Click image to open full size in new tab

Article Text

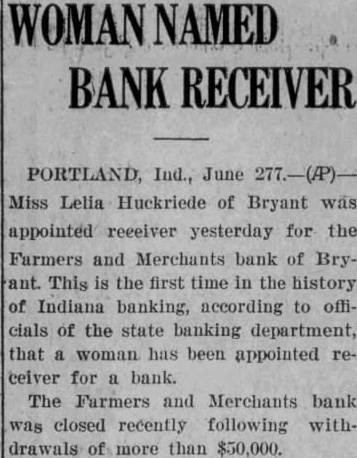

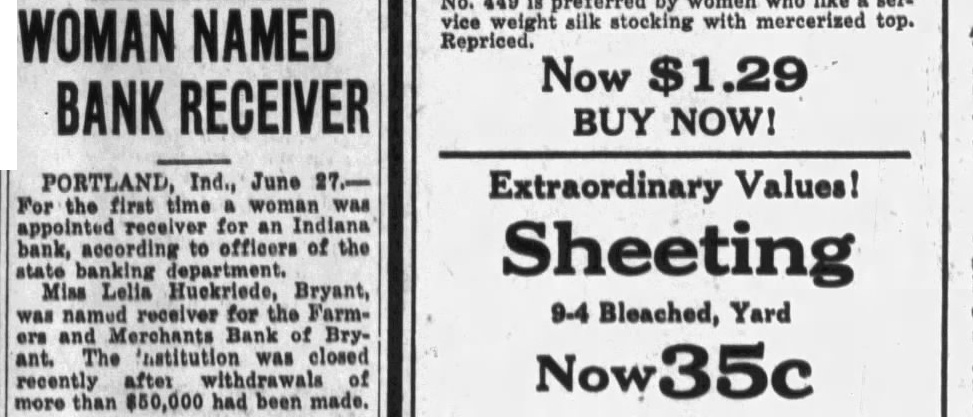

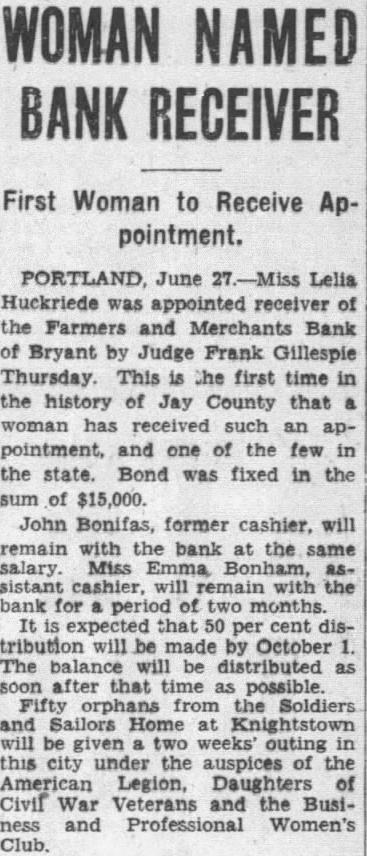

WOMAN NAMED BANK RECEIVER

Miss Huckriede in Charge of Bryant Institution.

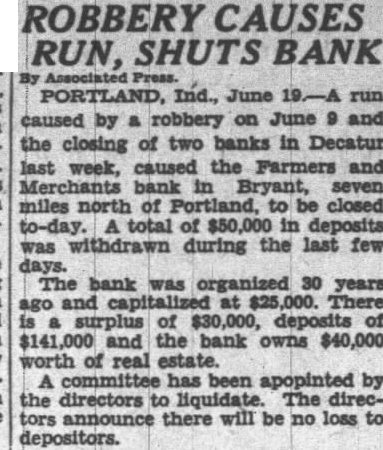

Portland. Ind., June 26.-Miss Lelia Huckriede. of Bryant. was appointed receiver for the Farmers and Merchants bank at Bryant this morning by Judge Frank Gillespie Her bond was fixed at $15,000 John Bonifas, cashier will assist Miss Huckriede in the work of settling the affairs of the bank Miss Emma Bonham, assistant cashier, will also assist with the work for two months It is thought that a distribution of at least 50 per cent can be made by October The Farmers and Merchants Bank was closed a few days ago following a run. when more than $50,000 in deposits were withdrawn. Suit for a receiver was filed by Luther Symons, state bank commissioner Two suits for $500 each have been filed by the Portland Drain Tile Company against the bondsmen of Orestes H. Devoe superintendent of construction of the Engle ditch in Bichland One suit was brought against John T Sutton, James Mulvahill and George A. Buckles. and the other, George A. Buckles, Augustus Cline and Oakley E. Milligan the defendants. Claim is made and Oakley E. Milligan are the defendants Claim is made in both suits that the contract for the ditch was let 1923 by Devoe to Jarrett and Funk This firm contracted with Martin Brothers of Dunkirk. to furnish the tile They were unable supply the amount and contracted with the Portland company for $465 It is alleged that Devoe failed to keep records of counts of done and to collect assessments when due He died in August. 1926 before the work was finished and without paying the Port land company but had $1,000 in his possession at the time of his death. Death Message Received A message was here today telling of the death of George E. Fleming 86. which suddenly this morning at Benton Harbor, Mich He was veteran of the Civil War and lived the greater part of his life in Jay County near New Mt. Pleasant. body be brought Friday will be held at o'clock Saturday after noon at the Williamson Chapel in charge of the Rev H. Nall Bur ial will be in Park Cemetery A fleet of twenty airplanes passed this city today flying toward the south It is thought that the ships were Army planes en route to Kentucky

Mother and Daughter Injured Mrs. Charles Bash and daughter Mildred suffered severe and bruises this morning when the car in which they were riding. driven by Mrs William Axe overturned near Bellefontaine The accident was caused by blowout The local Elks Lodge has secured the A1 C. Hansin Carnival Company to show here during the two day street carnival. July and 5. Evidence in the suit to set aside a deed by Peter Gaffer to Monahan has been completed in the Circuit Court The argument hearing was continued. The case was brought to Jay County from the Adams Circuit on a change of venue. Harry P. Clements is made defendant on note and real estate mortgage by Ora E. Whittinghill, of Redkey A Children's Day cantata, "Greater Than Solomon,' will be given at the Antioch M. E. Church Sunday evening.

Name New Tliff Administrator. J. V. Ashcraft was appointed administrator of the estate of David H Iliff. The Jay County Saving and Trust Company, former administrator, which is now in the hands of a receiver. was removed. Arrangements have been made with a number of families to give an outing to the children from the Soldiers and Sailors Orphans Home at Knightstown this summer The Jay County Business and Professional Women's Club is sponsoring the vacation. The children will be brought to Portland Sunday, July 20.