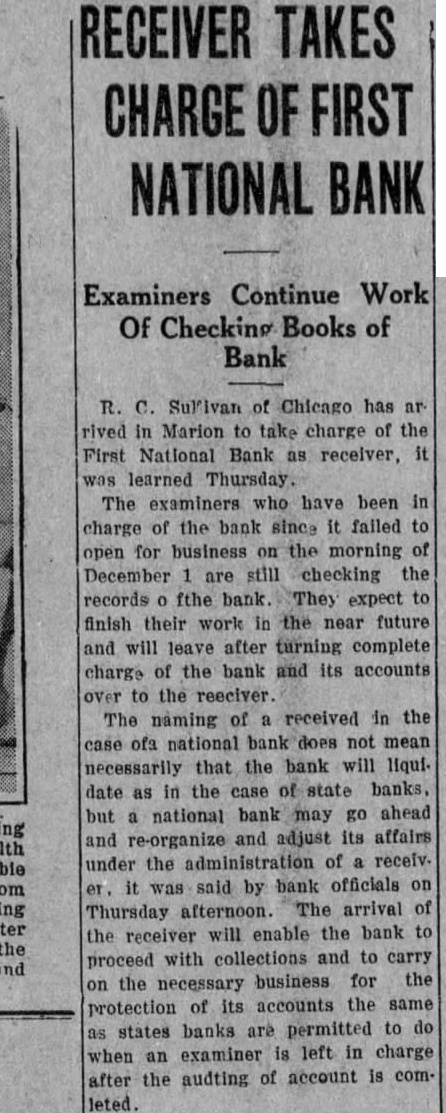

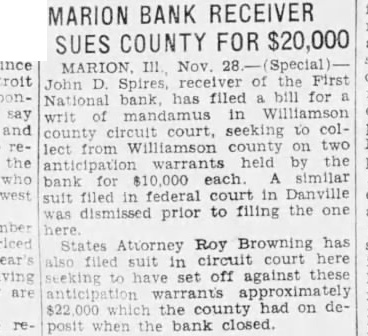

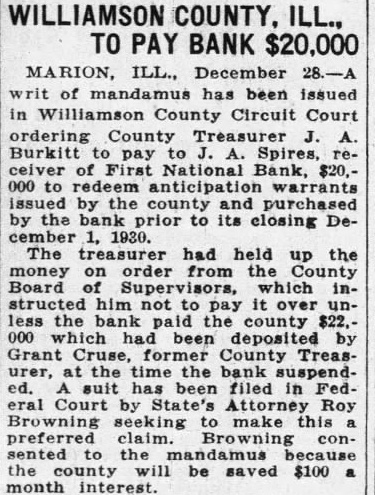

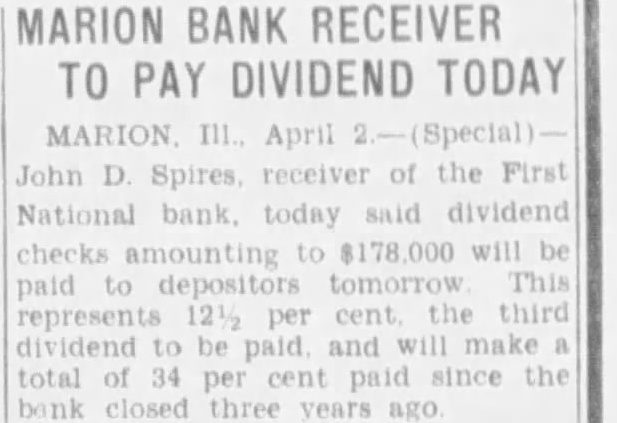

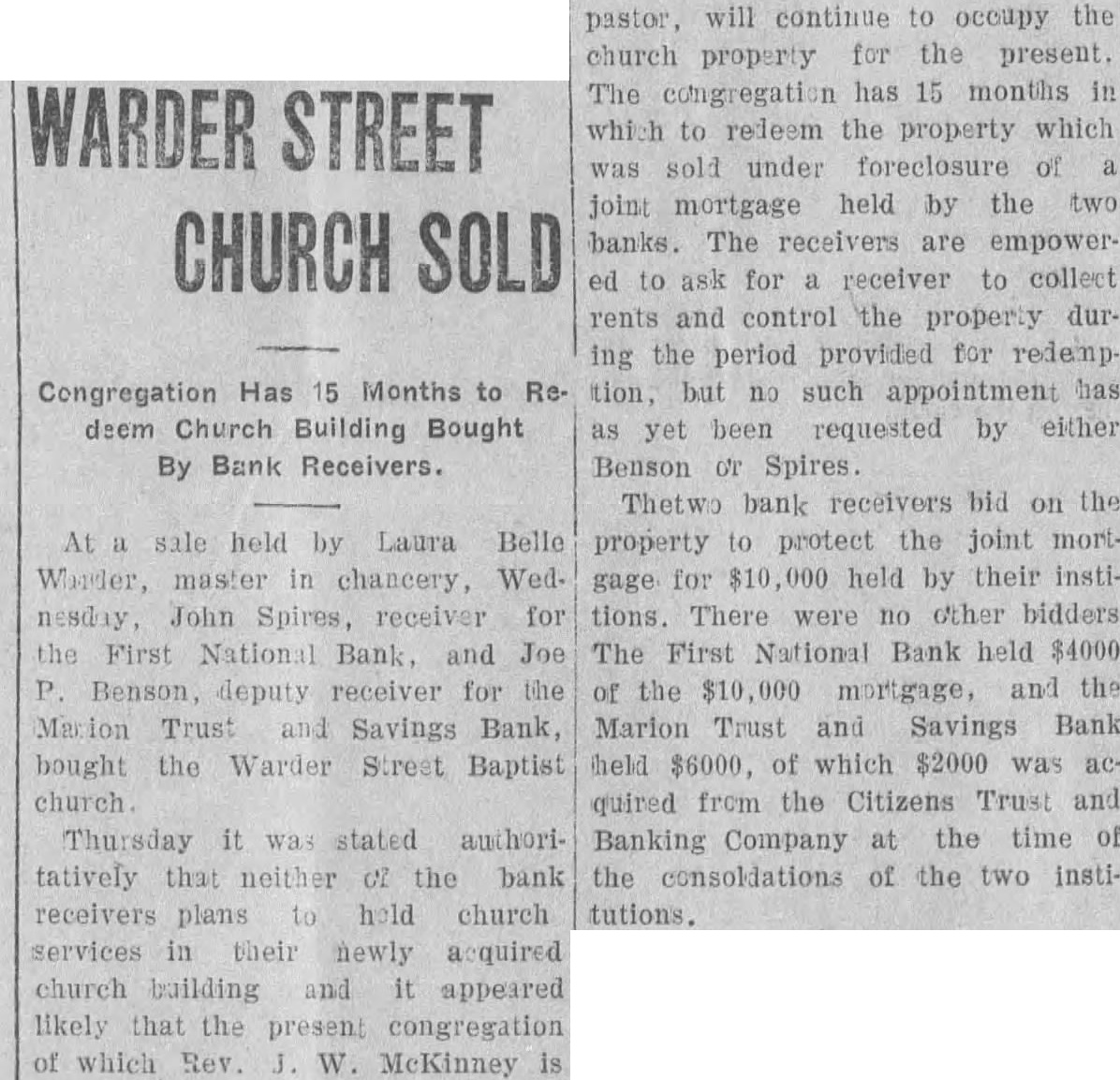

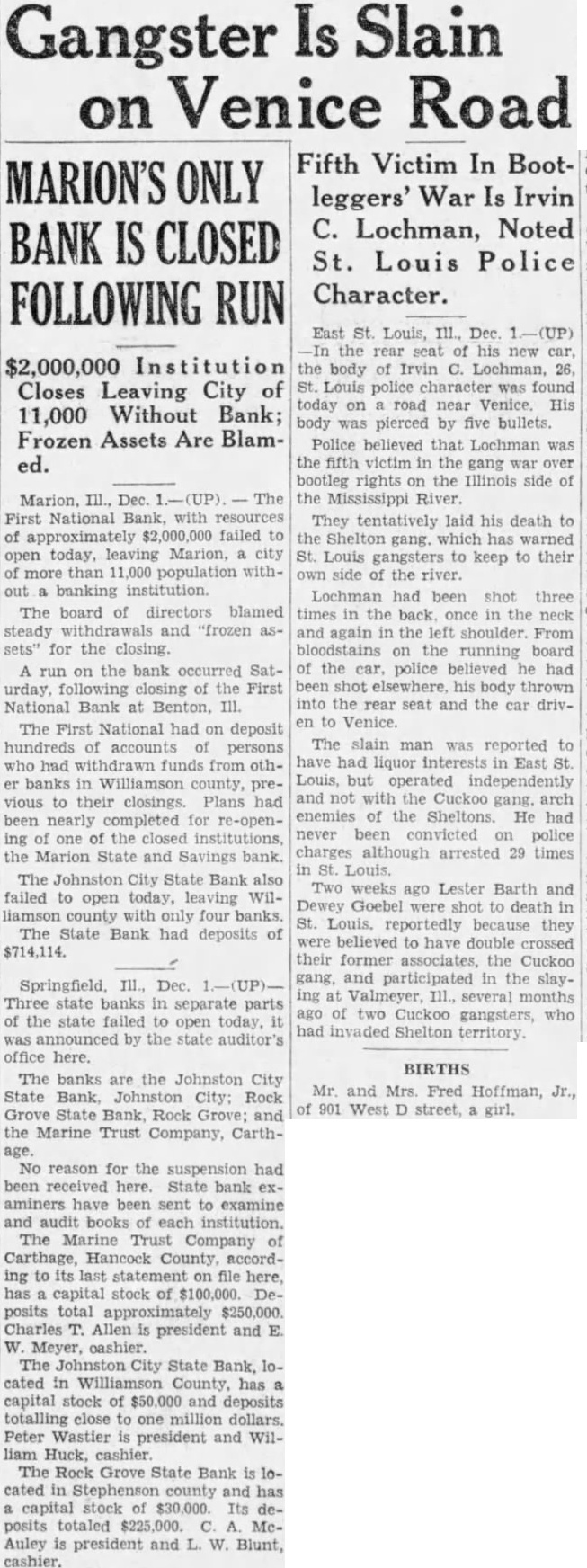

MARION'S ONLY BANK IS CLOSED FOLLOWING RUN

Gangster Is Slain on Venice Road

Fifth Victim In Bootleggers' War Is Irvin C. Lochman, Noted St. Louis Police Character.

$2,000,000 Institution Closes Leaving City of 11,000 Without Bank; Frozen Assets Are Blamed.

Marion, III., Dec. 1.-(UP). The First National Bank, with resources of approximately $2,000,000 failed to open today. leaving Marion, a city of more than 11,000 population without a banking institution. The board of directors blamed steady withdrawals and "frozen assets" for the closing. A run on the bank occurred Saturday. following closing of the First National Bank at Benton, Ill. The First National had on deposit hundreds of accounts of persons who had withdrawn funds from other banks in Williamson county, previous to their closings. Plans had been nearly completed for re-opening of one of the closed institutions, the Marion State and Savings bank. The Johnston City State Bank also failed to open today, leaving Williamson county with only four banks. The State Bank had deposits of $714,114.

Springfield, Ill., Dec. Three state banks in separate parts of the state failed to open today, it was announced by the state auditor's office here. The banks are the Johnston City State Bank, Johnston City; Rock Grove State Bank, Rock Grove: and the Marine Trust Company, Carthage. No reason for the suspension had been received here. State bank examiners have been sent to examine and audit books of each institution. The Marine Trust Company of Carthage, Hancock County, according to its last statement on file here, has capital stock of $100,000. Deposits total approximately $250,000. Charles T. Allen is president and E. W. oashier. The Johnston City State Bank. located in Williamson County, has a capital stock of $50,000 and deposits totalling close to one million dollars. Peter Wastier is president and William Huck, cashier The Rock Grove State Bank is located in Stephenson county and has a capital stock of $30,000. Its deposits totaled $225,000. C. A. McAuley is president and L. W. Blunt, cashier.

East St. Louis, Ill., Dec. 1.-(UP) the rear seat of his new car, the body of Irvin C. Lochman, 26, St. Louis police character was found today on road near Venice. His body was pierced by five bullets. Police believed that Lochman was the fifth victim in the gang war over bootleg rights on the Illinois side of the Mississippi River. They tentatively laid his death to the Shelton gang. which has warned St. Louis gangsters to keep to their own side of the river. Lochman had been shot three times in the back once in the neck and again in the left shoulder. From bloodstains on the running board of the car, police believed he had been shot elsewhere, his body thrown into the rear seat and the car driven to Venice. The slain man was reported to have had liquor interests in East St. Louis, but operated independently and not with the Cuckoo gang. arch enemies of the Sheltons. He had never been convicted on police charges although arrested 29 times in St. Louis. Two weeks ago Lester Barth and Dewey Goebel were shot to death in St. Louis. reportedly because they were believed to have double crossed their former associates, the Cuckoo gang, and participated in the slaying at Valmeyer, Ill., several months ago of two Cuckoo gangsters, who had invaded Shelton territory.

BIRTHS Mr. and Mrs. Fred Hoffman, Jr., of 901 West D street, girl.