Click image to open full size in new tab

Article Text

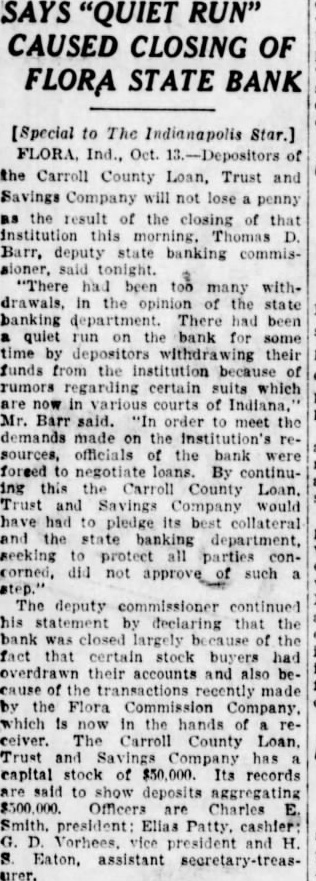

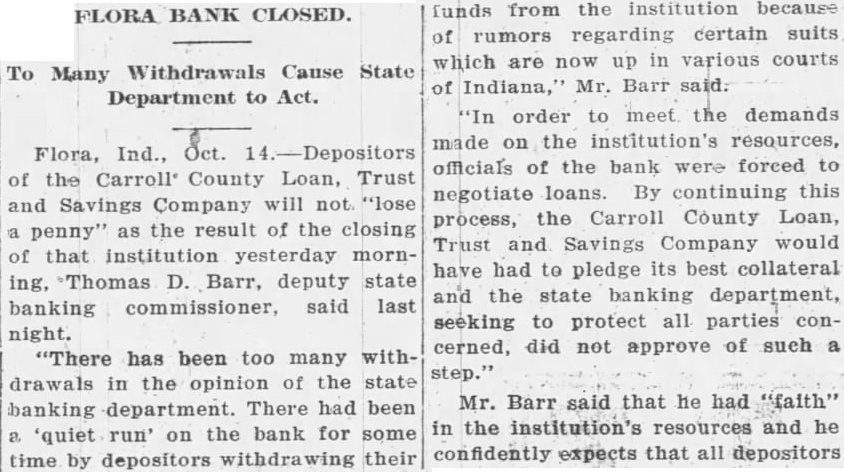

FEW CANDIDATES YET IN CARROLL

Aspirants Slow to FileDelphi News-Trustee Host to Camden Team.

[Special to Journal and Courler] DELPHI, Ind., March 23.-Candidates slow filing for Carrol county offices this spring. Morris Ayers of Delphi has announced as candidate for sheriff on the democrat ticket and Fletcher Metsker, from Monroe township, has filed for county recorder on the democrat ticket. John W. Kerlin has filed as precinct commitfor the second precinct in Rock Creek township. WILLS PROBATED. Three wills were probated Wed. nesday in the Carroll circuit court. The will of Mrs. James Riley leaves her entire estate to her husband, James D. Riley. The will of Mrs. Josephine Schermerhorn leaves property in Delphi to Mrs. Josephine S. Fry and Katherine Brackenridge, her two daughters. Her stock in the Carroll County Abstract company she leaves to her son, Reed Schermerhorn; the remainder of property is to be divided equally between her three children. Reed Schermerhorn executor. The will of Mrs. Mary Artist, $10 to her son Virgil; all of her household goods to her daughter, Violet Kasten, and the rest of the estate to be divided equally between her children, Earl, Irvin and Alva Artist, and Violet Kasten. The Citizens' bank of Delphi was named executor. William H. Guthrie has filed suit in the Carroll court against T. Williams et al, asking for foreclosure of a mortgage and for appointment of receiver for the property known as the Commercial hotel in Flora. Suit on promisory note demanding $485 has been filed by the Flora State bank, receiver for the Carroll county Loan, Trust and Savings Co., at Flora, against Albert Flora. The next meeting of the Delphi Chamber of Commerce has been announced for Thursday, April 5. Election officers other business of importance will be transacted. John Smock, son of Mr. and Mrs. Ed Smock, of Delphi, student at Indiana university, has just been awarded an varsity sweater, for his splendid showing in track athletics at the university this winter. He won first in the 440-yard dash in a meet between Ohio and Indiana state universities weeks ago. Mrs. Susan Little is at the home of her daughter, Mrs. Henry Cree, near Rockfield, where she is recovering from a broken rib which she received several days ago when she fell through the barn floor at the farm of Harold Cree. TO DELPHI SOON. William Mullin, of near Burrows, newly appointed Carroll county road superintendent, held public sale of his farming stock Tuesday, and will move shortly to the John Mears property in Delphi. Mr. and Mrs. Mears will move to their farm near Delphi. Walter Cheesman, 12-year old son of Mr. and Mrs. Ed Chees man, has been seriously 111 with pneumonia at his home in Delphi. Miss Margaret Cottrell, has been nursing Miss Laura Griffith, has returned to Lafayette. Mr. and Mrs. Carl Reed have moved to Indianapolis where Mr. Reed has accepted position as salesman with the Watkins Medical company. Mr. and Mrs. Charles Wood, who have been in California for several months, returned Wednesday to Delphi. A. daughter was born March 17 to Mr. and Mrs. Evan Sanderson, north of Delphi. County Assessor Orvil Shock is suffering from a severe injury to his leg which he received when he fell on board while working around his home several days ago HOSTS TO TEAM. Trustee and Mrs. Virgil Sink of Jackson township, entertained the Camden basketball team and Coach McPherson at dinner at their home, Wednesday evening. Mrs. Dean Balser entertained the ladies of the Ockley U. B. church at lunch Thursday at her home in Madison township. Rev. and Mrs. L. E. Knox of Delphi, are at Kokomo where they were called by the death of the latter's mother, Mrs. Boswell, who died at the home of her daughter there. Mrs. Boswell was 85 years of age.