Click image to open full size in new tab

Article Text

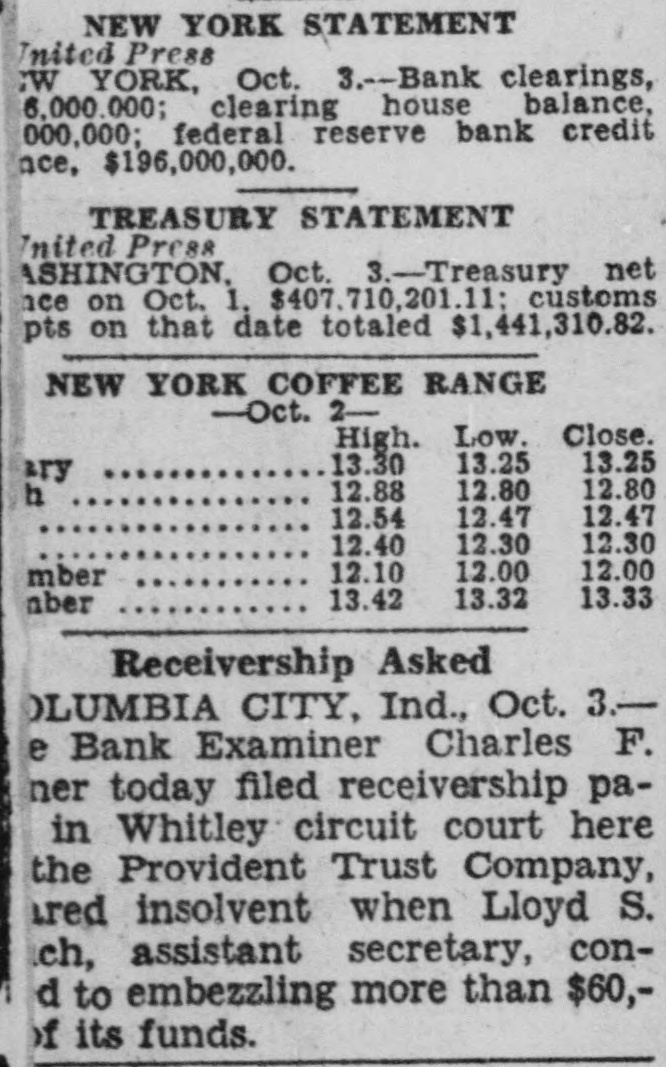

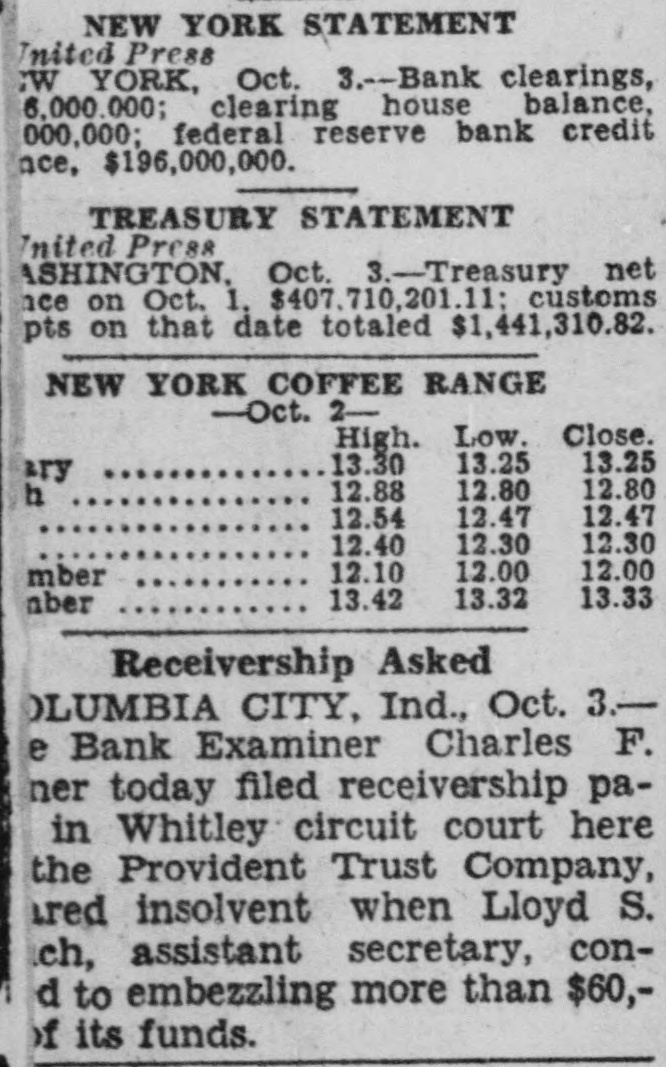

NEW YORK STATEMENT Inited Press :w YORK, Oct. 3.-Bank clearings, 6,000.000; clearing house balance, 000,000; federal reserve bank credit nce, $196,000,000. TREASURY STATEMENT Inited Press ASHINGTON, Oct. 3.-Treasury net nce on Oct. 1. $407,710,201.11; customs pts on that date totaled $1,441,310.82. NEW YORK COFFEE RANGE Oct. 2High. Low. Close. 13.25 13.25 13.30 ary 12.80 12.80 12.88 h 12.47 12.47 12.54 12.40 12.30 12.30 12.00 12.00 12.10 mber 13.33 13.32 13.42 aber Receivership Asked OLUMBIA CITY, Ind., Oct. 3.e Bank Examiner Charles F. ner today filed receivership pain Whitley circuit court here the Provident Trust Company, ared insolvent when Lloyd S. ch, assistant secretary, cond to embezzling more than $60,of its funds.