Article Text

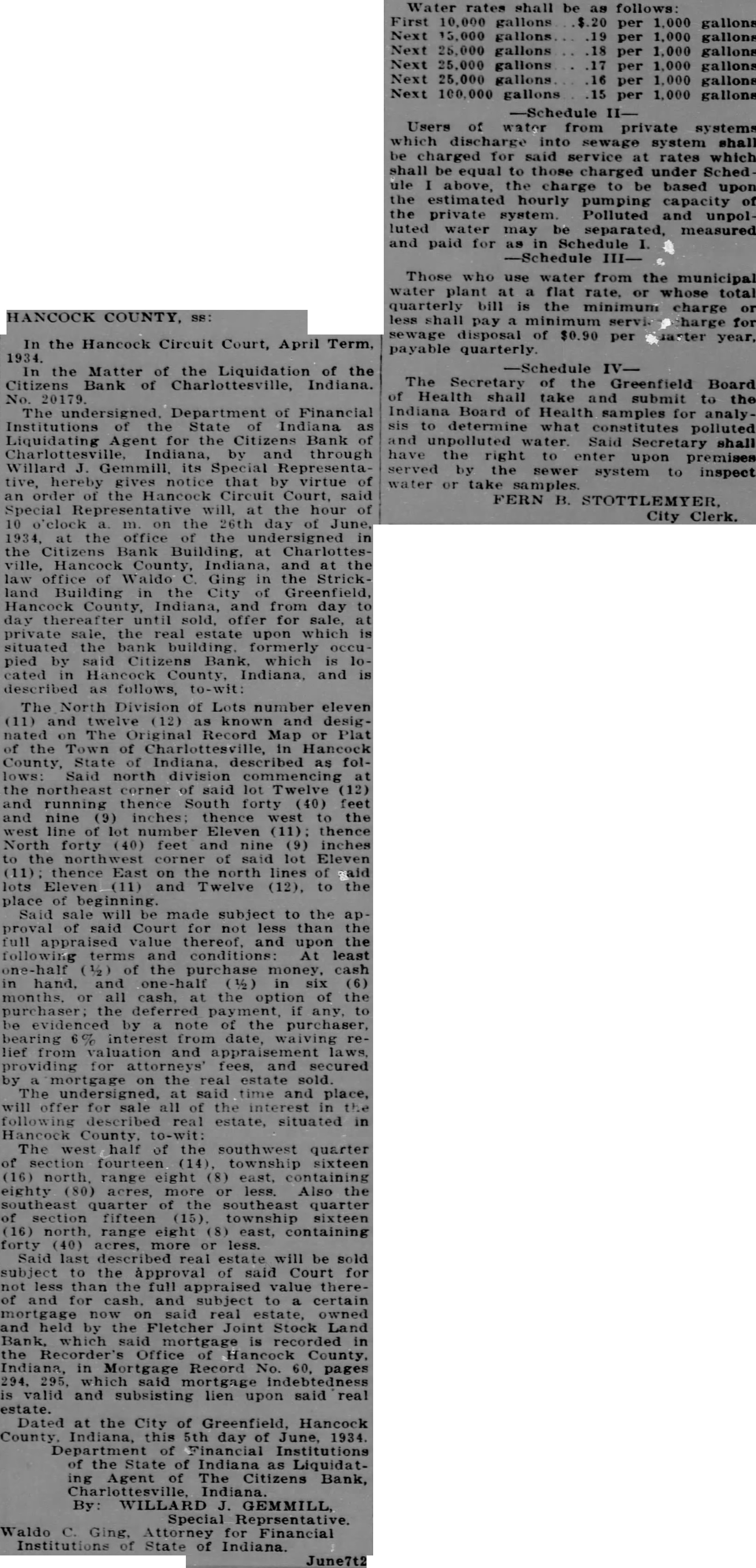

HANCOCK COUNTY. the Hancock Circuit Court, April Term. the Matter of the Liquidation the Citizens The Department Financial Institutions Liquidating through Willard Gemmill, tive, that by Special 26th day the Bank Ging the Building Hancock County, Indiana, and from day pied Citizens Indiana, and Division Lots number desigMap Town Said running thence South forty forty thence East beginning made subject the Court less the and the and laws, the and place, situated quarter fourteen sixteen range southeast fifteen eight containing last be the said Court value certain the Fletcher Joint Stock Land which recorded Record and subsisting lien upon said real City Hancock County Indiana, 5th day June, Indiana Liquidat Citizens Bank, By WILLARD Ging, Financial State Indiana. June7t2 shall follows gallons gallons Next Next gallons 1,000 gallons -Schedule Users of from private systems into sewage shall under above, based upon estimated hourly pumping capacity the private system. Polluted unpolmay measured -Schedule Those who water from the municipal water plant flat total quarterly bill the charge charge for $0.90 per payable quarterly -Schedule The Greenfield Board shall and submit Indiana Board Health samples for analyconstitutes polluted shall the sewer to inspect FERN City Clerk.