Article Text

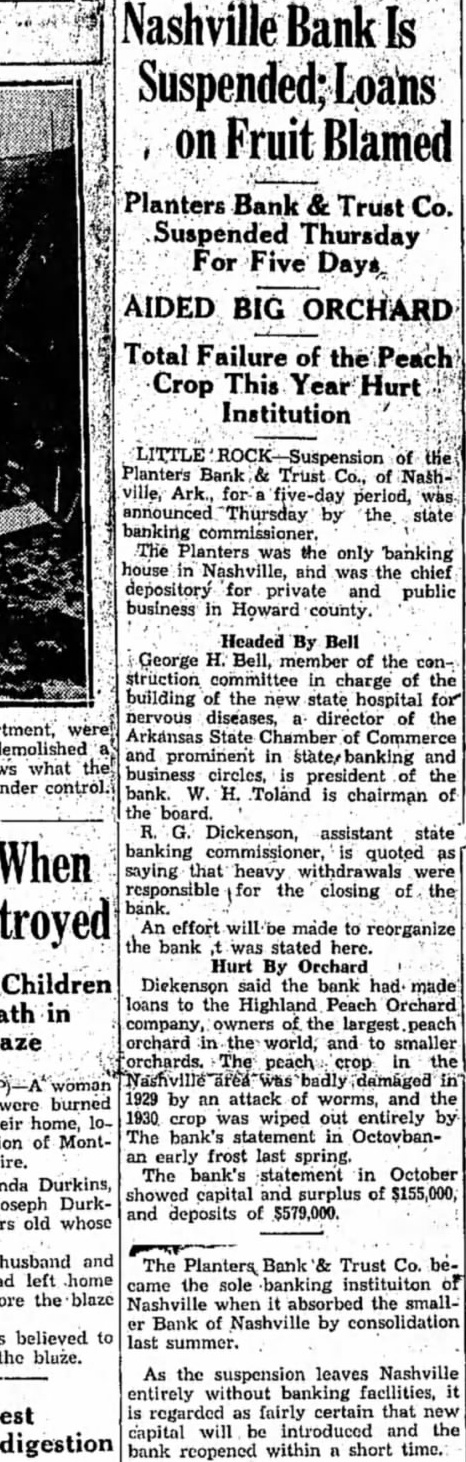

Nashville on Blamed Planters Bank & Trust Co. Suspended Thursday For Five Days AIDED BIG ORCHARD Total Failure of the Peach Crop This Year Hurt Institution Planters Bank Trust Co., of Nashville, Ark., period, announced Thursday by the state banking commissioner. The Planters was the only banking house in Nashville, and was the chief depository private and public business in Howard county. Headed By Bell George Bell, member of the construction committee in charge of the building of the new state hospital nervous diseases, director of the Arkansas State Chamber of Commerce and prominent in and business circles, president of the bank. H. Toland is chairman of the board. Dickenson, assistant state banking commissioner, quoted saying that heavy withdrawals responsible the closing of the bank. An effort made to reorganize the bank was stated here. Hurt By Orchard Diekenson said the bank had made loans to the Highland Peach Orchard company, owners of the largest peach orchard in and to smaller peach crop in the 1929 by an attack worms, and the 1930 crop was wiped out entirely by The bank's in Octovbanearly frost last spring. The bank's statement in October showed capital and surplus of $155,000, and deposits of $579,000. The Planters Bank & Trust Co. came the sole banking instituiton Nashville when absorbed the smallBank of Nashville by consolidation last summer. As the suspension leaves Nashville entirely without banking facilities, regarded fairly certain that new capital will be introduced and the bank reopened within short time.