Article Text

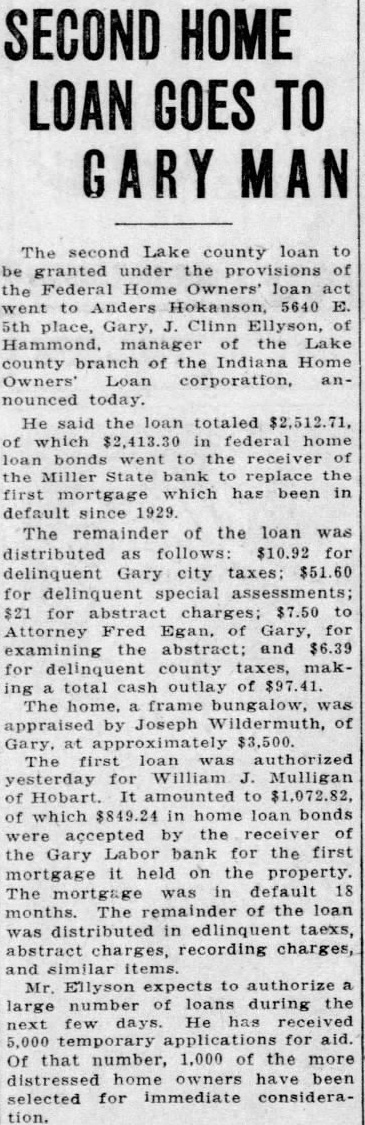

SECOND HOME LOAN GOES TO MAN second Lake county loan to granted under the provisions the Home Owners' Anders E. 5th place, Gary, Clinn Ellyson, of the Lake county of Indiana Home Owners' corporation, nounced today. He the loan totaled home loan the receiver the Miller bank replace the which has been default since 1929 The remainder of the loan was distributed $10.92 for delinquent Gary city for delinquent special $21 for abstract charges; $7.50 Attorney Fred Gary, for examining the abstract; and $6.39 for delinquent county taxes, maktotal outlay of The home, frame bungalow, appraised by Joseph of Gary, at approximately $3,500. for William Mulligan Hobart amounted to of which in loan bonds accepted the receiver the Labor for the first mortgage held on the property. The default 18 months. the loan distributed in edlinquent taexs, abstract charges, recording charges, and similar Ellyson expects authorize large number of loans during the few days. He received temporary for Of that number, 1,000 of the more distressed owners been selected for immediate consideration.