Article Text

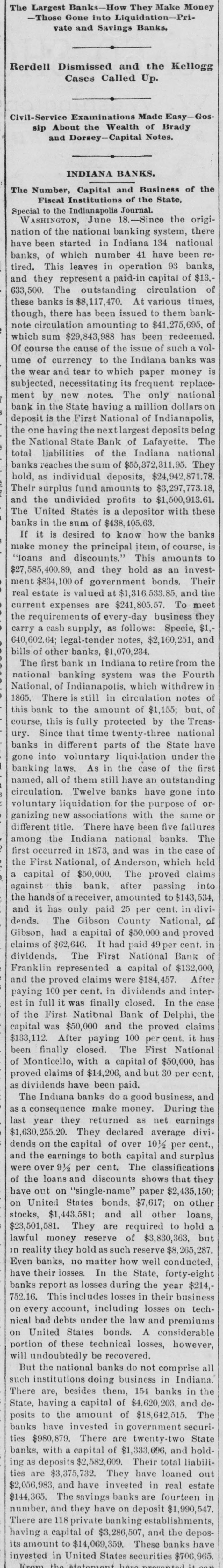

The Largest Banks-How They Make Money -Those Gone into Liquidation-Private and Savings Banks. Rerdell Dismissed and the Kellogg Cases Called Up. Civil-Service Examinations Made Easy-Gos sip About the Wealth of Brady and Dorsey-Capital Notes. INDIANA BANKS. The Number, Capital and Business of the Fiscal Institutions of the State, to the Indianapolis Journal. Special WASHINGTON, June 18.-Since the origination of the national banking system, there have been started in Indiana 134 national banks, of which number 41 have been retired. This leaves in operation 93 banks, and they represent a paid-in capital of $13.- of 633,500. The outstanding circulation these banks is $8,117,470. At various times, though, there has been issued to them bank- of note circulation amounting to $41,275,695, which sum $29,843,988 has been redeemed. Of course the cause of the issue of such a volume of currency to the Indiana banks was the wear and tear to which paper money is subjected, necessitating its frequent replacement by new notes. The only national bank in the State having a million dollars o deposit is the First National of Indianapolis, the one having the next largest deposits being the National State Bank of Lafayette. The total liabilities of the Indiana national banks reaches the sum of $55,372,311.95. They hold, as individual deposits, $24,942,871.78 fund amounts to $3,297,773.18 the undivided profits to and Their surplus $1,500,913.61. with these The United States is a depositor banks in the sum of $438, 405.63. If it is desired to know how the banks make money the principal item, of course, is "loans and discounts." This amounts to $27,585,400.89, and they hold as an investment $834,100 of government bonds. Their real estate is valued at $1,316,533.85, and the current expenses are $241,805.57. To meet the requirements of every-day business they carry a cash supply, as follows: Specie, $1,640,602.64; legal-tender notes, $2,160,251, and bills of other banks, $1,070,234. The first bank in Indiana to retire from the national banking system was the Fourth National, of Indianapolis, which withdrew of 1865. There is still in circulation notes this bank to the amount of $1,155; but, of course, this is fully protected by the Treasury. Since that time twenty-three national banks in different parts of the State have gone into voluntary liquidation under the banking laws. As in the case of the first named, all of them still have an outstanding circulation. Twelve banks have gone into for the purpose of ornew associations with same or ganizing voluntary liquidation the five failures title. There have been the Indiana national in 1873, and was in case of among different first occurred banks. which the held The First National, of Anderson, of $50,000. The a the capital proved claims into against this bank, after passing the hands of a receiver, amounted to $143,534, and it has only paid 25 per cent. in dividends. The Gibson County National, of Gibson, had a capital of $50,000 and proved claims of $62,646. It had paid 49 per cent. in dividends. The First National Bank of a capital Franklin represented $184,457. of $132,000, After and the proved claims were paying 100 per cent. in dividends and interest in full it was finally closed. In the case of the First National Bank of Delphi, the capital was $50,000 and the proved claims $133,112. After paying 100 per cent. it has finally closed. The First National of with a capital of has claims of $14,206, and but 30 per cent. been proved Monticello, $50,000, as dividends have been paid. The Indiana banks do a good business, and make money. During the returned as net They declared average as $1,630,255.20. last a consequence year they earnings dividends on the capital of over 10 1/2 per cent., and the earnings to both capital and surplus were over 9 1/2 per cent. The classifications of the loans and discounts shows that they have out on "single-name" paper $2,435,150; on United States bonds, $7,617; on other stocks, $1,443,581; and all other loans, $23,501,581. They are required to hold a lawful reserve of $3,830,363, but in hold as such reserve no matter how well Even reality banks, money they conducted, $8,265,287. have their losses. In the State, forty-eight banks report as losses during the year $214, 752.16. This includes losses in their business on every account, including losses on technical bad debts under the law and premiums on United States bonds. A considerable portion of these technical losses, however, will undoubtedly be recovered. But the national banks do not comprise all such institutions doing business in Indiana. There are, besides them, 154 banks in the State, having a capital of $4,620,203, and deposits to the amount of $18,642,515. The banks have invested in government securities $980,879. There are twenty-two State banks, with a capital of $1,333,696, and holddeposits $2,582,609. Their total liabiliThey ing ties as are $3,375,732. have in loaned real estate out $2,056,983, and have invested $144,365. The savings banks are fourteen in number, and they have on deposit $1,990,547. There are 118 private banking establishments, a capital of $3,286,507, and the deposto These having its amount $14,069,359. banks $706,965. have invested in United States securities From the statement