Article Text

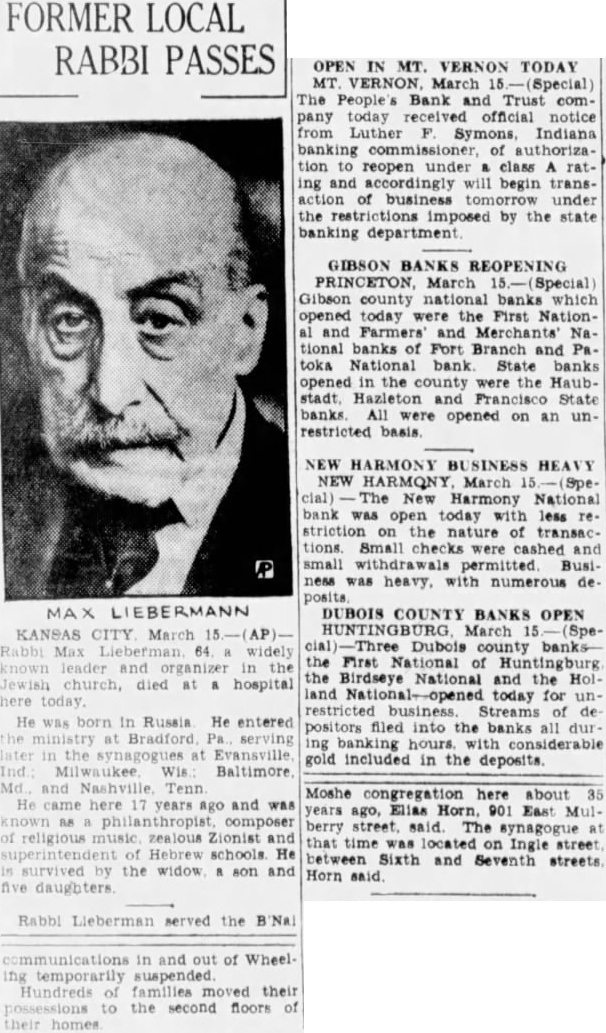

FORMER LOCAL RABBI PASSES OPEN IN MT. VERNON TODAY MT. VERNON March (Special) The People's Bank and Trust company today received official notice from Luther Symons, Indiana banking of authorization to reopen under class rating and accordingly will begin transaction of business under the imposed by the state banking department GIBSON BANKS REOPENING PRINCETON, March Special) Gibson county national banks which opened today were the First Nationand Farmers and Merchants' National banks of Fort Branch and Patoka National bank State banks opened the were the Haubstadt. Hazleton and State banks All opened on an unrestricted basis NEW HARMONY BU SINESS HEAVY NEW HARMONY March (cial) The New Harmony National bank was open today with less restriction the nature of transactions Small were cashed and small withdrawals permitted Business was heavy, with numerous de DUBOIS COUNTY BANKS OPEN HUNTINGBURG, March 15 (SpeThree Dubois county banksthe First National of Huntingburg the Birdseye National and the Holland today for un restricted business Streams of positors filed into the banks all durbanking hours with considerable gold included in the deposits. RMANN CITY March Rabbi widely leader and in the died hospital here He born in Russia He entered at the synagogues at Evansville Wis Baltimore and Tenn Moshe congregation here about 35 He years ago and was years ago, Elias Horn, 901 East Mulberry The synagogue music zealous Zionist and that time was located on Ingle street Hebrew schools He between Sixth and Seventh streets is survived by the widow son and Horn said. five Rabbl Lieberman served the B'Nal in and out of Wheel temporarily Hundreds of families moved their to the second floors of homes