Click image to open full size in new tab

Article Text

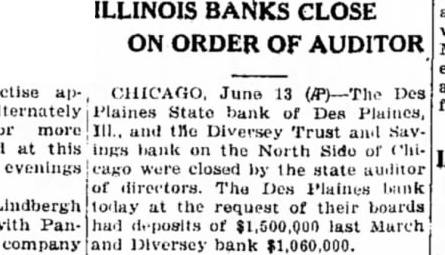

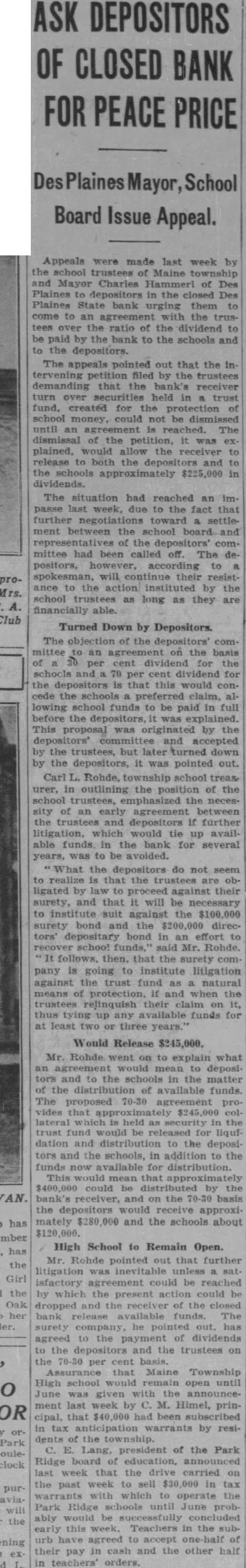

STATE AUDITOR REPORTS ON TWENTY CLOSED BANKS

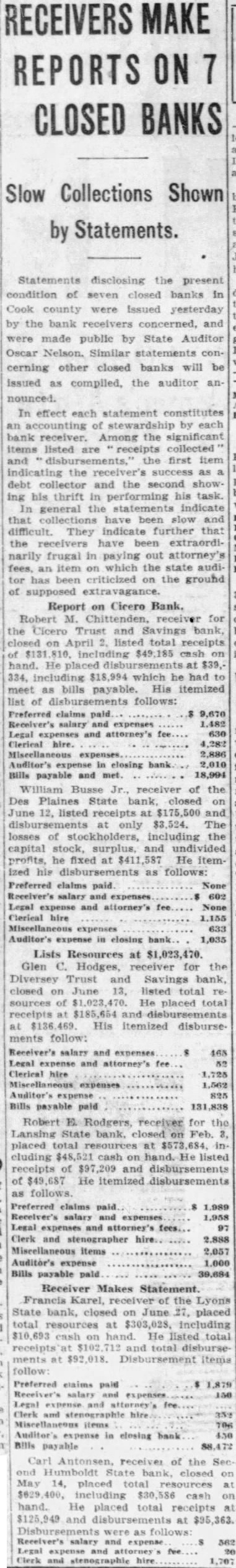

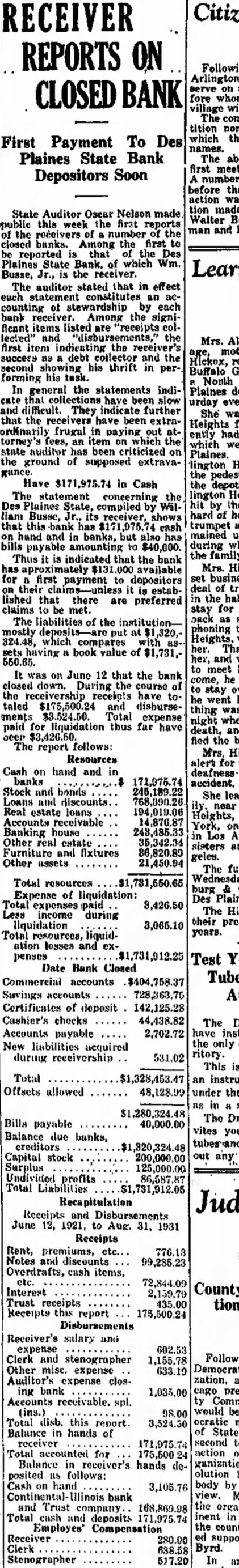

State Auditor Oscar Nelson yesterday made public reports of the receivers 20 more closed banks. The reports give the financial condition of the banks as of Sept. 30. The reports disclose the gross cost of receivership of the 20 banks together with that for 20 banks ly reported 8.6 per cent of the collected by the and money the net east, after deducting the operating income of the banks, is 2.8 per cent.

Bank Receivers' Reports. The receivers' reports on the individual banks CHELTENHAM TRUST [June 1931.] Cash hand. Total resources 303 Losses on conversion of claims paid Paid to creditors

4.511

10,772 2,555 145 34,643

16,930 25,034 6,526

40,558 633,028 7,548

182

5,929 995,804 8,545 13,407 15,950 BANK.

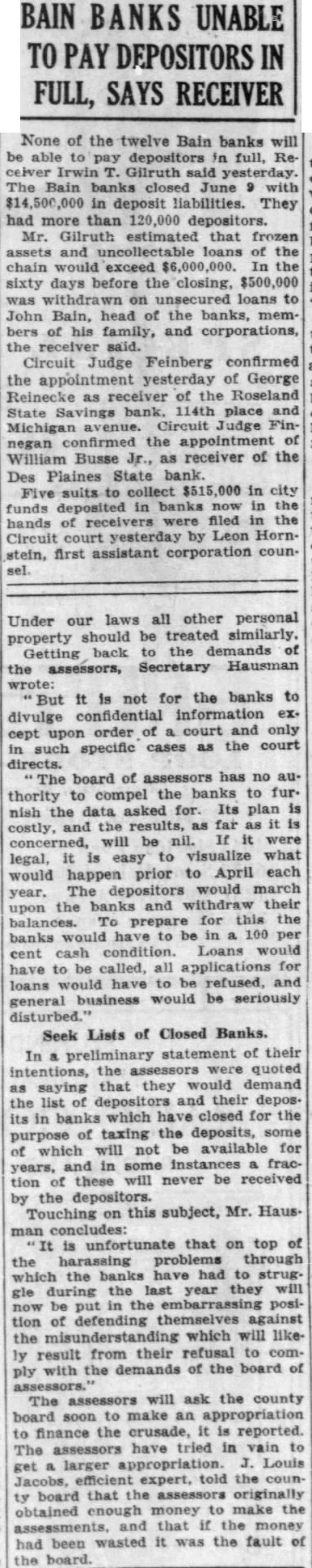

Legal expenses and attorneys' fees 1,008 Clerical hire. 538 Miscellaneous expense 1,473 CONGRESS TRUST AND SAVINGS BANK. [Closed June 28, 1932.]

Cash on hand. Total resources Losses on conversion of assets.... 12 Preferred claims paid. 183 Balance due 959,898 Receiver's salary and expenses. 1,451 Legal and attorneys' fees 21 Clerical hire. Miscellaneous 5,131

COTTAGE GROVE STATE BANK. [Closed June 23, 1932.] Cash on hand Total resources Losses on conversion of assets 92,661 Preferred claims paid. 75,000 Balance due 1,338,414 Receiver's salary and expenses.... 875 Clerical hire... expense. 4,565

ORAGIN STATE BANK. [Closed June 10, 1931.] Cash on Total Losses on conversion of assets... 65,599 Preferred claims 20,202 Paid to creditors [10 per cent] Balance due creditors Legal expenses and attorneys' fees 5,385 Clerical CRAWFORD STATE SAVINGS BANK. [Closed Jan. 15, 1931.] Cash on hand. 39.201 Total 943.578 Losses on conversion of assets. Preferred claims paid 14,805 Paid creditors 120 per cent] Balance due creditors 798,008 Receiver's salary and expenses Legal and attorneys' fees Clerical hire. 14.935 18,847 DEPOSITORS STATE BANK. [Closed Jan. 18, 1932.] Cash on hand. Total resources. 336 Losses on conversion of Preferred claims Balance due 067 Receiver's salary and expenses. 3.617 Legal expenses and attorneys' fees Clerical hire. Miscellaneous expense 11,875 DES PLAINES STATE BANK. [Closed June 13. 1931.] Cash 23,159 on Total 1,265,468 claims paid Paid to 120 per cent] Balance due Receiver's salary and expenses. 4,590 Legal expenses and attorneys' fees 15,000 Clerical Reports on the remaining closed banks will be made public from time to time by the auditor.

Balance due creditors Paid to creditors [25%] Receiver's and expenses Balance due Legal and attorneys' fees Receiver's salary and expenses. Clerical hire Legal expenses and attorneys fees expense Clerical hire CHICAGO BANK OF COMMERCE. expense. [Closed June 25, 1932.] CITY STATE BANK OF CHICAGO. Cash on Total resources Cash on hand. Losses on of Total Preferred claims paid. Losses on conversion of assets. Balance Preferred claims paid Receiver's and expenses Paid to creditors (27%) Legal expenses and attorneys' fees Balance due creditors. Clerical hire Receiver's salary and expenses Liquidation Costs Told. expense Legal and attorneys' fees CHICAGO LAWN STATE BANK. Liquidation costs of the 20 banks Clerical hire [Closed June 9, 1931.] public are summarized expense Cash on by the auditor as follows: COLUMBIA STATE SAVINGS BANK. Total Total Losses on of [Closed March 29, 1931.] Total Operating conversion claims Cash on collected. 9,505 Balance due Total Cheltenham Receiver's salary and expenses Losses on conversion of assets. Legal expenses and attorneys' fees Bank 983 Clerical hire Paid Commerce Balance due creditors. Chicago CICERO TRUST AND SAVINGS BANK. Receiver's salary and expenses 368,060 46,733 Lawn [Closed April of 1931.] Legal expenses and attorneys' fees Cicero Trust 41,784 23,649 Cash Clerical on Citizens Total expense State of assets Citizens COMMERCE TRUST AND Preferred claims 767 [Closed May 28, 1931.] Paid to creditors [10 per cent] Cash on hand Citizens Total resources and expenses on of Legal expenses and attorneys' fees claims paid Citizens Clerical hire Paid Trust expense due City STATE BANK OF AGO. Receiver's and Columbia [Closed May 25. 1932.] Legal and attorneys' Commerce Cash on hand Clerical hire Trust 37,031 Total resources Commercial of assets COMMERCIAL BANK OF CHICAGO 17,426 HEIGHTS. Balance due Common- [Closed Jan. 9, 1932.] Receiver's salary and expenses 4.136 Cash on wealth Legal and attorneys' fees Total resources Congress Clerical hire 873 Losses of assets Park Preferred claims paid Congress CITIZENS STATE BANK OF GLENCOE. Paid to creditors (25%) Trust 16,043 8,865 [Closed 1932.] Balance due Cottage Cash on hand 11,466 and Grove resources 138,032 Legal and attorneys' fees Crazin Preferred claims paid Clerical hire Crawford Balance due Miscellaneous expense Depositors Receiver salary and expenses 300 Clerical hire TRUST Des Plaines expense BANK Totals CITIZENS STATE BANK OF MELROSE Cash 20 banks PARK. Total previously [Closed Oct. 24. 1930.] on conversion of assets reported Cash 41,615 Preferred claims Total Balance due Total 40 Losses on of assets 79,669 Receiver's and expenses. banks Preferred claims paid. Clerical hire. Balace due creditors 625,693 salary and expenses Legal expenses and attorneys' fees CONGRESS PARK STATE BANK. Clerical hire [Closed Oct. 28, expense Cash on hand CITIZENS TRUST AND SAVINGS BANK. Total resources [Closed Aug. 5, 1930.] Losses conversion of assets Cash on hand 507 Preferred claims resources Paid to creditors per cent] Losses of assets Balance due Preferred claims paid 20.305 Receiver's salary and expenses.

18,706 30,654 14,992 149,239 615,823 772,593 2,186,090 40,000 300 16,613 83,081 21,318 fees 23,532 22,549 356,879 4.153 AND SAVINGS 719 000 634 690 2,568 1931.1 337 11,890 534